When investing, your capital is at risk. The value of investments can go down as well as up, and you may get back less than you put in. The content of this article is for information purposes only and does not constitute personal advice or a financial promotion.

Meta’s AI Bet: Cash Machine First, Science Project Second

Meta used to be easy to label. It was the Facebook company. Then the Instagram company. Then the social media ad company.

Now it looks more like something awkward to explain at family dinners: a business that prints cash from targeted ads and spends tens of billions each year on AI hardware so it can keep doing that for longer.

This is a look at what Meta actually is in late 2025, what the numbers say, and where the story could break in either direction.

What Meta is really trying to do

Strip away the brands and headlines, and the basic plan looks like this:

Step 1: Run one of the most profitable advertising machines on the planet.

Step 2: Use that cash to build one of the largest AI infrastructure footprints in the world.

Step 3: Hope the AI spend makes the ad machine harder to compete with and opens new revenue streams.

That is the tension in the stock. Today’s business is simple to understand and easy to like. Tomorrow’s business is expensive to build and harder to value.

On the current numbers, Meta is doing both at once.

Around 3.5 billion people use at least one Meta app every day.

Revenue in Q3 2025 was 51.2 billion dollars, up 26 percent year on year.

Operating margin, adjusted for a one-off tax charge, sits near 40 percent.

It looks less like a struggling tech turnaround and more like a profitable company that has chosen to make its own life difficult by spending aggressively on the future.

How Meta makes its money today

1. Family of Apps: the profit centre

Almost all of Meta’s revenue still comes from one place: the Family of Apps.

That includes:

Facebook

Instagram

WhatsApp

Messenger

Threads

Reels inside those apps

The model is straightforward. People share content and interact. Meta shows ads, mostly performance-based ads that try to get you to click or buy. AI systems sit in the middle, deciding who sees what.

The 2025 run rate tells the story:

Q1 2025 revenue: about 42.3 billion dollars, mid-teens growth.

Q2 2025 revenue: 47.5 billion dollars, roughly 22 percent growth.

Q3 2025 revenue: 51.2 billion dollars, 26 percent growth.

Revenue by User Geography In Millions - Source Meta Earnings Presentation Q3 2025

Two things changed over the last couple of years:

Reels stopped being a drag. Short-form video now pulls its weight in monetisation rather than just absorbing attention.

AI-driven tools improved ad targeting and pricing, especially for performance marketers.

In a sense, Meta turned “more complex models” into “more revenue per user”.

2. Reality Labs: the sinkhole for now

Then there is Reality Labs.

It builds headsets, smart glasses and the early pieces of what Meta thinks computing might look like in the future. It also loses around $ 4 to $ 4.5 billion per quarter.

Revenue is small, losses are large, and the payoff is uncertain. The only reason Meta can run that experiment at this scale is that the ad business is so profitable.

The AI angle without the buzzwords

AI shows up in Meta in three main ways.

1. AI inside the ad engine

First, quietly, inside the existing ad business.

Ranking, recommendations, pricing, click predictions, and safety systems almost all run on large models now. That is not a slide in a presentation. It shows up in complex numbers:

Better conversion rates for advertisers.

Higher effective prices per ad.

Enough improvement to help push revenue growth back into the high teens and mid-20s after a slower patch.

Meta is now adding a new signal to this mix.

From 16 December 2025, in most regions outside the UK, the EU, and South Korea, the company will use conversations with its Meta AI assistant as input to personalise both content and ads.

If someone spends time chatting about running shoes or kitchen gear, that intent can feed into what they see later. It is a neat example of how AI is not just a feature, but also a new data source.

It is also precisely the kind of thing that makes regulators nervous.

2. The attention war in short videos

Second, in how Meta fights for attention.

Short-form video is a brutal contest. TikTok, YouTube Shorts, and Reels are all trying to be the places people open when they have 30 seconds to spare.

Meta leans heavily on AI ranking to keep Reels relevant:

Find the next clip you are likely to watch.

Do it again, thousands of times per user.

Learn from every swipe and pause.

If Meta can keep Reels “good enough” while plugging it into its ad stack and social graph, it defends an important format without having to win every battle.

3. Llama and AI infrastructure as optionality

Third, in the more visible AI brand: Llama and Meta AI.

Meta is aiming to:

Own a massive GPU fleet, around 2 million units by fiscal 2026.

Build open-source large language models that developers can use.

Put Meta AI directly into WhatsApp, Instagram, Facebook, and Ray-Ban Meta glasses.

The obvious ways this might turn into revenue:

Paid API access and hosting.

Tools for fine-tuning and deploying models.

Enterprise or on-premises licences.

These are not material to the P&L yet. They sit in the “this could matter quite a lot later” bucket.

The numbers behind the story

It is easy to get lost in product announcements. The accounts are cleaner.

