The Irony at the Heart of Bitcoin

Bitcoin was born as a rebellion.

A peer-to-peer currency designed to outlive banks, bypass intermediaries, and decentralise power. Yet fifteen years later, it trades like the very system it set out to disrupt.

Ever since institutions entered the picture, Bitcoin has started to behave less like “digital gold” and more like a high-volatility tech stock. Its price now rises on easy liquidity, falls when interest rates climb, and shadows the Nasdaq as if it were just another risk asset.

Satoshi Nakamoto envisioned a monetary system without middlemen. But today, the largest holders of Bitcoin are ETFs, custodians, and banks. The anti-establishment asset has become one of the establishment’s favourite instruments.

The Latest Price Shock

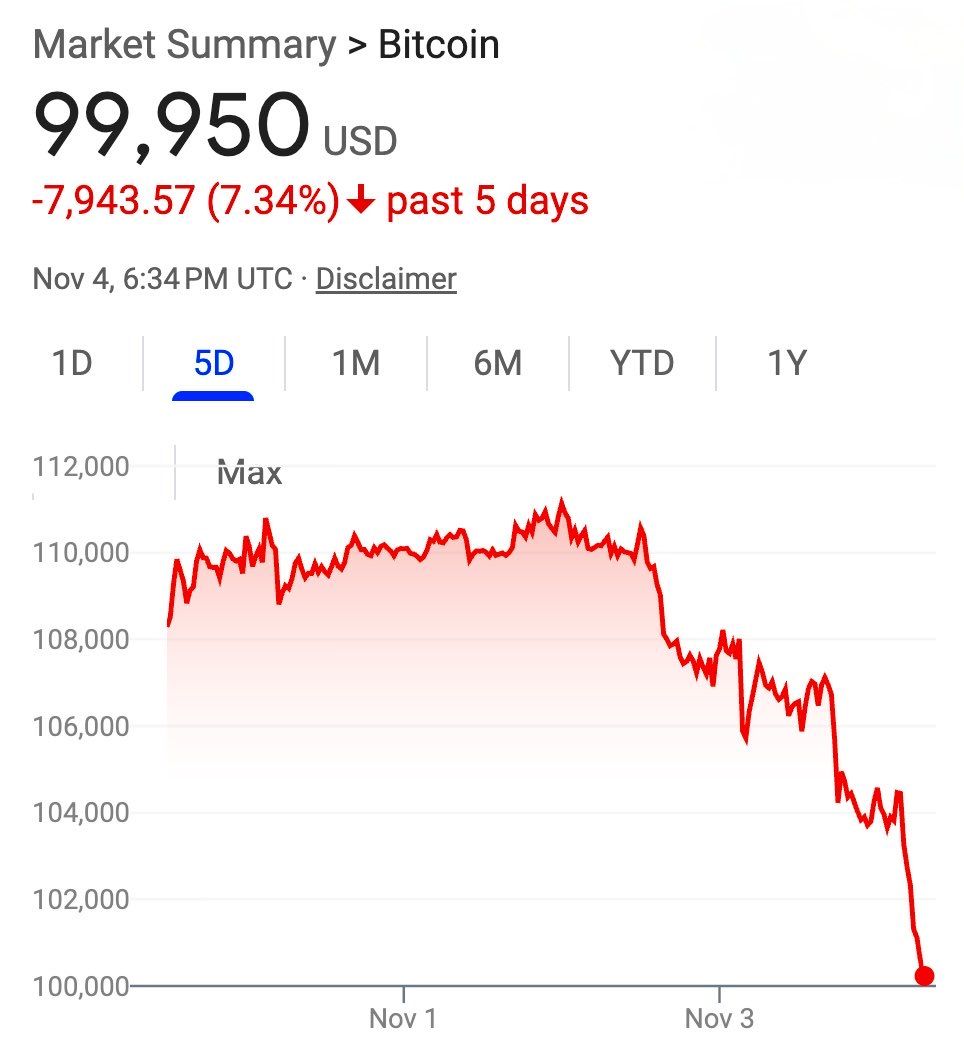

On 4 November 2025, Bitcoin slipped below US $100,000, its lowest level since June. The move caps a 20% drawdown from October’s record high of just above US $126,000, part of a broader correction across crypto markets (sources: TradingView, CoinDesk, Barron’s).

The irony runs deep. Bitcoin was meant to be a store of value, “digital gold.” Yet its price behaviour increasingly mirrors that of high-beta equities, not a monetary hedge.

Bitcoin falling below $100k USD

The Institutional Turn

The shift began in 2024, when spot Bitcoin ETFs launched from firms such as BlackRock and Fidelity Investments. Within months, billions flowed in, giving traditional investors access to Bitcoin through regulated financial channels.

But this mainstream acceptance came with side effects:

1. Correlation Shift

Bitcoin now moves in step with global risk assets, driven by liquidity cycles and macro sentiment rather than its own supply mechanics.

2. Custody Centralisation

ETF structures hold Bitcoin in institutional vaults, a direct contradiction of its “self-custody” ethos.

3. Narrative Drift

What started as a decentralised experiment in monetary independence has become a high-risk portfolio component, marketed as a diversification tool.

From Anti-Bank to Bank-Owned

It’s hard not to see the symbolism.

Satoshi built Bitcoin to escape the financial system. Wall Street repackaged it into ETFs to monetise it within that system.

Today, Bitcoin’s fate depends on central banks, fund flows, and ETF redemptions, not the ideals of decentralisation. It has been absorbed by the very forces it was meant to resist.

Does Institutionalisation Kill the Dream?

That depends on perspective.

Optimists see maturity. Regulation and institutional participation have brought credibility and liquidity.

Purists see betrayal. Bitcoin’s essence “be your own bank” is fading as control shifts back to centralised hands.

Realists acknowledge the paradox. For Bitcoin to scale globally, it had to integrate with traditional finance.

The uncomfortable truth is that Bitcoin cannot be both a hedge against Wall Street and a product sold by Wall Street.

What This Means for Investors

In 2025, owning Bitcoin is no longer just a bet on decentralisation. It’s a bet on the institutional adoption of decentralisation, a subtle but critical shift.

Its risk profile now aligns more with growth equity than hard money. That means greater volatility and exposure to liquidity cycles.

If you hold Bitcoin through ETFs, remember:

owning shares is not the same as holding private keys.

Because Bitcoin’s biggest challenge today isn’t its price.

It’s its identity.

Disclaimer: This publication is for general information and educational purposes only and should not be taken as investment advice. It does not take into account your individual circumstances or objectives. Nothing here constitutes a recommendation to buy, sell, or hold any investment. Past performance is not a reliable indicator of future results. Always do your own research or consult a qualified financial adviser before making investment decisions. Capital is at risk.

Markets move fast. Savvy investors spot trends early.

Every Monday, get my pre-market cheat sheet:

✅ What’s hot

✅ What’s fading

✅ Where smart money’s flowing

No hype, just data.

👉 Subscribe to stay ahead.