Disclaimer: This article is for informational purposes only and does not constitute financial advice. The content is not a recommendation to buy or sell any financial instruments. Please consult a qualified financial advisor before making any investment decisions. Past performance is not a reliable indicator of future results.

In investing, what is comfortable is rarely profitable.

The Problem

With 4,300 publicly traded U.S. stocks and millions of private companies, even the S&P 500, a standard benchmark, includes 503 stocks.

How do you know which ones will grow your wealth?

The Smarter Approach

If you had a choice between:

✅ A guaranteed $1 million

❌ A 50/50 shot at $3 million

Most smart investors would take the guaranteed win. Why? Because investing isn’t about chasing risky bets—it’s about making calculated, data-driven decisions that maximise gains while protecting against losses.

The Solution: A Data-Driven Portfolio for Risk-Averse Growth

Instead of gambling on thousands of stocks, focus on a select group of 10-20 top stocks chosen using:

📈 Institutional fund flow and allocation trends

📊 Institutional-grade market data

📈 Proven methodologies used by mutual funds & ETFs

🔎 A focus on risk-adjusted returns & sustainable growth

Successful investing is about managing risk, not avoiding it.

Why Choose Institutional Investing Stocks?

4 reasons why I follow Top Stocks from Institutional Investing:

1️⃣ Big Money Moves: Institutions trade large volumes, influencing stock prices. When they buy or sell, the market reacts.

2️⃣ Deep Research: They have access to top-tier analysts, data, and investment strategies that most retail investors never see.

3️⃣ Long-Term Focus: Many institutions invest with long-term goals, reducing the emotional decision-making that often leads to poor investment choices.

4️⃣ Market Influence: Institutional activity can drive trends, helping us spot momentum early and capitalise on key market movements.

By tracking these high-impact stocks, I identify the best opportunities with lower risk and higher potential for sustainable growth.

Smarter Market Insights. Straight to Your Inbox.

Every Monday, get data-driven stock market insights designed for everyday investors.

🔹 Spot where institutional money is flowing

🔹 Learn how market trends are shifting without the noise

🔹 Curated insights for risk-aware, long-term investors

🔹 Built for 9-5 professionals who want to grow smarter, not faster

📩 Join savvy investors who stay informed, not overwhelmed.

It is impossible to produce superior performance unless you do something different from the majority.

Introducing QIQS: My Data-Driven Investment Approach

Successful investing requires a sophisticated blend of quantitative and qualitative analysis in today’s complex financial landscape. My investment strategy, QIQS (Quantitative Insight and Qualitative Screening), combines broad market data from institutional investing with specific performance indicators to identify promising stock opportunities weekly.

