Trend in Focus 🔍

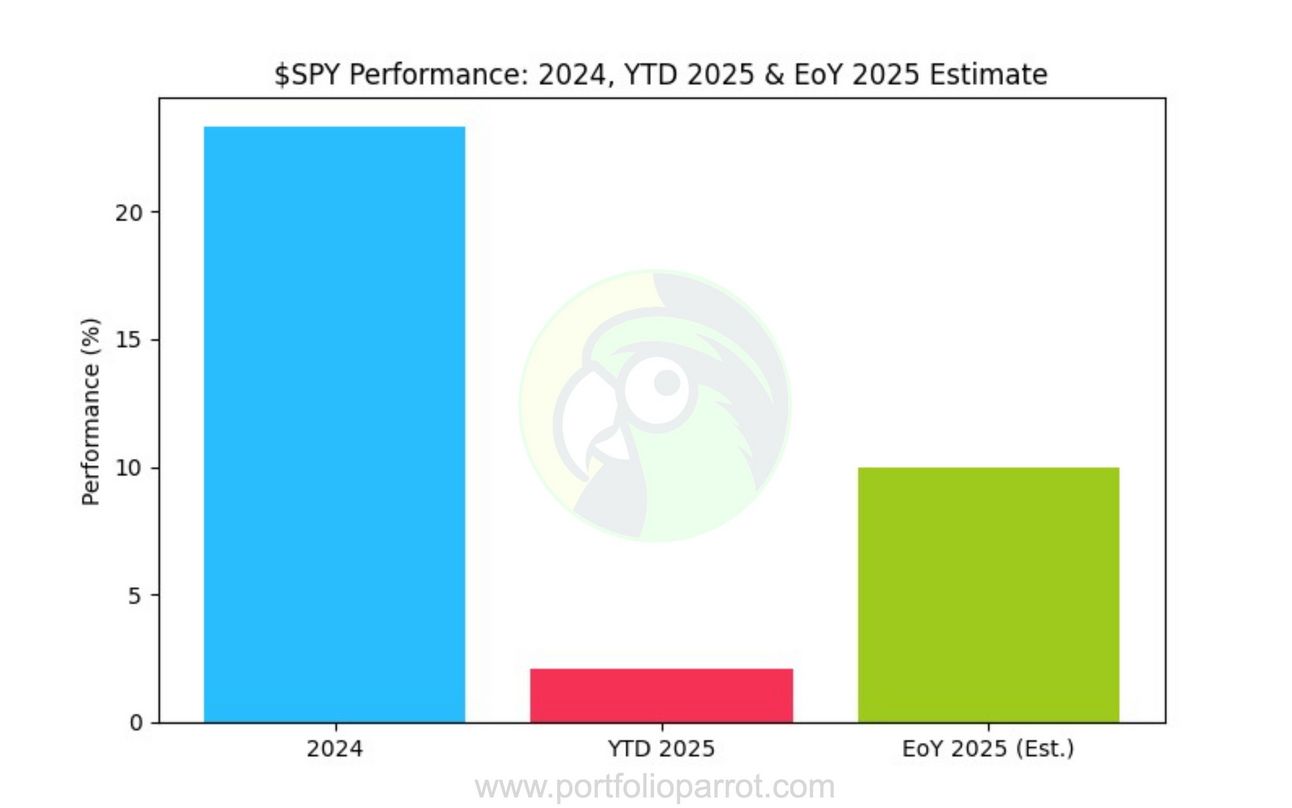

S&P 500: A Decade of Growth and What’s Next in 2025

With a decade of data behind us and forecasts shaping expectations for 2025, let’s dive into historical trends and expert predictions to see what the future might hold.

YTD Performance 13th of March 2025

YTD Performance 14th of March 2025

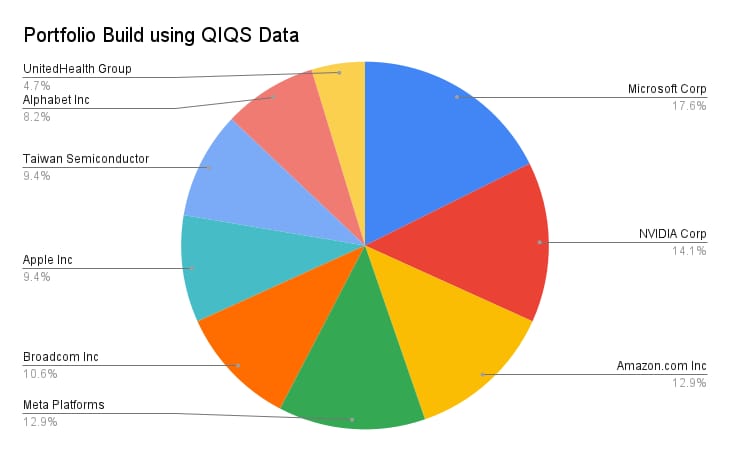

QIQS Stock Picks 💸

QIQS Data Scores

Portfolio Build using QIQS Data

9 Stocks Backed by Institutions and Market Intelligence 📈🔍

One-liners and Weekly Trends on why these 9 stocks are considered promising long-term investments using 1051 data points.

Here's a quick rundown of their strengths for 2025:

🔻 9. $UNH: UnitedHealth's projected 2025 revenues of $450-$455 billion and adjusted EPS of $29.50-$30.00 showcase its strong market position in healthcare.

⚪ 8. $GOOGL: Alphabet's 13% year-over-year revenue growth and strategic investments in AI and cloud computing drive its long-term potential in tech.

⚪ 7. $TSM: Taiwan Semiconductor's $100 billion investment plan for U.S. chip factories strengthens its global leadership in advanced semiconductor manufacturing.

🔻 6. $AAPL: Apple's consistent innovation and strong ecosystem of products and services, with a current stock price of $213.49, ensure its continued dominance.

⚪ 5. $AVGO: Broadcom's diverse product portfolio and strong position in 5G, cloud computing, and IoT markets fuel its growth potential in the semiconductor industry.

⚪ 4. $META: Meta's significant investments in AI and metaverse technologies drive its future growth potential in digital advertising and beyond.

⚪ 3. $AMZN: Amazon's e-commerce leadership and AWS cloud services fuel its continued market dominance and long-term growth potential.

⚪ 2. $NVDA: NVIDIA's dominance in AI chips and data center technologies drives its explosive growth in the tech industry.

⚪ 1. $MSFT: Microsoft's leadership in cloud computing (Azure) and AI integration cement its position as a market leader in the tech industry.

These 9 stocks show strong potential for 2025 and long-term investing due to their robust financial performances, strategic focus on emerging technologies like AI, and leadership positions across various industries.

Quantitative Insight Qualitative Screening (QIQS) data has been used to pick these stocks from institutional investing.

NOT FINANCIAL ADVICE.

Always do your own research and understand your risk tolerance before investing.