When investing, your capital is at risk. The value of investments can go down as well as up, and you may get back less than you put in. The content of this article is for information purposes only and does not constitute personal advice or a financial promotion.

Looking Ahead to 2026: Where AI Really Is in the Market Cycle

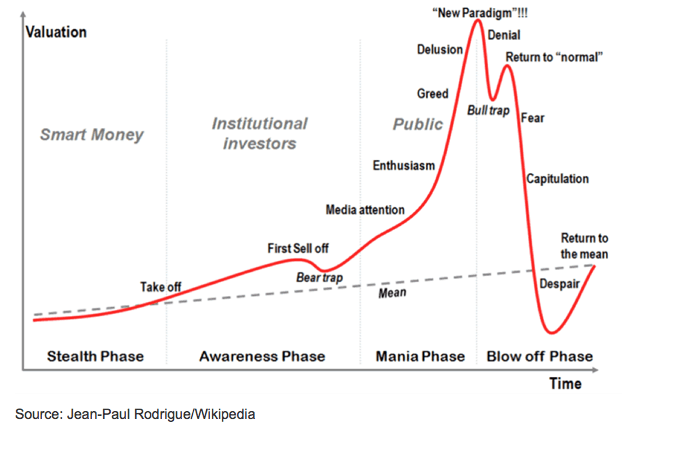

Psychology of a Market Cycle

If you want to misunderstand AI today, just ask if the story is over.

It is not.

The more helpful question, as we move toward 2026, is more straightforward and more complex: what phase are we actually in?

The truth is, AI has moved past the exciting stage and into a more demanding one. It’s not a collapse or a boom, but something quieter and more telling.

From belief to proof

From 2023 to early 2025, AI stocks rose on belief alone. The technology delivered, the possibilities seemed endless, and money poured in.

By late 2025, things shifted. AI didn’t stop working, but expectations became clearer. Now, people have a better sense of AI demand, its growth speed, and the costs involved.

As we move into 2026, markets care less about big ideas and more about real results.

This change isn’t dramatic. It’s usually just confusing.

Where AI sits as we approach 2026

AI today sits between late distribution and early normalisation.

Anatomy of a Bubble

The stories are still appealing, and companies are still spending, but prices don’t rise just because there’s a good story anymore.

Three signs make this shift clear.

First, the top companies stopped speeding up. They didn’t fall apart, but they stopped surprising people. This is a normal adjustment phase.

Second, weaker business models started to fall behind quietly. There were no big headlines or panic, just poor results.

Third, earnings are now more important than announcements. This is typical in the later stages of any big technology cycle.

Two AI cycles are moving at different speeds

The biggest mistake is to see AI as just one big investment.

It is not.

Infrastructure AI moves into 2026 on relatively firm ground. Compute, networking, and manufacturing capacity are tied to real budgets and real demand. Growth slows from extreme rates, but the floor is visible.

