When investing, your capital is at risk. The value of investments can go down as well as up, and you may get back less than you put in. The content of this article is for information purposes only and does not constitute personal advice or a financial promotion.

TL;DR (for the 9–5 investor)

What’s happening

Celestica Inc. has moved from being a traditional electronics manufacturer to supplying hardware for AI and cloud data centres.

Why it matters

AI spending goes beyond just chips. It also covers networking, racks, cooling, and integration, the less flashy parts that make sure expensive computing works.

What the market is missing

This isn’t about AI hype. It’s about execution. Celestica succeeds when customers trust it to deliver complex systems on time, again and again.

Key risk to watch

Customer concentration is a key risk. When only a few large buyers control spending, timing becomes more important than news headlines.

Investor lens

Believing in AI isn’t enough. The real issue is how long infrastructure spending will remain high relative to what’s already priced into the stock price.

A company that changed without changing its name

$CLS ( ▼ 0.02% ) has been in business for decades. Most of that time, it was in a field that rarely excites investors: electronics manufacturing services.

This industry is known for thin margins, unpredictable cycles, and customers who care more about price than loyalty.

Then something changed.

The change didn’t happen overnight or with a flashy rebrand. Celestica gradually shifted toward parts of the value chain that are most stressed when demand rises, such as networking, system integration, and rack-level hardware. This work bridges the gap between raw components and working infrastructure.

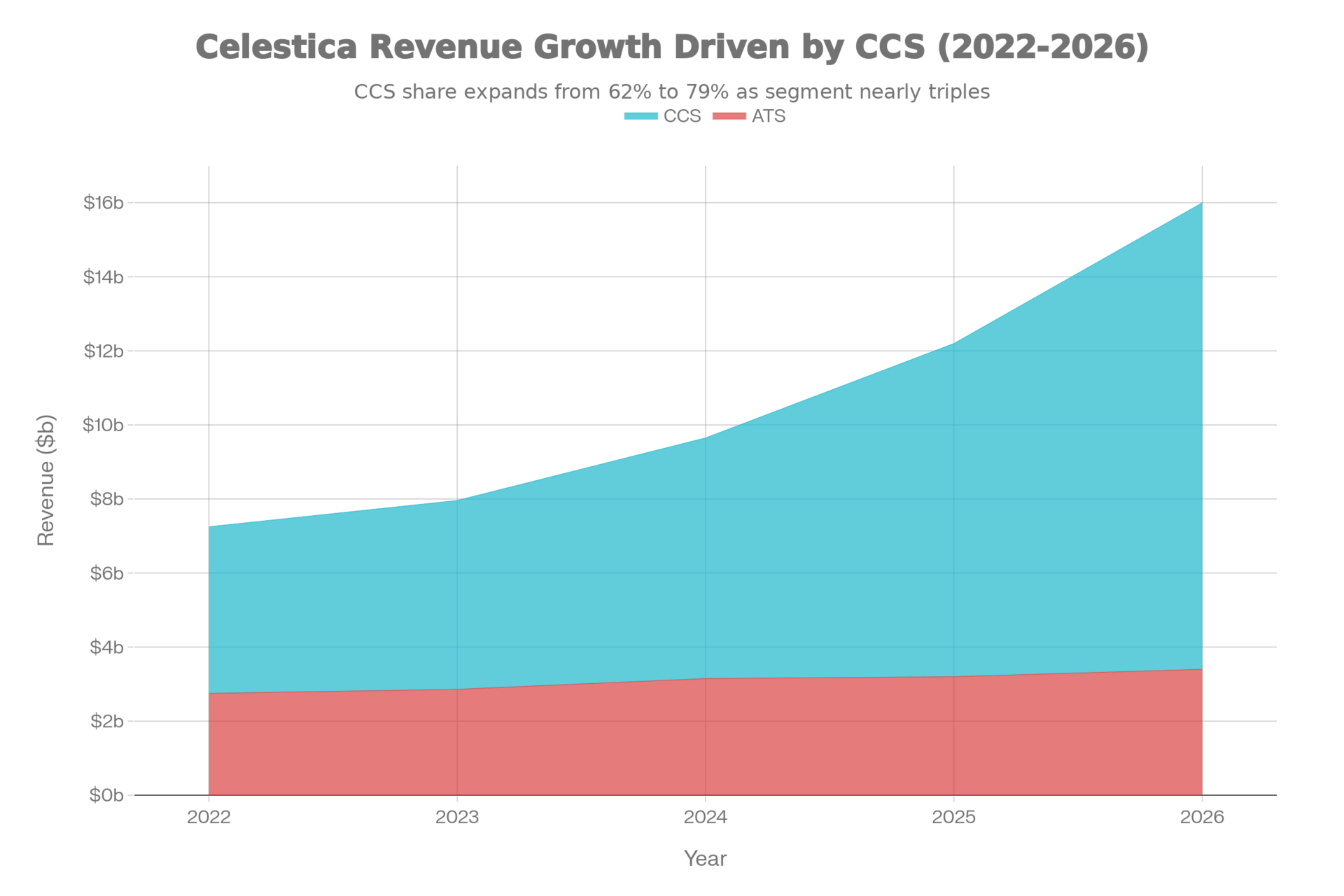

Today, the business is split into two segments:

Connectivity & Cloud Solutions (CCS): servers, storage, networking, full data-centre systems

Advanced Technology Solutions (ATS): aerospace, defence, industrial, healthcare, capital equipment

The key change is within CCS. Celestica no longer assembles what customers design. Now, through its hardware platform work, it also helps create the systems.

