When investing, your capital is at risk. The value of investments can go down as well as up, and you may get back less than you put in. The content of this article is for information purposes only and does not constitute personal advice or a financial promotion.

How to Handle Market Downturns: A Practical Guide for Investors

Market downturns never feel good. Your portfolio dips. Headlines scream. Twitter/X turns into a chaos pit. Suddenly, every “long-term investor” feels the urge to do something.

But here’s the truth, investors often forget:

Downturns aren’t bugs of the system they are features.

They are the price of long-term returns.

Here’s your no-nonsense guide to staying calm, making smart decisions, and coming out stronger on the other side.

1. Accept That Volatility Is Normal (and Healthy)

Imagine a market that only goes up. Sounds nice…

until you realise every asset would be overpriced, returns would collapse, and nobody would build wealth.

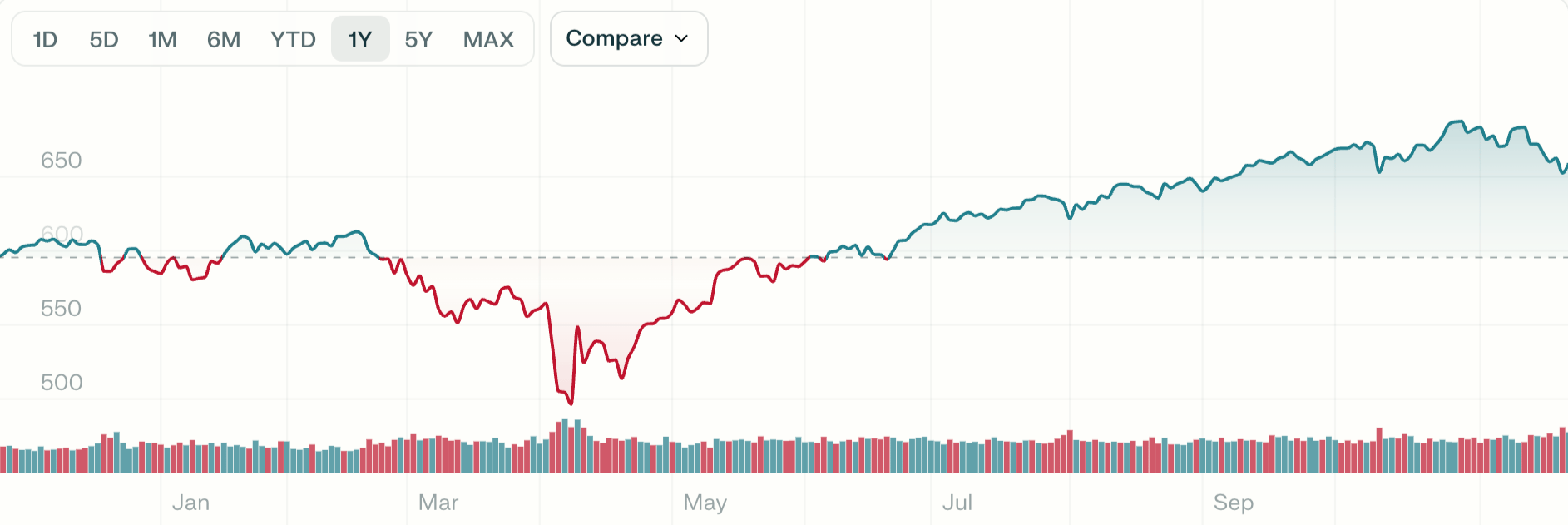

$SPY over the last year

Volatility is the mechanism that rewards patient investors.

S&P 500 history:

Average intra-year drawdown: –14%

% of years with a positive return: ~74%

If you’re feeling anxious, it usually means you forgot that downturns are the toll gate we all pay.

Reframe it:

Downturn = temporary pain for permanent gain.

2. Focus on Cash Flow, Not Market Noise

For 9–5 investors, your superpower isn’t timing, it’s consistent income.