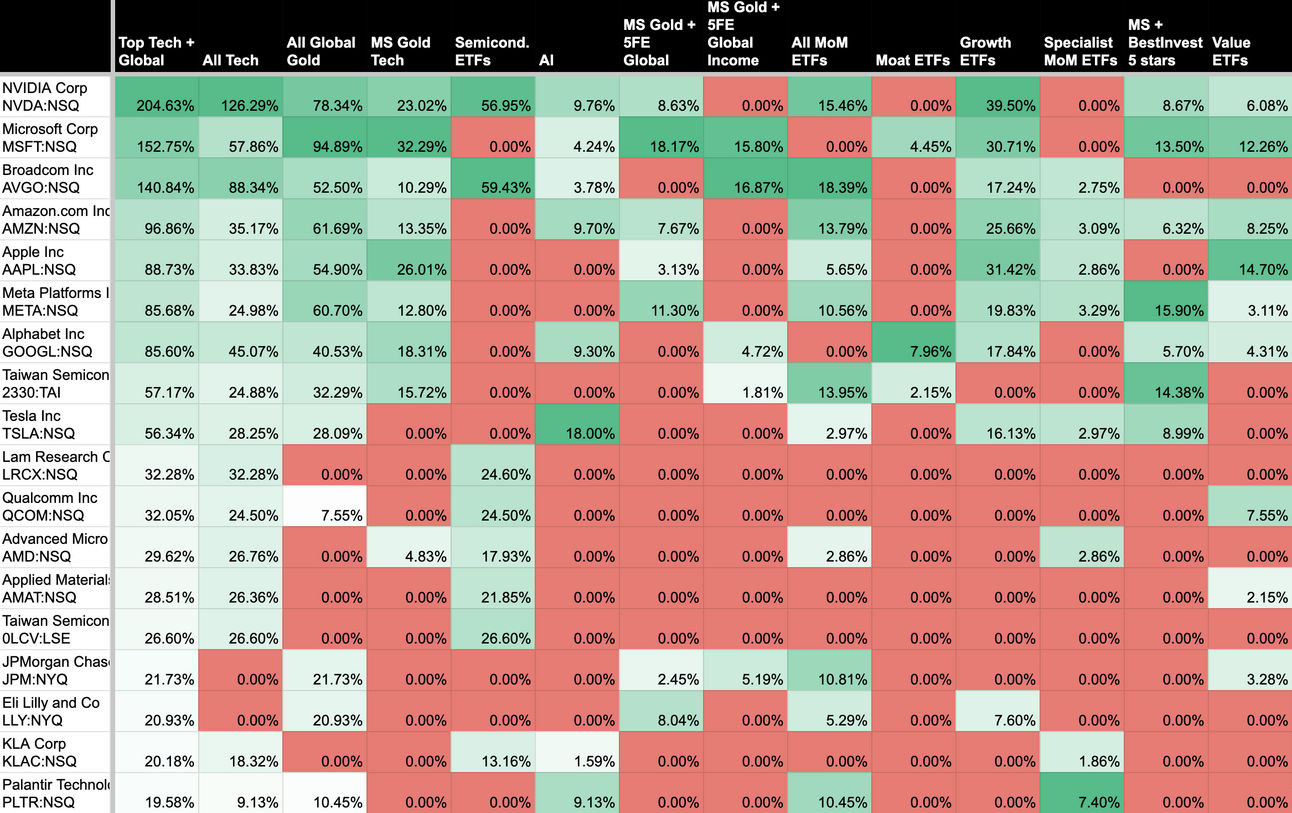

Step 1: Quantitative Foundation: ETF and Fund Analysis

Quantitative research identifies hotspots of institutional funding.

The first step in this method involves a deep quantitative analysis of ETF and fund holdings. I can pinpoint which stocks receive the highest institutional investment by examining the stock allocation data of various ETFs and mutual funds.

🔍 Why This Matters:

✅ Professionals with significant research resources manage ETFs and funds.

✅ Their allocation decisions provide valuable insights into which stocks the market favours.

How It Works:

📊 Data Collection: Gather up-to-date holdings data from various ETFs and funds across different sectors and strategies.

📈 Allocation Analysis: Use algorithmic tools to identify stocks with the highest allocation percentages.

📑 Ranking: Create a list of stocks based on their prevalence and weighting in fund portfolios.

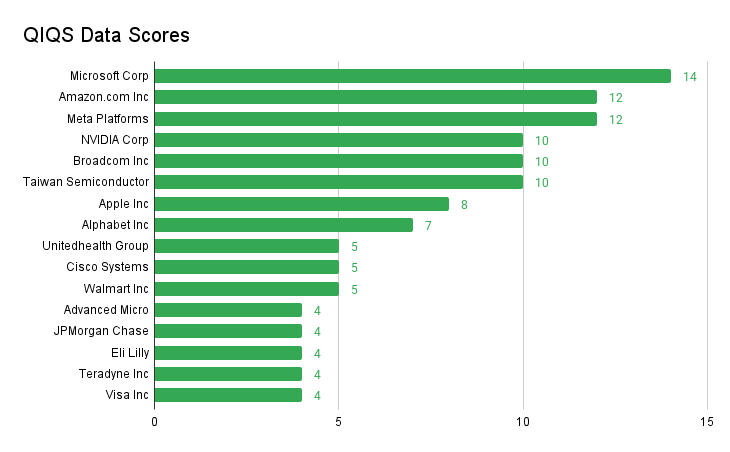

Step 2: Qualitative Refinement

Tally of quantitative and qualitative scores.

While quantitative analysis provides a strong starting point, qualitative filters ensure we select only the best investments.

🔍 Why This Matters:

✅ Adds context to the raw data

✅ Identifies future potential and risks

✅ It helps avoid value traps

Qualitative Screening Process:

📊 Market Outperformance Probability: Measures a stock's likelihood of outperforming the broader market.

📢 Analyst Buy Ratings: Looks at consensus recommendations from top financial analysts.

💰 Upside Potential: Analyses projected price targets and capital appreciation potential.

📉 Technical Analysis: Uses moving averages to identify trends and entry points.

Step 3: Weekly Stock List Generation

QIQS data drives the weighted composition of the investment portfolio.

This method produces a weekly list of high-potential stocks by combining institutional-grade quantitative insights from ETF and fund allocations with key qualitative factors.

🔹 This approach enables investors to enter the market at any time

🔹 Builds long-term portfolios with data-driven confidence

Get Data-Driven Stock Insights Every Monday

Stay informed with curated insights based on institutional activity and market trends designed for everyday investors.

🔹 Weekly stock market insights delivered straight to your inbox

🔹 Learn how institutions are positioning their portfolios

🔹 Use data to guide your research and decisions

🔹 Built for 95 professionals who value risk-aware investing

📩 Cut through the noise. Get clear, data-backed insights — no hype, no guesswork.

Subscribe now. It’s free.

Minimizing downside risk while maximizing the upside is a powerful concept.

The Benefits of My QIQS Approach:

✅ Leverages institutional investment trends

✅ Incorporates both fundamental and technical analysis

✅ Considers professional analyst opinions

✅ Focuses on stocks with a higher probability of outperformance

✅ Provides a regularly updated list of investment candidates

✅ Adapts to changing market conditions

Unlock the Institutional Edge with Market Intelligence — Now in Your Hands

Retail investors often lack access to the robust research and data institutions use to invest billions. My approach distils these high-level insights into an easy-to-follow investment strategy so you can make confident, well-informed decisions without the guesswork.

Get Data-Driven Stock Insights Every Monday

Want to navigate the markets with more confidence? Subscribe for curated stock insights backed by institutional activity and real-time market data.

🔹 Discover fresh ideas each week — no fluff

🔹 See where institutional investors are allocating capital

🔹 Use data to support smarter, risk-aware investing

🔹 Designed for 95 professionals building long-term wealth

📩 We cut through the noise to bring you clear, actionable insights — no hype, just the data that matters.

Subscribe now — it’s free.