When investing, your capital is at risk. The value of investments can go down as well as up, and you may get back less than you put in. The content of this article is for information purposes only and does not constitute personal advice or a financial promotion.

Amphenol $APH ( ▲ 2.35% ) and the Quiet Business of Making AI Work

How a company that makes connectors became central to modern computing and grew into a $160 billion hardware giant

Five years ago, most investors would not have been able to explain what Amphenol does.

They make connectors, cables, and sensors, the components hidden inside other products.

These are not the types of products that make headlines, appear in keynote presentations, or get compared to software platforms or breakthrough chips.

But things have changed.

Amphenol has quietly become a key player in AI hardware, not by inventing something flashy, but by providing the essential parts that make everything function.

Every new technology still needs to move electricity from one place to another, and AI has made this fact even clearer.

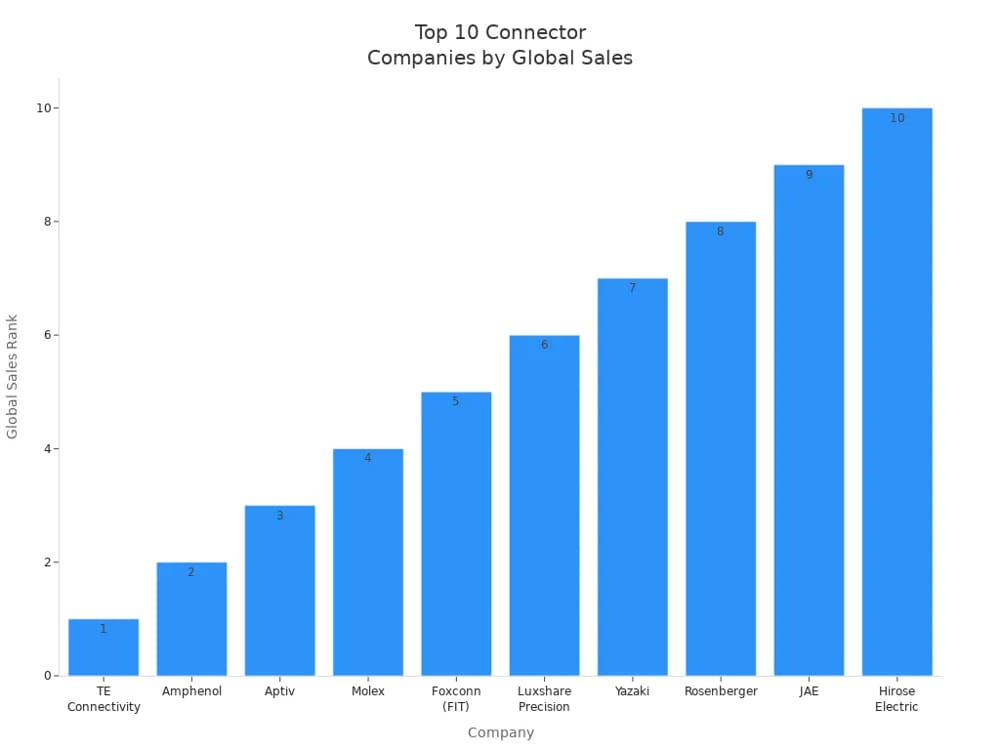

Top 10 global connector manufacturers by sales rank (as of 2024). Amphenol is #2 behind TE.

Why this cycle changed the narrative

AI infrastructure did more than increase demand for computing power. It also put pressure on every weak spot in the system.

Power delivery. Thermal management. Signal integrity. Bandwidth. Reliability at scale.

These challenges happen after the chip, not within it.

As data centre racks became denser and more power-hungry, the value of high-quality interconnect rose sharply. Not more chips, but more stuff around the chips. More cables. More connectors. More failure points that could not afford to fail.

That shift showed up clearly in Amphenol’s numbers in 2025. Quarterly revenue crossed $6 billion for the first time. More interestingly, the incremental operating margin for the quarter was 47%.

That combination matters. It tells you that demand was strong and profitable. Growth with leverage tends to get markets’ attention.

The bull case: why the optimism exists

1) AI revenue growth is becoming material

Bull models increasingly assume AI-related revenue rising from just over $4 billion toward ~$8.4 billion over the next few years. The logic is straightforward: AI systems scale connectivity faster than compute. More GPUs mean disproportionately more cables, connectors, and power solutions.