Every month, you get to deploy new capital:

Salaries

Bonuses

Side-hustle income

Investing buckets you built

Downturns become opportunities because your fresh money buys more:

“When stocks go on sale, 9–5 investors should be the happiest people in the room.”

3. Use my Simple 3-Bucket Strategy

This protects you psychologically and financially.

My Simple 3-Bucket Strategy

Bucket 1 Cash Buffer (3–6 months)

So you never sell at the worst time.

Bucket 2 Long-Term Core Holdings

Your Apples, Microsofts, Amazons, and Nvidias are secular growth giants.

You don’t touch these in downturns. You accumulate them.

Bucket 3 Opportunity Capital

Cash set aside for downturns or oversold leaders.

Helps you “buy the dip” without wrecking your budget.

4. Zoom Out: Time Smooths Everything

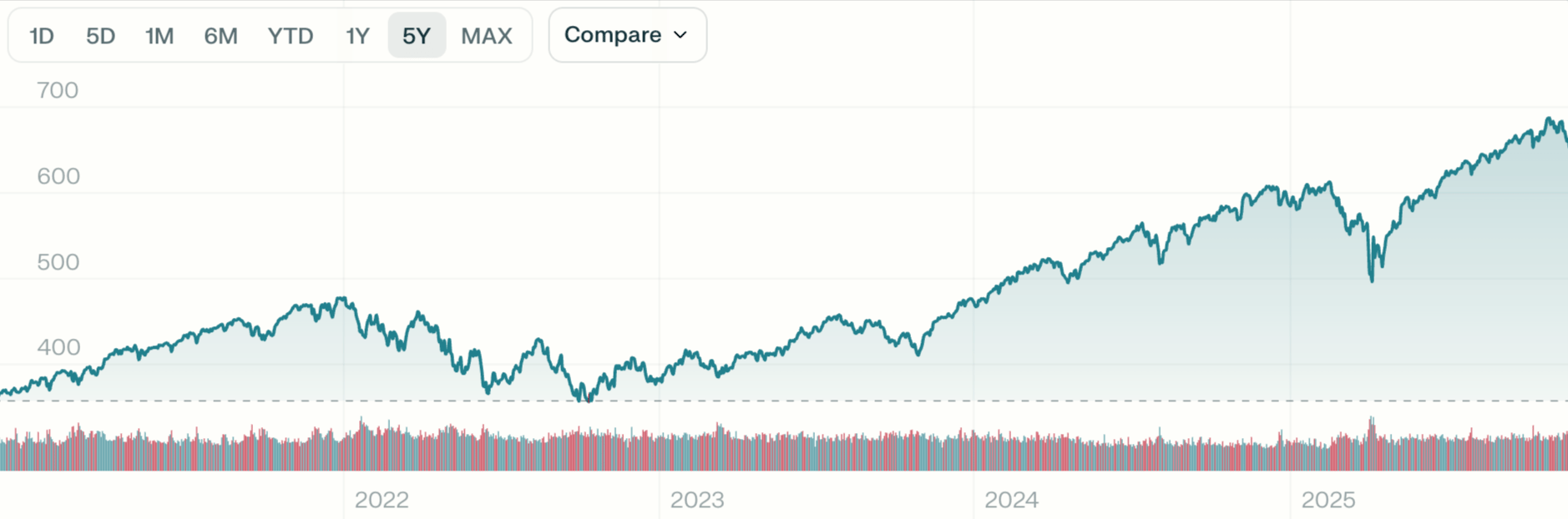

$SPY over the previous 5 years

If you check your portfolio every hour, everything looks like a crisis.

Check it monthly, and it looks like progress.

Check it yearly, and it looks like wealth creation.

Zooming out is a cheat code.

Here’s why:

The S&P 500 has never been negative over any 20-year rolling period.

Tech cycles (AI, Cloud, Mobile, Internet) reward long-term conviction.

The longer your horizon, the less power volatility has over you.

