When investing, your capital is at risk. The value of investments can go down as well as up, and you may get back less than you put in. The content of this article is for information purposes only and does not constitute personal advice or a financial promotion.

A Big Nvidia Party, Then The Lights Went Out

Thursday looked like another victory lap for the AI trade. Nvidia reported blockbuster numbers on Wednesday night, and futures reacted on cue. At the open, the S&P 500 was up well over 1 percent, the Nasdaq more than 2 percent. By the close, the rally had not only faded, but it had flipped.

Extreme Fear is driving the US market

The S&P 500 fell about 1.6 percent to roughly 6,539, the Nasdaq Composite dropped around 2.2 percent to 22,078, and the Dow Jones Industrial Average finished near 45,752, down about 0.8 percent.

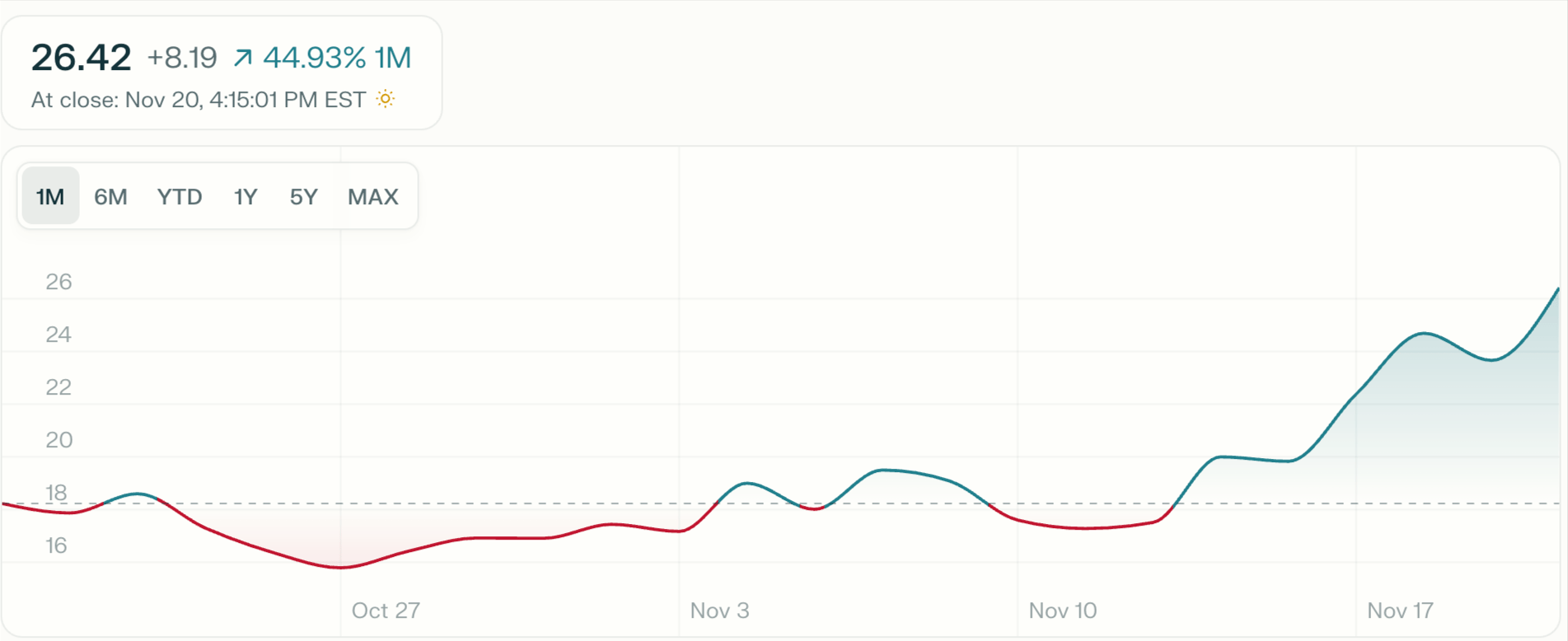

Nvidia itself followed the same script. The stock jumped in after-hours and pre-market trading after management described demand for its Blackwell chips as “off the charts,” then reversed to end down about 3 per cent as investors decided the valuation party might have gone a little too far.

The message from the tape was simple. Earnings can be excellent. Prices can still be fragile.

What Actually Moved On The Day

The reversal was broad, but not uniform.

Ten of the eleven S&P 500 sectors ended lower

Ten of the eleven S&P 500 sectors ended lower, led by technology and communication services. Semiconductor names that had rallied hard into Nvidia’s print gave back ground despite the strong numbers.

A notable exception was Walmart. The retailer gained roughly 6 to 7 percent after beating third-quarter expectations and raising guidance, a signal that US consumers are still spending heading into the holiday period.

Volatility resurfaced. The VIX moved back into the mid-20s, its highest level since May, reflecting renewed demand for downside protection.

The VIX moved back into the mid-20s

Outside equities, the “risk off” pattern showed up almost everywhere else.

Bitcoin dropped below 87,000 dollars, its lowest level in around seven months and down sharply from almost 125,000 dollars a month ago.

The 10-year US Treasury yield edged lower as buyers moved into government bonds.

Oil slipped to the high 50s per barrel on demand concerns, while gold ticked higher as the classic hedge trade reappeared.

Nvidia’s print answered one question about AI demand. The rest of the market spent the day asking several new ones.