This may seem like a small change, but it makes Celestica more complex to replace and more deeply involved with its customers.

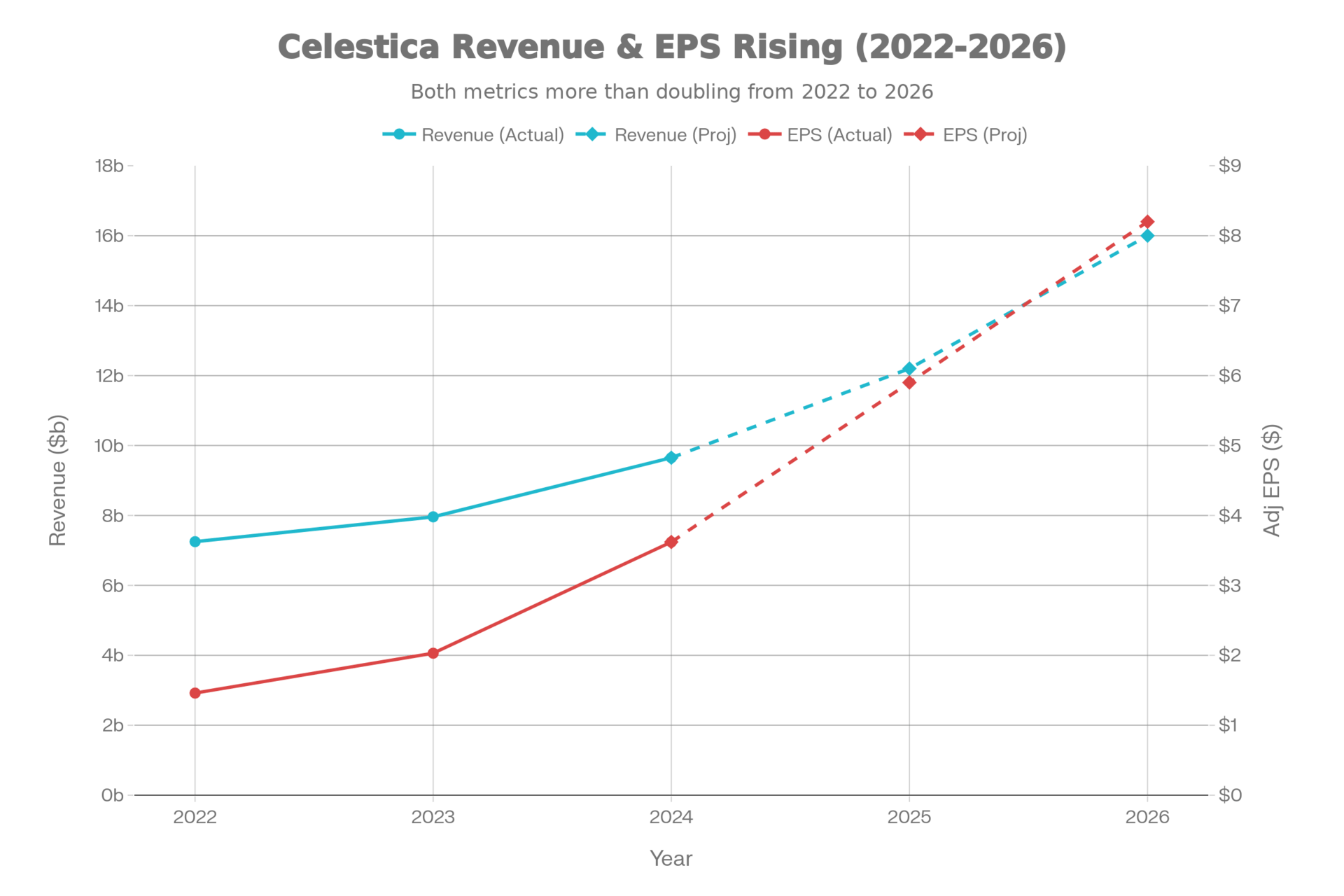

The numbers tell you when the story changed.

For years, Celestica grew like most manufacturers: slowly, steadily, and without much excitement.

Then, as AI infrastructure spending increased, Celestica’s growth sped up. Revenue rose, and earnings grew even faster. Margins improved not because manufacturing became high-margin, but because handling complex work pays better than making basic products.

Cash flow increased along with earnings, which is more important than any story. Growth backed by real cash is different from growth based on hope.

