As retail powerhouses, Walmart and Amazon have carved out dominant positions in their respective domains. However, as physical and digital commerce boundaries blur, these two giants increasingly compete head-to-head. Both companies present compelling opportunities for long-term investors—Walmart with its stability and dividends and Amazon with its growth and innovation. Here’s how they compare.

E-Commerce & Digital Strategy

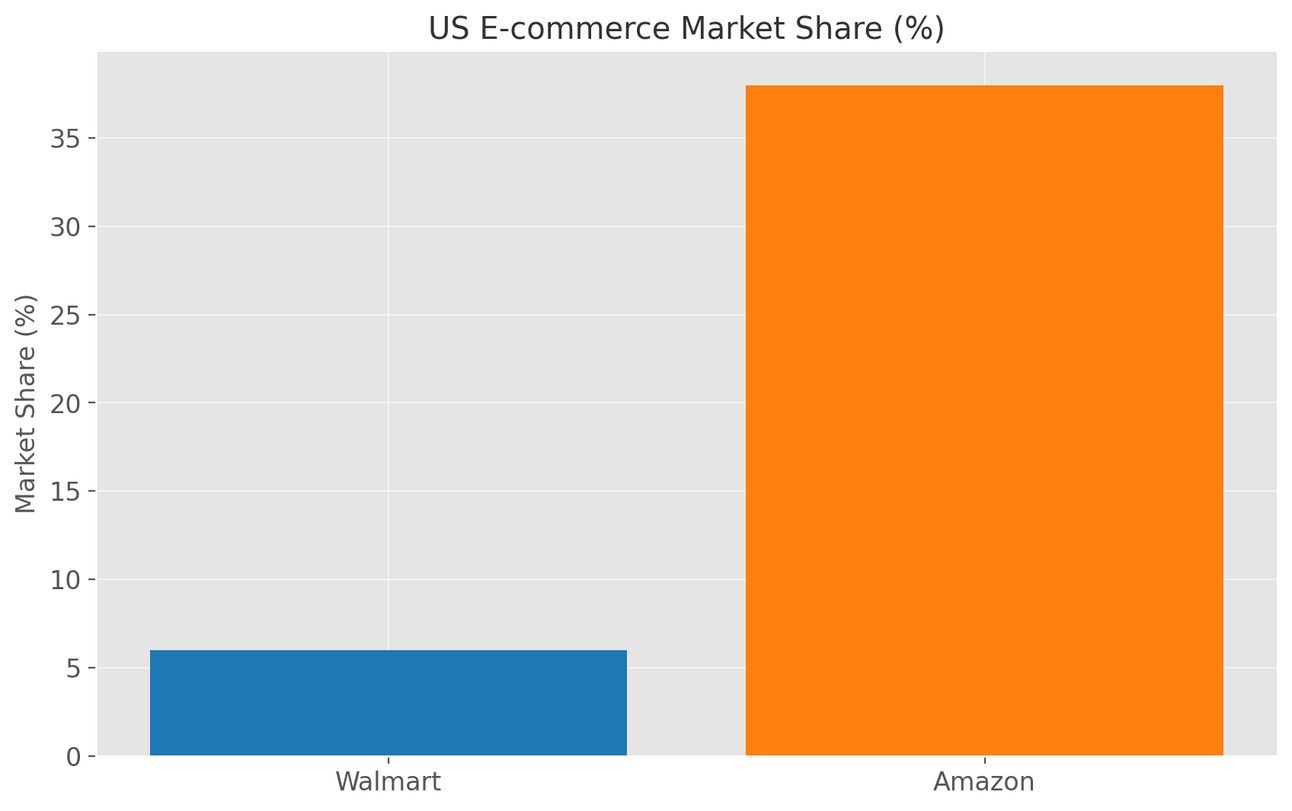

US Ecommerce Market Share

Walmart has emerged as a formidable player in e-commerce, with global online revenue exceeding $100 billion in 2023, growing 23% year-over-year. Its omnichannel approach leverages its extensive store network for services like curbside pickup and local delivery. Walmart+ membership is gaining traction, while investments in automation and AI are enhancing operational efficiency. The company also monetises its platforms through Walmart Connect, its fast-growing retail media business.

Amazon, the undisputed leader in e-commerce, continues to dominate with its third-party marketplace and Prime membership ecosystem. Despite slower growth post-pandemic, Amazon is doubling down on operational efficiency with one-day delivery and expanding its physical retail presence through initiatives like Amazon Fresh and cashier-less stores. Its digital ecosystem—including Alexa, Prime Video, and Kindle—remains a key competitive advantage.

Global Reach & Growth Potential

Walmart operates in 19 countries and has a stronghold in North America while expanding in high-potential markets like India through Flipkart. The international segment outpaced U.S. growth in FY2024 as Walmart scaled back from low-performing regions to focus on digital-first markets.