Four Risks The Market Is Actually Grappling With

1. Fed Rate Cut Odds Have Collapsed

Six weeks ago, a December rate cut looked almost baked in, with some models assigning probabilities near 90 percent. After the delayed September jobs report and a batch of Fed communication on Thursday, that view has flipped. Market implied odds for a December cut have dropped into the 20–30 percent range, depending on the measure.

Minutes and public comments tell the same story. Several officials are open to cutting in December, but many prefer to wait for more data. The committee is split, and the Fed’s message is that policy is “not on a preset course.” For markets that had started to price a smooth easing cycle through 2026, that is a meaningful reset.

2. AI Valuation And Funding Structure Look Stretched

The AI trade is not only about earnings growth, it is about how that growth is funded.

Large investors, including teams at Citadel, have flagged emerging structural risks. One concern is the build-out of long-dated debt against assets that become obsolete quickly. Issuers are selling 30- to 40-year bonds to finance hardware that effectively depreciates over roughly 4 years. If the cash flows from AI projects fall short of expectations, that timing mismatch can become painful.

Another flag is the surge in issuance of zero-coupon convertibles. Volumes are approaching levels last seen in 2001 and 2021, both periods that preceded sizeable market drawdowns. The underlying AI demand story may be real. The capital structure and its pricing still have to make sense.

3. The Labour Market Is Strong And Soft At The Same Time

The delayed September employment report, held up by the six-week government shutdown, added to the confusion rather than clearing it.

Headline payrolls showed 119,000 jobs added, more than double the 51,000 economists expected. At the same time, the unemployment rate ticked up to 4.4 percent, the highest since late 2021, as more people re-entered the labour force. There was visible weakness in areas like transportation and warehousing.

For the Fed, this is tricky. The economy is not clearly rolling over, but it is not unambiguously strong either. Without an October report, and with the next major jobs data not due until mid-December, the December meeting will be held in a partial data fog.

4. Inflation Is Stubborn, And Tariffs Complicate The Picture

Headline US inflation is running at roughly 3 percent year on year, above the Fed’s 2 percent target. Core goods prices had been a source of disinflation, but recent readings show renewed pressure as tariffs work their way through supply chains, particularly in import-heavy categories like apparel and recreation goods.

If tariffs keep inflation above target, it becomes harder for the Fed to justify cutting rates, even if growth slows. That combination of sticky inflation and softer activity is exactly the mix that makes equity valuation more sensitive to every new data point.

The Catalysts That Matter From Here

Federal Reserve December Meeting

The 9–10 December FOMC meeting is the key near-term event. A decision to hold the policy rate at 3.75–4.00 percent would formalise the “higher for longer” narrative that markets moved towards on Thursday. A surprise cut would re-ignite optimism in long-duration growth assets, especially tech. The press conference will be closely analysed for how Chair Powell describes the split within the committee and what that implies for 2026.

Flash PMI Data After The Shutdown

Flash PMIs for the US, the Eurozone, the UK, and Japan are due on Friday. These surveys will be the first broad read on activity since the US government reopened. The focus will be on whether the renewed tariff environment and uncertainty around rates have started to drag on new orders and hiring, or whether October’s rebound in services sentiment has carried over into November.

Earnings Season Tail Especially Retail And AI

Earnings season is moving into its final phase. Walmart’s strong results and upgraded outlook showed that the US consumer still has spending power, at least in large format essentials. The question now is whether more discretionary names show the same resilience, and whether AI-exposed companies beyond Nvidia can convert enthusiasm into durable cash flows. Any guidance cuts for 2026 would feed directly into the valuation debate.

Treasury Yields And Credit Markets

The 10-year Treasury yield, hovering around the low 4 percent area, is a rough “stress gauge” for equities. A sustained move below 4 percent would likely signal rising recession worries. A move back above 4.2 percent would reinforce the idea that high real yields are here for longer than the equity market had hoped.

Credit is the other side of the same coin. The overlap between AI funding, private credit and conventional bond markets is growing. Any sign of strain in funding for data centres, chip capacity or cloud infrastructure could force investors to re-price both credit and equity risk premia.

December CPI As The First Verdict On The Fed

The December CPI release in mid-January will be the first inflation print after the Fed’s December decision. If inflation re-accelerates, it would strengthen the case for a longer pause and keep real rates elevated into early 2026. If it continues to cool, it would open the door again to a more accommodating path later in the year.

How To Read A Day Like This

The surface story is simple: Nvidia impressed, the market sold off anyway. The underlying story is more nuanced.

Indexes are still up strongly year to date, with the S&P 500 gaining around 10 percent and semiconductors up by more than 30 percent in 2025.

Thursday’s move was less about a single earnings report and more about the tension between high growth expectations, uncertain policy, and an expensive part of the market bearing much of the load.

Crypto, long-duration equities and other “high beta” pockets all pointed in the same direction, which is usually a sign of positioning being reset rather than a sudden change in the long-term story.

For a 9–5 investor, 20 November 2025 will likely appear on a long-term chart as a one-day wobble within a larger trend. At ground level, it was a reminder that even very strong fundamentals can run into the brick wall of expectations, funding structures and central bank timing.

Disclaimer: This publication is for general information and educational purposes only and should not be taken as investment advice. It does not take into account your individual circumstances or objectives. Nothing here constitutes a recommendation to buy, sell, or hold any investment. Past performance is not a reliable indicator of future results. Always do your own research or consult a qualified financial adviser before making investment decisions. Capital is at risk.

Markets move fast. Savvy investors spot trends early.

Every Monday, get my pre-market cheat sheet:

✅ What’s hot

✅ What’s fading

✅ Where smart money’s flowing

No hype, just data.

👉 Subscribe to stay ahead.