5. Stay Invested. Missing the Best Days Destroys Returns

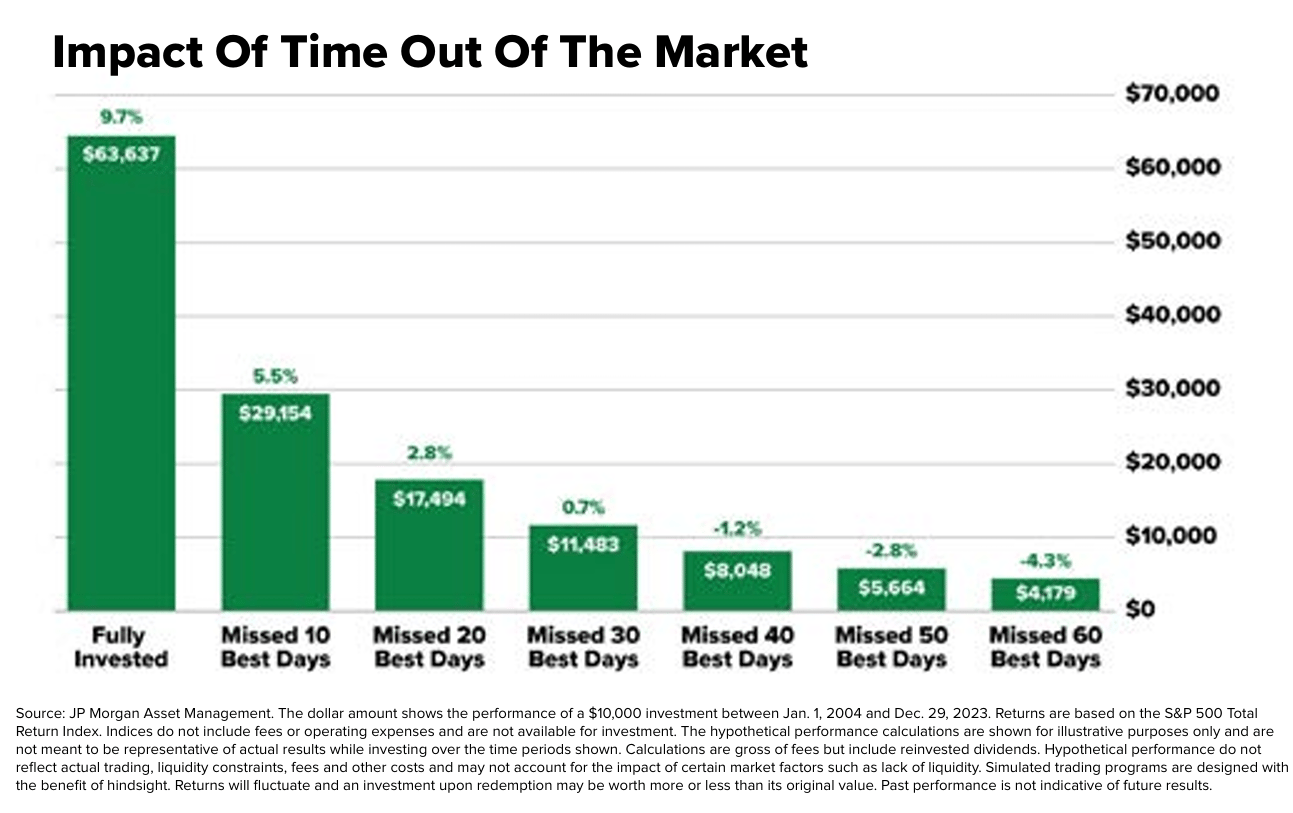

Data from J.P. Morgan and BlackRock shows:

Missing the 10 best days over 20 years cuts returns by more than 50%

Missing the 20 best days reduces returns to almost zero

And the kicker?

Those “best days” almost always follow the worst days.

Panic selling means missing the rebound.