Amazon has significant market shares in over 20 countries, including the U.S., Western Europe, Japan, and India. While it faces regulatory challenges in Europe and struggles in China, Amazon is aggressively expanding its AWS infrastructure globally and tailoring strategies for localized market penetration.

Financial Performance

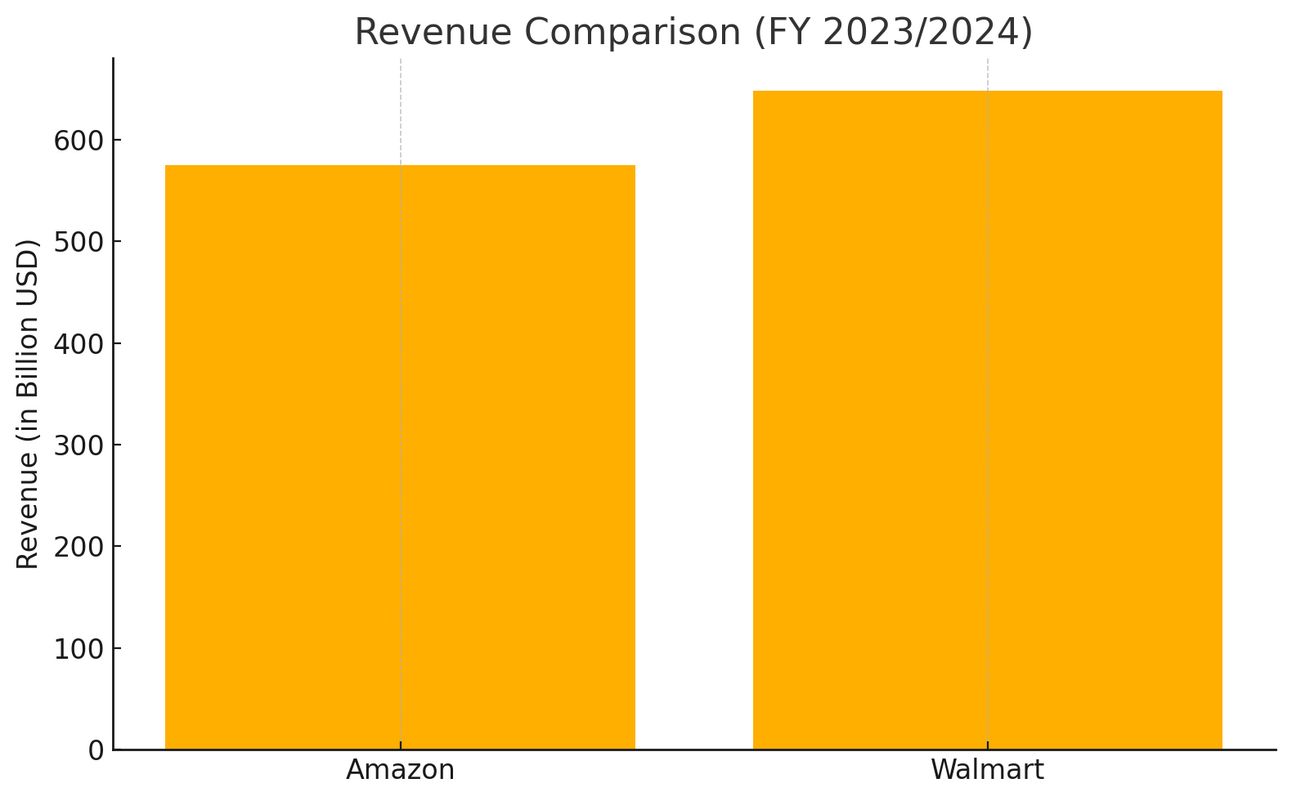

Revenues Comparison

Metric | Walmart | Amazon |

|---|---|---|

FY2023 Revenue | $611B | $575B |

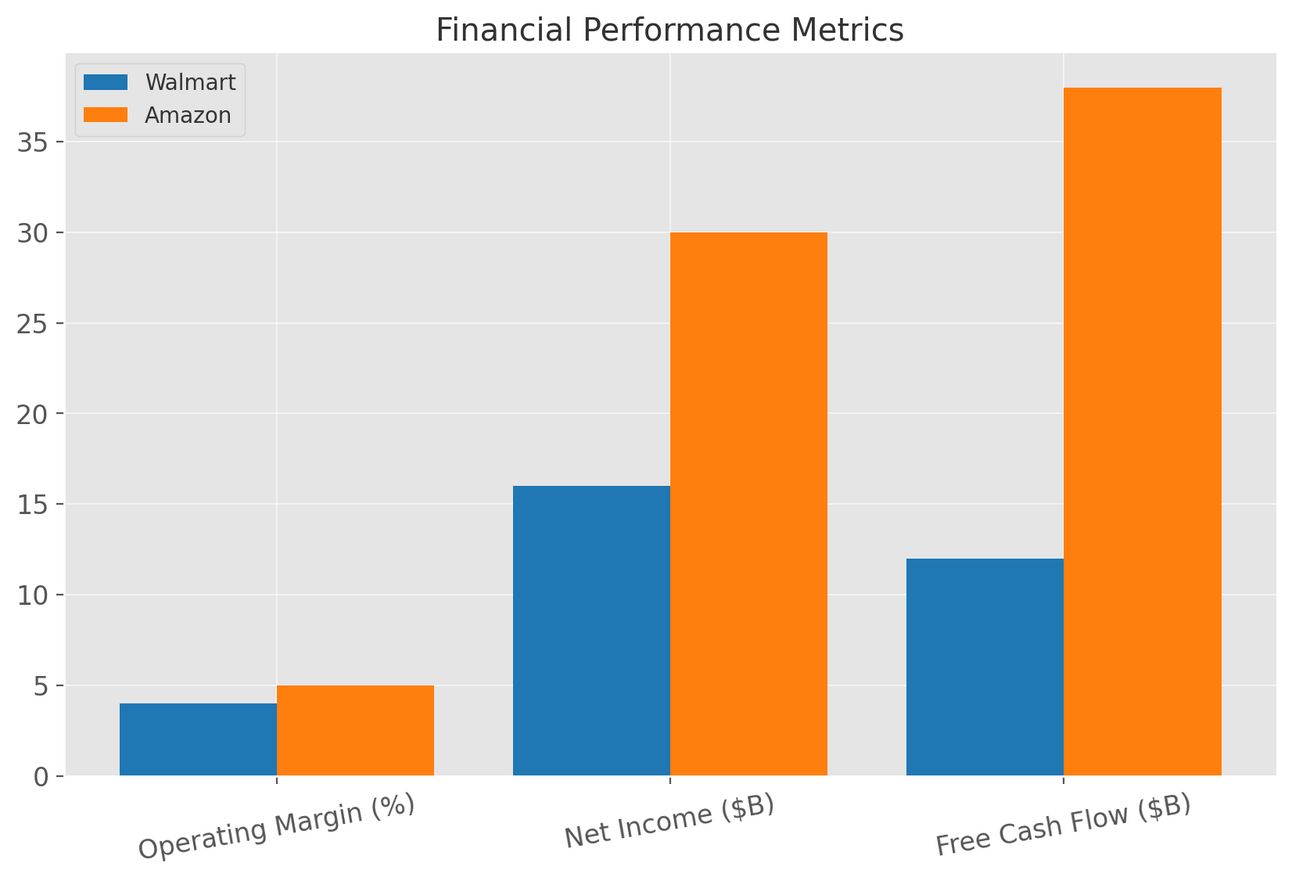

Operating Margin | ~4% | ~5% (AWS: 27%) |

Net Income | $16B | $30B |

Free Cash Flow (TTM) | $12B | $38B |

Financial Metrics

Walmart excels at converting operating cash into free cash flow, ensuring consistent earnings even during economic downturns. Its grocery dominance contributes to steady revenue streams.

Amazon, while historically reinvestment-heavy, is now entering a profitability phase driven by AWS and advertising. Its net income rebounded strongly in 2023, with further growth expected.

Valuation & Capital Allocation

Valuation Metrics

Walmart trades at a forward P/E of ~25x with a 1.5% dividend yield. It appeals to value-focused investors seeking predictable income through dividends and buybacks.

Amazon has a forward P/E of ~30x but boasts a lower PEG ratio (~1.6), reflecting higher earnings growth potential. It reinvests heavily in cloud computing, AI, and logistics rather than offering dividends.

Competitive Advantages

Advantage | Walmart | Amazon |

|---|---|---|

