Stock in Focus 🔍

This week, we’re looking at Boeing, which has received favourable data that has pushed it up the rankings.

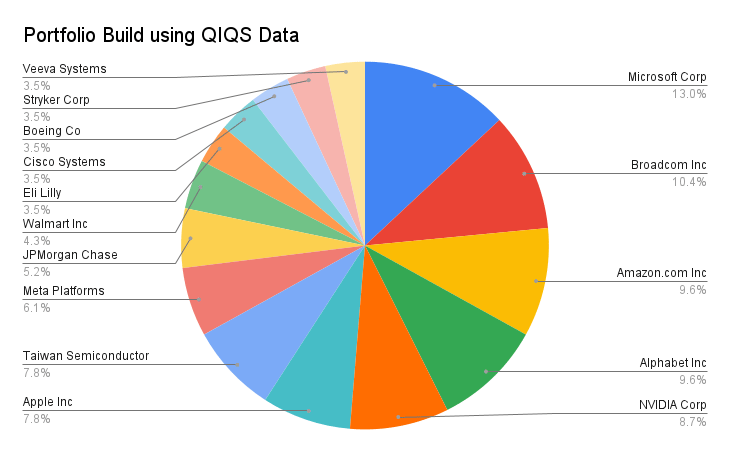

QIQS Stock Picks 💸

⬆️15. $VEEV: Veeva's strategic role in life sciences, 18% CAGR guidance, and momentum in AI-driven enterprise apps make it Wells Fargo's top pick for 2025.

⬆️14. $SYK: Stryker's projected 8%-9% organic sales growth and robust demand for medical technology products highlight its resilience and innovation.

⬆️13. $BA: Despite challenges, Boeing's major aircraft orders and potential asset sales position it for a rebound in the aerospace sector.

🔻12. $CSCO: Cisco's $56B revenue projection, AI-driven Hypershield launch, and successful Splunk integration solidify its leadership in networking and security.

⚪11. $LLY: Eli Lilly's innovative drug pipeline, including treatments for diabetes and Alzheimer's, drives its strong growth outlook with a 28% revenue increase.

⚪10. $WMT: Walmart's e-commerce expansion and consistent revenue growth demonstrate its adaptability in the evolving retail landscape.

⬆️9. $JPM: JPMorgan's robust earnings, digital transformation efforts, and leadership in financial services reinforce its long-term stability.

🔻8. $META: Meta's significant investments in AI and the metaverse and strong advertising revenue growth fuel its future potential.

🔻7. $TSM: TSMC's critical role in advanced chip manufacturing and global expansion plans ensures its semiconductor supply chain dominance.

⬆️6. $AAPL: Apple's ecosystem loyalty, continuous innovation, and strong services growth anchor its market leadership.

⚪5. $NVDA: NVIDIA's dominance in AI chips and data center technologies drives explosive growth with a 206% YoY revenue surge.

⬆️4. $GOOGL: Alphabet's diversification into cloud computing, AI advancements, and digital advertising leadership highlight its long-term strength.

🔻3. $AMZN: Amazon’s e-commerce leadership and AWS cloud dominance, supported by AI-driven innovations, ensure sustained growth.

⬆️2. $AVGO: Broadcom’s focus on AI-driven semiconductor solutions and VMware integration fuels its strong market trajectory, which includes 44% year-over-year revenue growth.

⬆️1. $MSFT: Microsoft's leadership in cloud computing (Azure) and AI integration drives its 16% revenue growth and cements its position as a tech giant.

QIQS (Quantitative Insight Qualitative Screening) data has been used to pick these stocks from institutional investing.

Not financial advice. Always do your own research and understand your risk tolerance before investing.