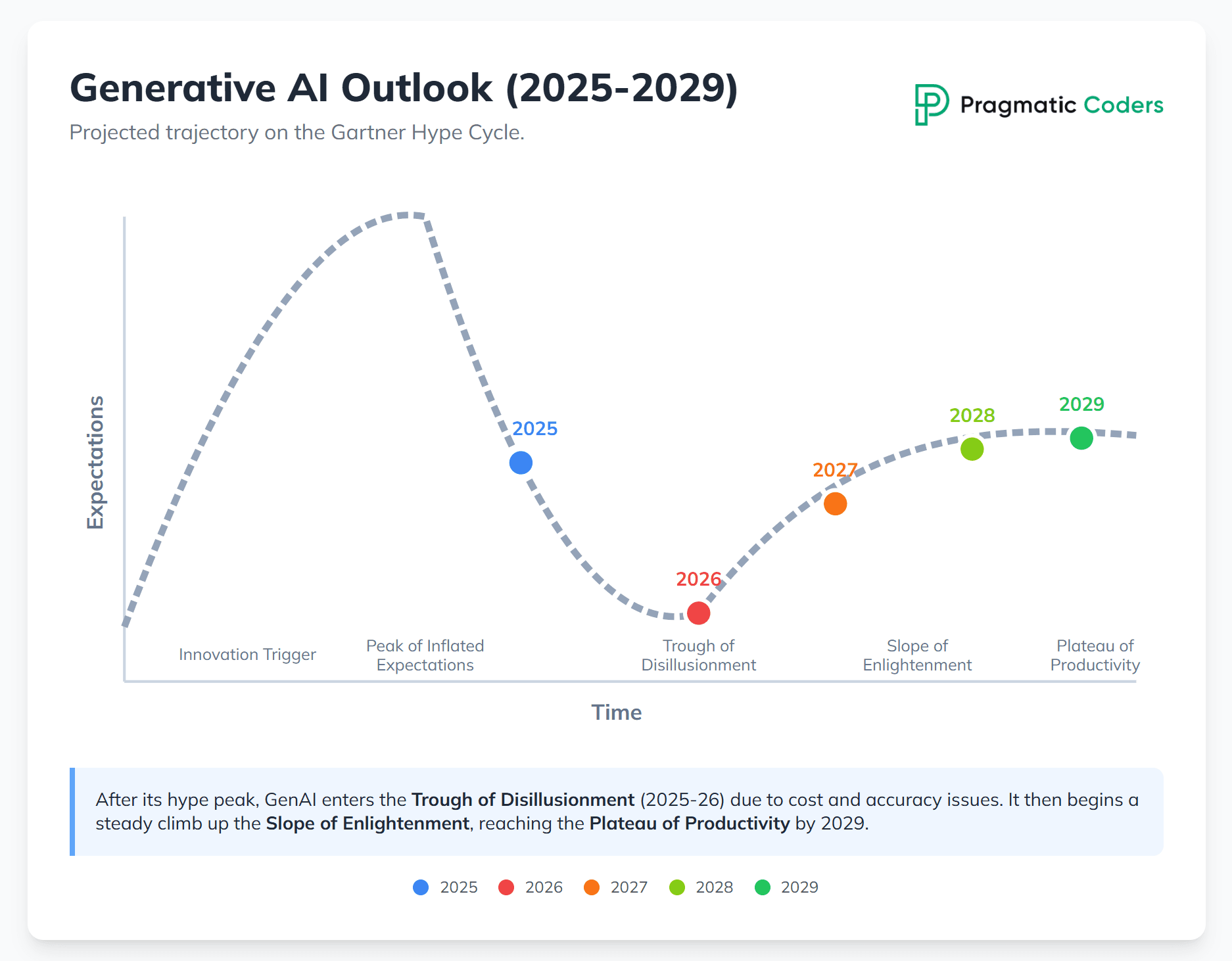

Generative AI Outlook (2025-2029)

Application and hype-driven AI is still working through excess. Many models promised monetisation before they proved margins. 2026 is where that gap gets tested.

This isn’t a negative outlook. It’s just how new industries mature.

AI Agents Outlook (2025-2026)

What changes in the 2026 market behaviour

The questions investors ask are changing.

In 2024, the question was: Is this AI?

In 2026, the question becomes: Does this earn?

Now, things like revenue quality, capital needs, and free cash flow are what count.

Big ideas don’t fail just because they’re wrong. They stall when expectations get ahead of what’s possible.

The Fabulous 8 through a 2026 lens

This is about where things stand, not about making predictions.

NVIDIA $NVDA ( ▼ 0.04% )

By 2026, Nvidia seems less like a fast-moving stock and more like a company settling into its success. Demand stays strong, growth levels out, and the stock becomes more volatile instead of just rising quickly.

Microsoft $MSFT ( ▼ 0.06% )

Microsoft didn’t get caught up in the hype. AI is now just a regular part of its earnings, and that steady approach matters in later cycles.

Broadcom $AVGO ( ▲ 0.14% )

Broadcom already acts like it’s in 2026. Its custom chips and networking grow steadily, without much hype. The company’s cash flow speaks for itself.

Alphabet $GOOGL ( ▼ 0.16% )

Alphabet’s main challenge for 2026 isn’t its technology; it’s making money from it. The market knows the tech works, but now wants to see profits.

Meta Platforms $META ( ▲ 0.24% )

Meta has already adjusted its value. Now, AI helps with efficiency and advertising rather than with big changes. Results matter more than stories.

Amazon $AMZN ( ▲ 0.03% )

Amazon heads into 2026 with AI options, but expectations are higher. Results, not just big plans, now measure AWS spending.

Apple $AAPL ( ▼ 1.43% )

Apple treats AI as just another feature, not a game-changer. This approach is less flashy but makes the company more stable.

Taiwan Semiconductor Manufacturing $TSM ( ▼ 0.52% )

TSMC benefits no matter which AI story comes out on top. By 2026, this ability to stay above the fray is a real strength.

What 2026 is unlikely to be

It is unlikely to be a replay of 2023.

It is unlikely to be a thematic collapse.

If fear appears, it will affect some areas, not the whole market.

What’s more likely is uneven progress, sudden shifts, and long periods with little happening.

That’s often when lasting returns begin to build.

Portfolio Parrot takeaway

By 2026, AI isn’t just a story to follow; it’s a business to judge on its own merits.

The first profits went to those who spotted AI early.

The next profits will go to those who stick around when expectations settle down.

The real risk isn’t missing out on AI.

It’s owning AI at the wrong stage.

Disclaimer: This publication is for general information and educational purposes only and should not be taken as investment advice. It does not take into account your individual circumstances or objectives. Nothing here constitutes a recommendation to buy, sell, or hold any investment. Past performance is not a reliable indicator of future results. Always do your own research or consult a qualified financial adviser before making investment decisions. Capital is at risk.

Markets move fast. Savvy investors spot trends early.

Every Monday, get my pre-market cheat sheet:

✅ What’s hot

✅ What’s fading

✅ Where smart money’s flowing

No hype, just data.

👉 Subscribe to stay ahead.