Broadcom Inc. (NASDAQ: AVGO) stands out as a unique hybrid blending semiconductor prowess with an expanding software ecosystem in the rapidly evolving technology landscape. With a market cap exceeding $934 billion, Broadcom has positioned itself at the nexus of AI-driven hardware and enterprise infrastructure software. But does this make AVGO stock a buy in today's market? Let's dive into a comprehensive analysis.

The Dual-Engine Growth Model

Semiconductor Dominance

Broadcom's semiconductor solutions, which generated $28.2 billion in fiscal 2023 revenue, are anchored by:

75% market share in Ethernet switching

Custom ASICs offering 40-60% cost efficiencies for AI workloads

AI chip segment revenue of $3.7 billion in Q4 2024 (+150% YoY)

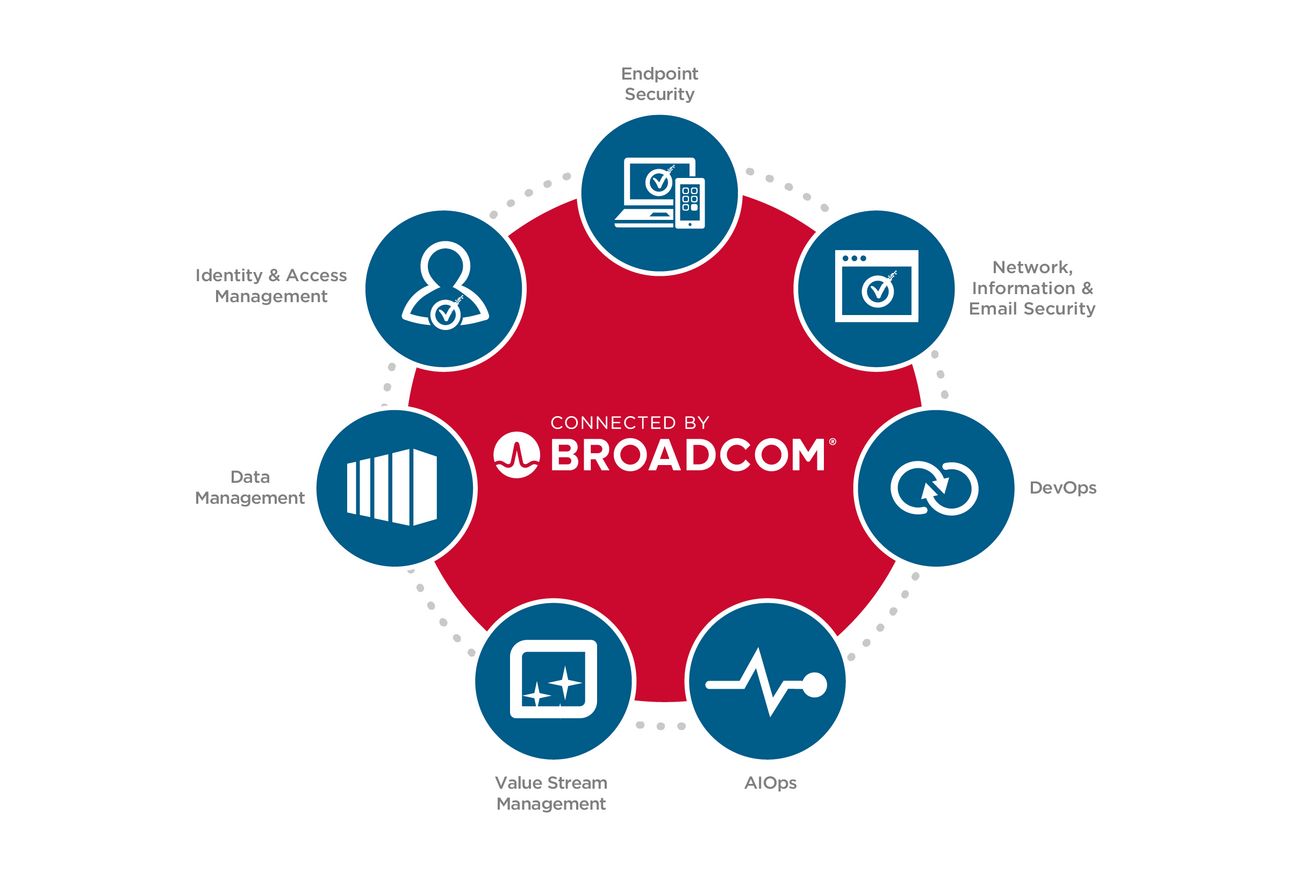

Software Transformation

The $61 billion VMware acquisition in 2023 marked Broadcom's evolution into a software powerhouse:

Infrastructure software now contributes 40% of revenue

90% gross margins in the software segment

Successful transition to subscription models, with 30% growth in annual recurring revenue

Financial Health Check

Non-GAAP gross margin: 76.9% in Q4 2024 (+800bps YoY)

Industry-leading EBITDA margins of 65%

Annual free cash flow of $12.4 billion

Debt-to-EBITDA ratio of 3.2x, considered manageable

The Bull Case

AI Chip Proliferation: Broadcom is capturing a significant share of the $90 billion AI ASIC market.

VMware Monetization: Software segment ARR growing at 30% YoY.

Margin Expansion: Analysts project 800bps of incremental EBITDA margin expansion through 2026.

The Bear Case

Valuation Concerns: Trading at 20x EV/Sales, a 60% premium to its 5-year average.

AI Revenue Concentration: 45% of AI revenue comes from just two customers - Meta and Google.

Regulatory Risks: Ongoing FTC scrutiny of VMware pricing practices.

The Neutral Perspective

Strong fundamentals justify premium multiples, but current levels may be extreme.

The stock trades 22% above its 200-day moving average, suggesting potential for mean reversion.

2.8% dividend yield provides some downside protection.

Investment Takeaway

Broadcom offers unique exposure to AI infrastructure and enterprise cloud migration trends. While the long-term outlook remains positive, current valuations demand near-perfect execution. Investors might consider:

Existing Holders: Maintain positions given operational momentum.

New Investors: Look for entry points below $200 for a more favorable risk-reward ratio.

Risk Management: Set stop-losses around the $175 support level.

A 12-18 month price target of $1,250 (25% upside) seems achievable, assuming 20% EPS growth and multiple stabilization. However, investors should remain vigilant to market conditions and company-specific developments that could alter this outlook.

📈 Want to stay ahead of the market?

Subscribe to my free weekly newsletter, where I break down institutional investing trends, stock picks, and wealth-building strategies for 9-5 investors!