When investing, your capital is at risk. The value of investments can go down as well as up, and you may get back less than you put in. The content of this article is for information purposes only and does not constitute personal advice or a financial promotion.

TL;DR for the 9–5 Investor

What’s happening

Applied Materials is valued for an expected AI-driven upturn, but management and current policies make the near-term outlook uncertain.

Why it matters

HBM, gate-all-around, and advanced packaging make chip production more complex, increasing demand for a range of tools.

What the market is missing

AI demand is not just one trend. It is about a mix of factors. Moving to higher-value process steps and packaging can be as important as the total number of wafers.

Key risk to watch

China's export restrictions and ongoing policy uncertainty are key risks. AMAT expects these issues could reduce 2026 revenue by about $600 million, with some estimates as high as $710 million.

Investor lens

Use Buy, Hold, or Watch to guide your decision: Buy if bookings and margins improve in the second half of 2026. Hold if growth is steady but not exciting. Watch for policies tightening and valuations dropping.

Applied Materials and the Reality Check on the AI Tool Cycle

Most AI stories start with a model doing something impressive.

Applied Materials’ story is less flashy: a factory needs tools to deposit layers, etch patterns, check for defects, and repeat this process hundreds of times. Even the AI revolution depends on this cleanroom work.

This is why AMAT is important. It may not be exciting, but it is essential. Making more advanced chips means needing more of AMAT’s products.

As of early January 2026, the stock sits around $268.87. At that price, the market is not arguing about whether AI exists. It is arguing about timing and friction. Specifically, whether a back-half 2026 pickup in demand is strong enough to justify a premium valuation, and whether geopolitics takes a meaningful bite before that pickup arrives.

AMAT sits at $268.87

The business

Applied Materials builds equipment for making semiconductors and provides long-term support for these machines. The business has three main parts:

Semiconductor Systems: the main engine, tools used in chip fabrication, such as deposition and etch

Applied Global Services (AGS): spares, upgrades, subscriptions, and service contracts

Display and adjacent markets: smaller, but part of the mix

The services segment helps steady the business. Tool orders can be delayed, but service revenue is more reliable. This does not remove the ups and downs, but it makes them less sharp and more gradual.

