When investing, your capital is at risk. The value of investments can go down as well as up, and you may get back less than you put in. The content of this article is for information purposes only and does not constitute personal advice or a financial promotion.

ASML in late 2025: the world’s priciest bottleneck

Some companies are important, but others are essential; you can’t make the product without them.

ASML sits in the second category.

To make advanced semiconductors for AI, data centers, or top smartphones, you need a machine that only one company provides: EUV lithography. That company is ASML.

So, as of late December 2025, the simplest way to see ASML is as a chokepoint. It’s not a chip designer, a foundry, or even a typical equipment supplier. It’s more like a toll booth on the path to smaller nodes.

ASML Market Share by Segment (2024)

Data points that anchor the thesis

ASML’s own reports give us the basic facts:

2024 net sales: €28.3B

2024 gross margin: 51.3%

2024 net income: €7.6B

2025 outlook (maintained in Q1 2025): €30B–€35B net sales; 51%–53% gross margin

2030 framework (Investor Day): €44B–€60B annual sales; 56%–60% gross margin

ASML Financial Performance & Guidance (2023-2025E)

These numbers are important because they show rare confidence in long-term goals, supported by a strong customer base and a technology roadmap that’s hard to replace.

The technology moat: monopoly, then “monopoly plus”

ASML’s edge isn’t just having a better product; it’s being the only option for top-tier lithography.

1) EUV: one supplier, one gate

ASML is widely described as the sole supplier of EUV lithography tools, which are central to advanced-node manufacturing.

In reality, the main question isn’t about competing EUV vendors. It’s about how quickly factories can use ASML’s machines and how many lithography steps the next chip generation needs.

2) High-NA EUV: the next gate is already being installed

The 2026–2028 period matters because the industry’s focus shifts toward High-NA EUV, designed to support sub-2nm logic and leading-edge DRAM. ASML positions the TWINSCAN EXE:5200B as a High-NA system aimed at volume production in that regime.

Intel’s installation of the first commercial High-NA tool is a big step. It shows this technology is moving out of the lab and into real production.

On pricing: widely reported figures place High-NA systems in the hundreds of millions per tool, often quoted around €350 million / $380 million for the platform class. (Public sources vary by configuration and context, but the direction is consistent: these tools are materially more expensive than prior generations.)

3) Lithography intensity: “more passes” becomes the business model

Even if the number of chips made stays the same, more complex designs mean more critical patterning steps. For ASML, this makes their machines both a production bottleneck and a way to earn more per wafer.

This is the underappreciated part of the story: the “AI boom” can be cyclical at the application layer while manufacturing complexity keeps compounding underneath it.

Structural demand: three shifts that keep the order book busy

“AI” is the headline. ASML’s demand drivers are more specific than the headline.

1) Generative AI infrastructure build-out

SEMI’s industry outlook (reported by Reuters) points to continued growth in wafer fab equipment spending through 2026 and 2027, driven by rising logic and memory demand for AI applications.

ASML doesn’t supply all the equipment, but at the most advanced chip levels, their machines are essential.

2) Semiconductor sovereignty: duplication is the feature

Efforts to build more local and allied chip factories, driven by policy and incentives, make the industry less cost-efficient but more redundant in where capacity is located.

Redundancy usually hurts global profit margins, but it benefits companies that sell the machines needed for many factories in different regions.

3) Memory transitions: EUV moves deeper into DRAM economics

As memory moves to more advanced processes for AI, the need for better lithography grows. When equipment spending shifts, memory investment can change quickly. Still, industry experts agree that demand for advanced patterning is rising with AI.

The business model: selling machines, then monetising the installed base

One way to look at ASML is that it sells rare, complex machines and keeps earning from them over time.

ASML’s 2024 results show the scale and profitability profile that comes from this position: €28.3B net sales and 51.3% gross margin.

ASML also emphasizes its 'Installed Base Management' in reports, showing that its business isn’t just about one-time machine sales.

This matters because service and upgrades bring steadier income than new machine orders. It doesn’t end the ups and downs, but it makes them less extreme.

Financial trajectory: what management has actually put on record

Many semiconductor forecasts are vague, but ASML’s public targets are unusually specific.

2025 expectation (reiterated in Q1 2025): €30B–€35B net sales; 51%–53% gross margin

2030 opportunity (Investor Day framing): €44B–€60B annual sales; 56%–60% gross margin

It’s important to note that the 2030 margin targets aren’t guaranteed; they’re an 'opportunity' range based on scenarios. Still, having such ambitious targets shows where ASML thinks its business could go.

Risks that actually move the needle

ASML’s risks are obvious. They make headlines and show up in quarterly results by region.