Amphenol's quarterly revenue breakdown by segment (Q3 2024 - Q3 2025)

2) Market positioning compounds the upside

Amphenol’s advantage is not just one product. The company was among the first to enter the market, has a broad presence across AI and data centre platforms, and continues to expand through smart acquisitions. When customers choose standard suppliers, having a broad range matters.

Segment | Q3 2025 Revenue | YoY Growth | Organic Growth | Operating Margin | Key Risk |

|---|---|---|---|---|---|

Communications Solutions | $2.91B | +101% | +78% | 30.6% | AI demand sustainability |

Harsh Environment Solutions | $1.45B | +38% | +18% | 25.2% | Cyclical automotive/industrial slowdown |

Interconnect & Sensor Systems | ~$1.4B | ~+18% | ~+12% | ~20% | Lower-margin commodity products |

3) Revenue growth with operating leverage

Passing the $6 billion quarterly revenue mark while posting a 47% incremental operating margin is the type of operating leverage that excites markets. It suggests a mix of improvement and pricing discipline, not just volume growth.

Metric | 2025 Performance (Est./Reported) | Year-over-Year Growth |

Total Revenue | ~$22.7 Billion | +49% |

Adjusted EPS | ~$3.30 | +74% |

Operating Margin | 27.5% (Record High) | +560 bps |

Free Cash Flow | ~$1.2 Billion (Q3) | 97% Conversion |

Dividend Yield | 0.74% | +52% Hike (eff. Jan 2026) |

The board approved a 52% increase in the quarterly dividend to $0.25 per share, payable January 7, 2026 (record date December 16, 2025).

The important point is not the dividend yield itself, but what it signals about the company’s confidence.

Management would not raise dividends by so much if they were unsure about steady cash flow, especially while still making acquisitions.

The bear case: why scepticism persists

1) Cash conversion may normalise

As investments increase, cash conversion is expected to slow down. This is important because the optimistic view depends on strong free cash flow to support both acquisitions and shareholder returns. If cash conversion drops, choices about where to spend money become more obvious.

2) Commodity costs can bite quietly

Connectors are carefully designed, but their costs still depend on metals, resins, and other materials. If these costs rise, profit margins could shrink, especially if the company cannot raise prices as growth slows.

The stock is priced much higher than usual, given its history. This price assumes that growth will stay strong as the AI market develops. If growth slows down faster than expected, the primary concern will be whether the company can keep up, not just how much it can grow.

Amphenol valuation perspectives showing significant divergence

Buy, hold, sell: three ways investors frame the same facts

These are descriptions of market logic, not instructions.

Why some buy

Exposure to AI, electrification, defence, and connectivity through one diversified platform.

Evidence that AI-related demand is high-margin, not just high-volume.

A long record of disciplined acquisitions expanding the earnings base.

Why some hold

The business momentum is strong, but much of it is already reflected in the share price.

Earnings growth may need time to “grow into” the valuation rather than justify further multiple expansion.

Large integrations ahead create a natural pause for new conviction.

Why do some sell or reduce

Valuation prices in continued execution with little tolerance for ordinary quarters.

AI spending is secular, but deployment remains cyclical. A pause would change sentiment quickly.

Rising investment intensity and commodity costs could pressure near-term cash metrics.

What actually matters next

AI-linked organic growth, not acquisition-assisted growth

Operating margin behaviour as the mix stabilises

Cash conversion trends as capex and M&A overlap

Order cadence from data centre customers

Bottom line

Amphenol is in an unusual position, selling products that are not flashy but have suddenly become essential. AI did not create the need for connectivity; it simply made it more obvious.

Right now, the main question is not about the quality of the business. It is whether a company that just had an exceptional year can still impress if its next year is just very good.

This uncertainty is what makes Amphenol both fascinating and a bit uneasy for investors.

Disclaimer: This publication is for general information and educational purposes only and should not be taken as investment advice. It does not take into account your individual circumstances or objectives. Nothing here constitutes a recommendation to buy, sell, or hold any investment. Past performance is not a reliable indicator of future results. Always do your own research or consult a qualified financial adviser before making investment decisions. Capital is at risk.

Markets move fast. Savvy investors spot trends early.

Every Monday, get my pre-market cheat sheet:

✅ What’s hot

✅ What’s fading

✅ Where smart money’s flowing

No hype, just data.

👉 Subscribe to stay ahead.