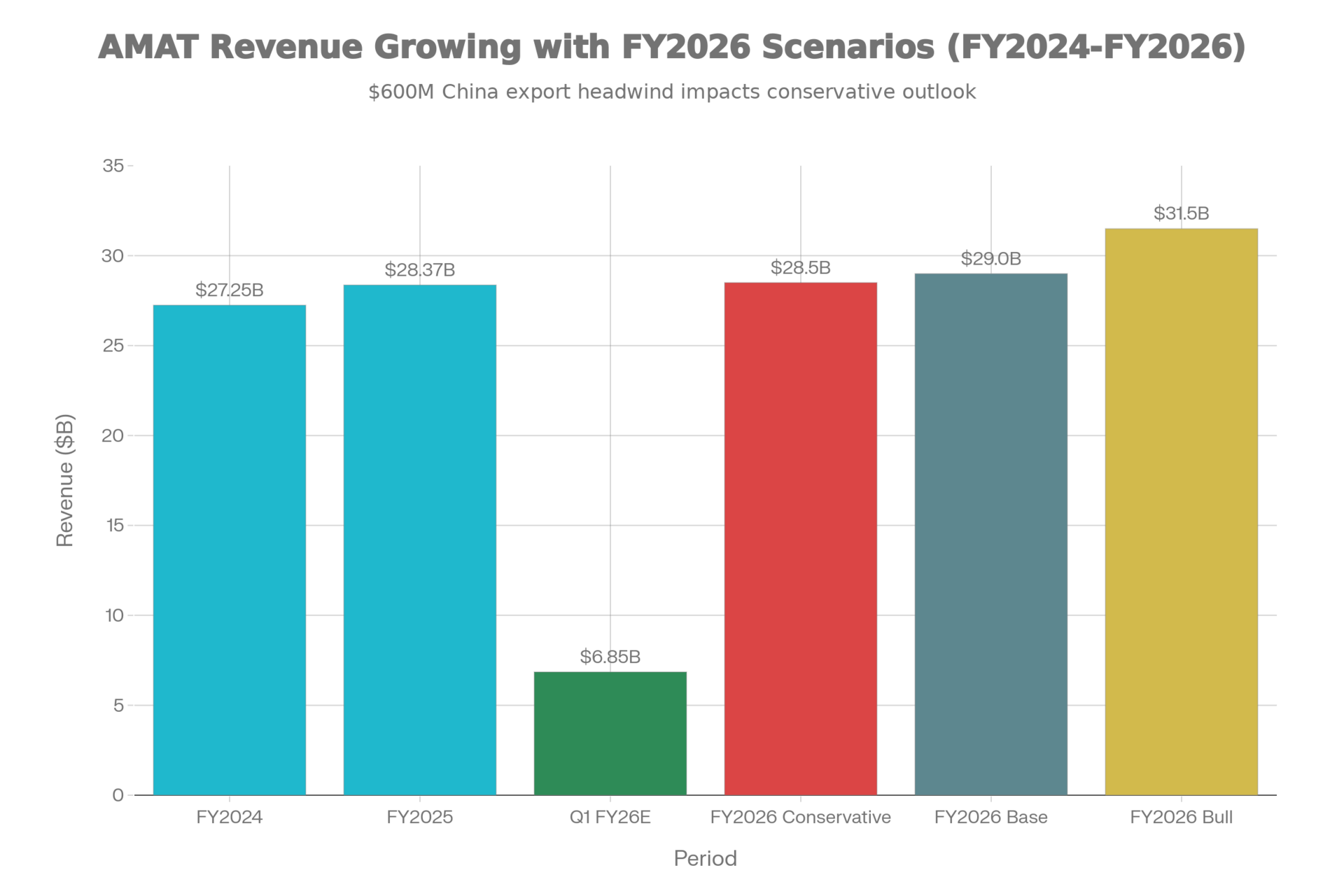

In fiscal 2025, AMAT posted record revenue of $28.4 billion and non-GAAP EPS of $9.42, with gross margin around 48.8%. Those are strong numbers for a company that lives inside one of the most cyclical industries on earth.

AMAT’s revenue is growing

Why AI changes the equipment math

It helps to think of AI as needing more complex chips, not just more chips.

AI accelerators and the systems around them push complexity in three places that matter for AMAT:

Leading-edge logic

Smaller nodes and new device structures mean more process steps and tighter tolerances.High-bandwidth memory (HBM)

Memory is no longer a commodity add-on. In AI systems, it is part of the performance ceiling.Advanced packaging

Chiplets and stacking are not marketing terms. They are engineering works that require new tools.

This is why people talk about “tool intensity.” A given fab does not just buy more tools. It often buys more specialised tools and higher-value tools as complexity increases. If the growth of AI is the main story, then “tool intensity” is the key detail behind the numbers.

HBM is the near-term hinge

HBM is where demand becomes tangible because of physical limits. Training and inference require a lot of bandwidth and generate heat, so they require fast, nearby, and stacked memory.

Samsung has been widely reported as planning a significant HBM capacity increase by the end of 2026, often cited as moving from roughly 170,000 wafers per month toward 250,000 wafers per month. The exact figures vary by reporting, but the message is consistent: the industry is preparing for a step-change in high-end memory output.

Why does AMAT care?

Because HBM stacking is a complex process, yield, deposition, etching, metrology, and packaging are all important, and these are areas where AMAT specialises.

If HBM demand increases and remains high, AMAT stands to benefit significantly.

The uncomfortable part: China

AMAT does not just benefit from global growth. It is also involved in the debate over who can build certain technologies and where they can be built.

China has been a large revenue contributor for $AMAT ( ▲ 0.27% ) in recent years. Export controls and licensing rules have already changed the attainable market. Applied Materials has cited an expected fiscal 2026 revenue impact of around $600 million, with some reporting pointing to $710 million.

For a company this size, that revenue loss is not a threat to survival. The bigger problem is uncertainty. Policy risks mean not just lost sales, but also delayed orders, limited plans, and customers who hesitate to commit until rules are clear.