Missing the Best Days Destroys Returns

6. Don’t Confuse Headlines with Reality

The media wants your attention, not your calm.

“AI bubble!”

“Rate cuts delayed!”

“Recession incoming!”

“Tech crash!”

Zoom out again, and none of these headlines change long-term drivers:

AI spending is compounding

Cloud workloads are rising

Consumers are spending

Earnings grow over time

When in doubt, trust earnings and cash flows, not noise.

7. Automate Your Investing

Automation removes emotional errors.

Set up:

Monthly ETF contributions

Weekly/biweekly buys for high-conviction stocks

A watchlist with entry targets

Simple rules you follow in volatility

“Automate your consistency, don’t automate your anxiety.”

8. Stick to Your Framework (Not Your Feelings)

Every serious investor needs a simple filter.

Portfolio Parrot Mental Model (PPMM):

Is this business a long-term winner?

Is the valuation reasonable relative to its growth?

Are institutions still accumulating it?

Is the narrative strengthening or weakening?

Am I thinking logically or emotionally?

Downturns test your framework, not your faith.

9. Remember the Law of Concentration

You’ve covered this before:

Most of the market’s long-term returns come from a small group of exceptional companies.

Downturns are when those companies temporarily go on sale.

That’s where long-term compounding begins.

10. Most Investors Lose Money Because They Overreact

History is consistent:

Markets punish emotional reactions

Markets reward disciplined ones

Those who panic-sold Amazon in 2001, Apple in 2008, and Nvidia in 2022 all made the same mistake:

Their emotions had a shorter time horizon than their portfolio.

11. Learn From Past Downturns (History Is a Map, Not a Mystery)

When markets fall, it always feels different.

History shows it’s usually the same story wearing new clothes.

Since 1928:

Bear markets have averaged 35–40% declines

They’ve typically lasted around one year

Every major one in modern history has eventually been followed by new highs

Here’s what past downturns looked like:

Event | Peak → Trough | Decline | Recovery Profile |

|---|---|---|---|

Wall Street Crash (1929) | Oct 1929 – Jun 1932 | ~89% (Dow) | Multi-year recovery; deep economic damage |

Black Monday (1987) | Aug 1987 – Dec 1987 | ~33% | Recovered in ~2 years |

Dot-Com Bust (2000–02) | Mar 2000 – Oct 2002 | ~49% | Took just over 5 years |

Global Financial Crisis (2007–09) | Oct 2007 – Mar 2009 | ~57% | Returned to new highs in ~4 years |

COVID Crash (2020) | Feb 2020 – Mar 2020 | ~34% | Recovered in ~5 months |

2022 Inflation Sell-Off | Jan 2022 – Oct 2022 | ~25% | New highs by mid-2023 |

2025 Tariff Drop | Feb 2025 – Apr 2025 | ~23% | Sharp partial rebound |

Three lessons stand out:

Depth varies. Recovery pattern repeats.

The strongest up days cluster inside bear markets.

Time horizon determines the outcome, not the headlines.

Even the worst starting points in history eventually recovered for long-term holders.

Final Message: Downturns Are Where Future Wealth Is Born

If you handle volatility correctly, downturns flip from threat to advantage.

You become the investor who:

Buys quality companies at fair prices

Ignores short-term noise

Focuses on cash flow

Plays the long game

Uses downturns to accelerate wealth

That’s the mindset of the 9–5 investor who eventually breaks out of the 9–5.

Disclaimer: This publication is for general information and educational purposes only and should not be taken as investment advice. It does not take into account your individual circumstances or objectives. Nothing here constitutes a recommendation to buy, sell, or hold any investment. Past performance is not a reliable indicator of future results. Always do your own research or consult a qualified financial adviser before making investment decisions. Capital is at risk.

Markets move fast. Savvy investors spot trends early.

Every Monday, get my pre-market cheat sheet:

✅ What’s hot

✅ What’s fading

✅ Where smart money’s flowing

No hype, just data.

👉 Subscribe to stay ahead.