Grocery Market Share | Controls ~25% of U.S. grocery sales | Limited presence |

Digital Ecosystem | Growing advertising and fintech businesses | Prime ecosystem with over 200M members |

Cloud Infrastructure | Not applicable | AWS dominates cloud computing |

Fulfillment Network | 10K+ stores enabling same-day delivery | Advanced AI-driven logistics |

Risks

Walmart: Faces margin pressures from rising costs and must execute its digital strategy effectively to compete.

Amazon: Faces regulatory scrutiny globally and risks from heavy reinvestment and maturing e-commerce growth.

Strategic Outlook

Walmart: Evolving into a tech-enabled omnichannel leader by integrating retail media, memberships, and marketplace services.

Amazon: Transforming into a diversified tech platform with strong momentum in cloud computing, AI innovations, and global retail expansion.

Investor Takeaway

For investors seeking stability, consistent cash flows, and dividends, Walmart offers a defensive play.

For those prioritizing growth potential despite volatility, Amazon provides broader upside through its diversified tech-driven model.

A balanced portfolio may benefit from exposure to both stocks to capture the evolving future of global retail.

Disclosure: This article is for informational purposes only and does not constitute investment advice.

📈 Want to stay ahead of the market?

Subscribe to my free weekly newsletter, where I break down institutional investing trends, stock picks, and wealth-building strategies for 9-5 investors!