Semiconductor cycles are already difficult to predict based on economics alone. When geopolitics are involved, forecasting becomes even harder, and pricing mistakes are more likely.

Valuation: the market is already paying for a good story

At roughly 31x P/E in the thesis inputs you provided, AMAT is not being priced like a cheap cyclical. It is being priced like a durable compounder with a visible runway.

That can be justified. AMAT has strong margins, meaningful services revenue, and an R&D budget built for next-gen transitions. It also has peers that trade at rich valuations for slightly different reasons.

ASML tends to carry a premium tied to lithography franchise economics

KLA often trades like a more defensive quality name, given process control exposure

Lam is often treated as more leveraged to the memory cycle

Metric | AMAT | LRCX | ASML |

|---|---|---|---|

Current Price | $268.87 | $185.00 | $790.00 |

P/E Ratio | 31.05x | 33.0x | 37.59x |

EV / Revenue | 7.5x | 12.4x | 12.9x |

EV / EBITDA | 22.2x | 28.5x | 28.1x |

Dividend Yield | 0.66% | 0.54% | 0.71% |

52-week Return | +56.1% | +107% | +34% |

AMAT trades at lower revenue & EBITDA multiples than competitors.

AMAT is in the middle: it is diversified enough to handle downturns, but still affected by industry cycles.

The key point is that when a cyclical stock is priced high, investors have less patience for missed expectations.

Scenarios for end-2026, anchored to $268.87

The following numbers are not forecasts. They show what would need to happen for each scenario to be reasonable.

Bull case: the inflexion becomes visible and durable

In this scenario, HBM demand rises significantly, advanced packaging becomes more important, and new technology transitions stay on track.

The back-half 2026 acceleration shows up in bookings and guidance

Mix shifts toward higher-value AI tools

Profit margins remain strong or even grow as higher-value products help cover additional costs.

Bull range: $310 to $330 by end-2026

That is roughly +15% to +23% from $268.87.

Base case: steady growth, partial H2 improvement

In this scenario, business improves, but not by much. Service revenue helps steady results. China slows growth, but does not stop it.

Revenue grows modestly

Margins inch up, helped by mix and cost actions

The stock trades as a fairly valued, good-quality cyclical company.

Base range: $265 to $280 by end-2026

That is roughly 1% to +4% from $268.87.

Bear case: policy drag plus a normal capex pause

In this scenario, export uncertainty has a greater impact than expected, and customers slow equipment purchases to absorb prior investments.

Growth underwhelms relative to the multiple.

Estimates get trimmed

The stock’s valuation drops to more typical levels for cyclical companies.

Bear range: $210 to $235 by end-2026

That is roughly -22% to -13% from $268.87.

What to watch

A busy investor does not need to monitor every press release. A few signals do most of the work:

HBM and packaging commentary from Samsung and other memory leaders

Order and booking visibility into the second half of 2026

China policy updates and how AMAT describes licensing and demand mix

Margins and mix as a sanity check that “AI tools” are showing up in results, not just slides

If these signals stay positive, AMAT will look like a top company supporting next-generation chips. If they weaken, the stock’s high price could fall quickly, as often happens when expectations are not met.

Bottom line

Applied Materials is a company that does well when the industry gets more complex, and investors are patient. It provides the equipment needed to turn ideas into real chips. AI, HBM, and advanced packaging all add complexity, and AMAT is well-positioned to benefit from this.

The current debate is not about whether AMAT will matter in the long run. It is about whether demand will pick up soon enough, and if China's policy will cooperate, to make today’s stock price reasonable.

Disclaimer: This publication is for general information and educational purposes only and should not be taken as investment advice. It does not take into account your individual circumstances or objectives. Nothing here constitutes a recommendation to buy, sell, or hold any investment. Past performance is not a reliable indicator of future results. Always do your own research or consult a qualified financial adviser before making investment decisions. Capital is at risk.

Markets move fast. Savvy investors spot trends early.

Every Monday, get my pre-market cheat sheet:

✅ What’s hot

✅ What’s fading

✅ Where smart money’s flowing

No hype, just data.

👉 Subscribe to stay ahead.