1) China and export controls: revenue mix whiplash

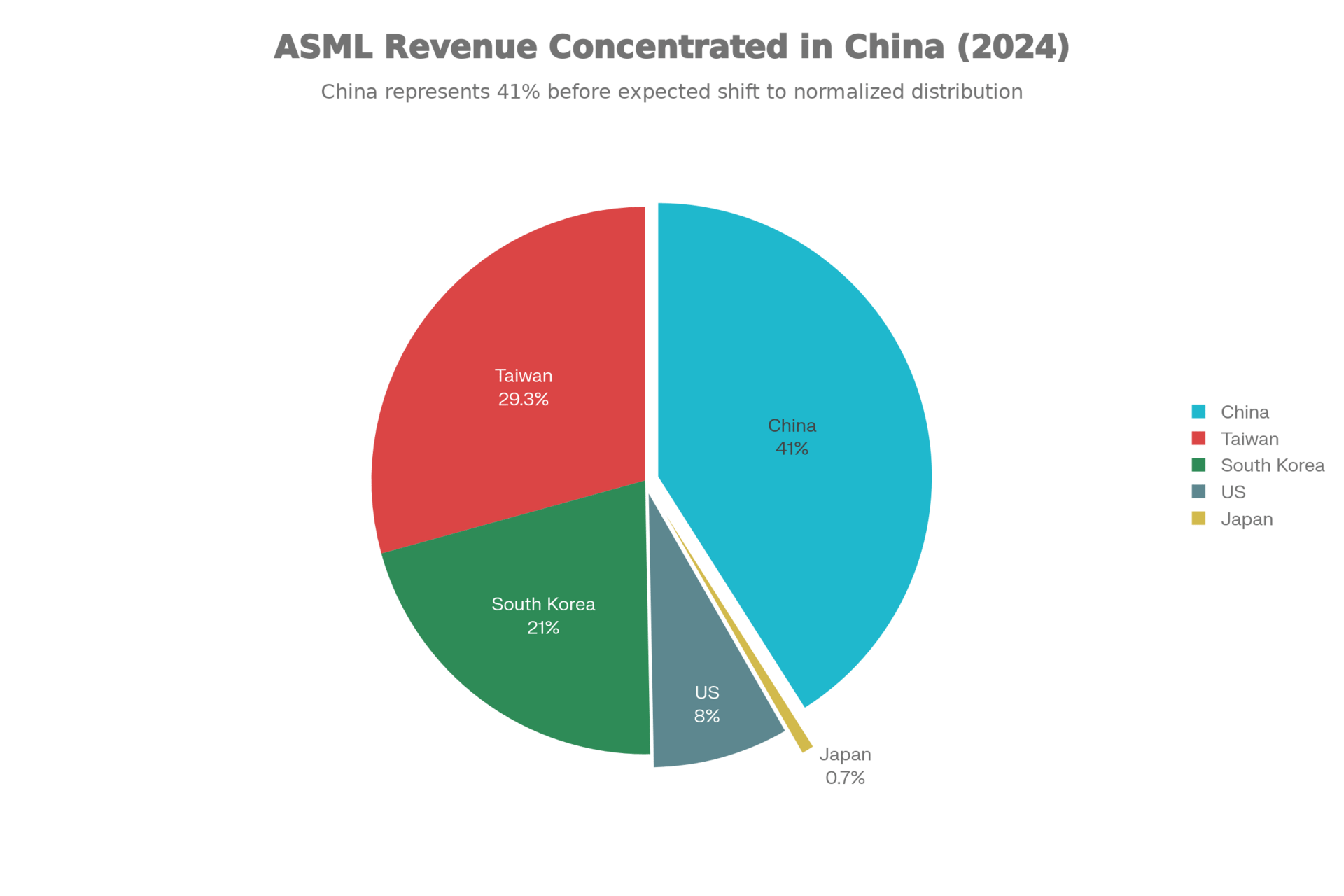

ASML Geographic Revenue: 2024

Reporting in late 2025 highlights how China-related restrictions and workarounds can affect ASML’s exposure and the broader ecosystem. The Financial Times described Chinese chipmakers upgrading older ASML tools to push capabilities within constraints, while noting that ASML’s China revenue surged in 2024 and was expected to drop with tightening restrictions.

Meanwhile, Reuters reported on China’s government-backed push to develop its own EUV technology, showing that geopolitics now directly shapes the technology roadmap. The takeaway isn’t that China will vanish from the market. Instead, policy risks will change the mix, timing, and predictability of business.”

2) Customer concentration: a small club at the frontier

At the cutting edge, there are only a few customers. This focuses both demand and negotiations, and it means that if one big customer changes their schedule, ASML’s equipment deliveries can shift too.

3) The “transition year” problem

When the industry shifts to a new platform, there’s often an awkward phase with overlapping testing, learning, and planning. High-NA is meant to drive the next growth phase, but how quickly it ramps up still matters. The market tends to expect either a perfect transition or a disaster, but reality is usually somewhere in between.

Bottom line: why ASML earns a scarcity premium

ASML’s thesis in late 2025 can be summarised in one line: advanced chipmaking requires EUV, and EUV requires ASML.

But that doesn’t mean ASML’s stock will rise smoothly. Semiconductor spending is still cyclical, geopolitics is a major risk, and platform changes can cause timing issues.

If you want to connect the AI era to the real world, remember: AI runs on silicon, and silicon chips are made with light. ASML provides that light.

Disclaimer: This publication is for general information and educational purposes only and should not be taken as investment advice. It does not take into account your individual circumstances or objectives. Nothing here constitutes a recommendation to buy, sell, or hold any investment. Past performance is not a reliable indicator of future results. Always do your own research or consult a qualified financial adviser before making investment decisions. Capital is at risk.

Markets move fast. Savvy investors spot trends early.

Every Monday, get my pre-market cheat sheet:

✅ What’s hot

✅ What’s fading

✅ Where smart money’s flowing

No hype, just data.

👉 Subscribe to stay ahead.