The stock responded and climbed quickly. Now, the primary debate is not about Celestica’s execution, but whether expectations have gotten ahead of reality.

Celestica Revenue & EPS Rising

Why AI infrastructure looks boring until it doesn’t

AI discussions usually focus on compute. GPUs. Accelerators. The expensive, headline-grabbing pieces.

In reality, performance bottlenecks often arise in other areas, such as networking bandwidth, power delivery, cooling, and physical integration. If these fail, even the best chips can’t be used.

Celestica built its strategy around that reality.

High-speed Ethernet switches. Rack-level systems. Designs optimised for AI workloads. These are not impulse purchases. Qualification takes time. Once a system works, customers are reluctant to change it.

This leads to something manufacturers rarely get: customer loyalty.

That’s why people now see Celestica less as just manufacturing capacity and more as essential infrastructure. It’s not glamorous, but it’s necessary and usually gets paid for.

Revenue Growth Driven by CCS

Three futures, all plausible

Stocks don’t succeed or fail on their own. They do well or poorly compared to what people expect.

Bull case: execution stays boring, results stay impressive

In the optimistic scenario, AI infrastructure spending remains strong longer than expected.

Clusters keep scaling. Networking and integration remain constraints. Celestica keeps getting follow-up calls because it already shipped the last system without incident.

Margins improve slowly as the company grows. Earnings keep beating expectations a little. The market starts to see Celestica more as a specialist infrastructure supplier than just a manufacturer.

The stock price seems high, but it’s not unreasonable given the company’s improving results.

What keeps this alive

Continued hyperscaler demand, not just guidance

New programs without pricing concessions

Operating leverage showing up quietly, quarter by quarter

Base case: the business works, the stock grows

The base case is more typical and less exciting.

Growth slows down from its peak. CCS continues to drive results, while ATS remains steady. Margins stop growing and hold steady.

Nothing breaks. But nothing dazzles either. The stock still grows, but without the boost from higher valuations. Returns come from earnings growth, not excitement. This is when good companies can become frustrating investments, even if they’re still solid businesses.s.

What this looks like

Decelerating but healthy growth

Fewer upside surprises

More attention is paid to capex timing

Bear case: customers remember they are in charge

The pessimistic scenario isn’t about poor management.

It’s about being too dependent on a few customers.

Celestica’s customers are large, rational, and disciplined. If spending pauses, programs stretch. In hardware, delays show up quickly. And when revenue is concentrated, small competition doesn’t go away during a slowdown; it gets tougher. Bigger rivals can lower prices to win key deals. Since Celestica’s margins are still modest, it has little room for mistakes if pricing pressure and slower growth occur together.

That’s when a high stock price stops being a reward and starts making disappointment worse.

What breaks the story

Clear signs of capex digestion

Higher customer concentration

Margin pressure from pricing or execution friction

Buy, hold, sell: how this actually plays out

This isn’t investment advice. It’s just a way to think clearly when there’s a lot of noise.

Reasons to buy

You might buy Celestica if you think AI infrastructure spending is still in its early stages and that execution will keep mattering more than price.

Celestica has already shown it can handle complex projects, scale them up, and turn growth into cash. If its platform work continues to grow, the business will remain distinct from older EMS companies.

Reasons to hold

You hold the stock when the business is solid, but the current price already shows that strength.

Growth continues. Excitement fades. Returns require patience rather than multiple expansions. This is often the most extended phase of a successful company’s public life.

Reasons to sell

You might sell when market cycles and customer concentration become the primary concerns.

If customers cut back on spending and competition intensifies at the same time, margins and stock prices can drop faster than expected. This isn’t because the company failed, but because expectations were too high.

Competition and reality checks

Celestica doesn’t control this market.

Competitors like Jabil and Flex are heading the same way. Asian ODMs are still strong. Competition will get tougher, not easier.

Celestica’s edge so far has been its focus and speed. To keep this up, it needs discipline, careful growth, and the ability to avoid chasing every opportunity at any cost.

Final thought

Celestica isn’t a turnaround story anymore, and it’s not a cheap stock. Its price now assumes that AI infrastructure spending will last and that strong execution will keep setting it apart.

The bull case says the build-out lasts longer than expected.

The base case says it continues, but more slowly.

The bear case says the industry already built enough plumbing.

All three scenarios make sense. The stock’s future depends on which one happens first.

Disclaimer: This publication is for general information and educational purposes only and should not be taken as investment advice. It does not take into account your individual circumstances or objectives. Nothing here constitutes a recommendation to buy, sell, or hold any investment. Past performance is not a reliable indicator of future results. Always do your own research or consult a qualified financial adviser before making investment decisions. Capital is at risk.

Markets move fast. Savvy investors spot trends early.

Every Monday, get my pre-market cheat sheet:

✅ What’s hot

✅ What’s fading

✅ Where smart money’s flowing

No hype, just data.

👉 Subscribe to stay ahead.