1. Profit and cash

For Q3 2025:

Revenue: 51.2 billion dollars, up 26 percent year on year.

Operating margin, excluding the one-off tax item: around 40 percent.

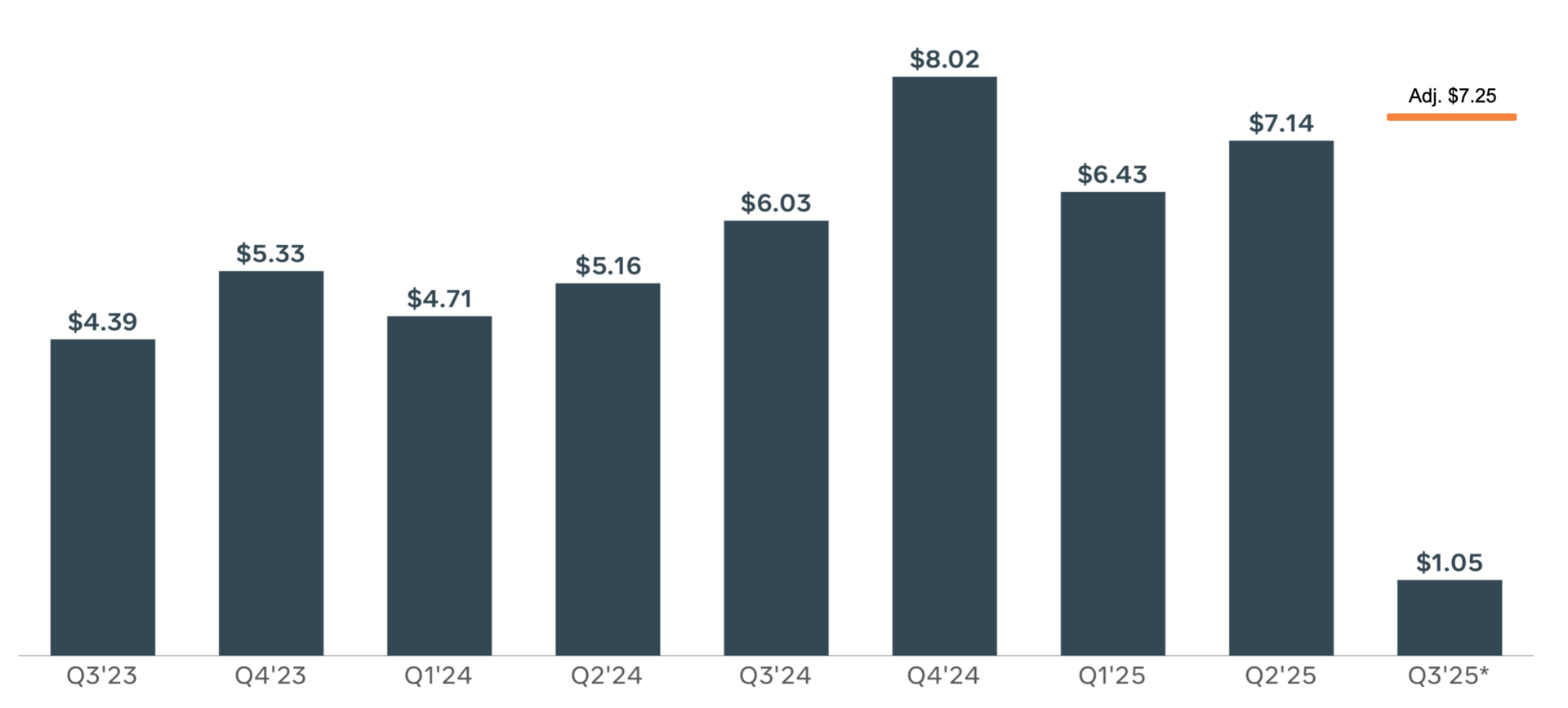

Adjusted EPS: roughly 7.25 dollars.

Diluted Earnings Per Share Excluding this one-time tax charge

On a cash basis:

Operating cash flow is in the region of 30 billion dollars per quarter.

Meta holds over $ 40 billion in cash and liquid assets.

For a company of this size, those are elite economics.

2. Capex and the AI build out

Now the other side.

2025 capital expenditure guidance: 70 to 72 billion dollars.

Management has flagged that 2026 capex and overall expenses will be higher again.

A large share of that spend is going into:

Data centres.

GPUs.

Networking and storage.

In plainer terms: Meta is taking a big slice of its operating cash flow and prepaying for the next few years of AI capacity.

The next chapter of the story depends on whether that capacity ends up full and well monetised, or underused and painful.

What the current price is saying

The market gives us a starting point.

Price: 647.95 dollars.

Trailing P/E: about 31.5 times.

Implied trailing twelve-month EPS: about 22.6 dollars.

For forward scenarios, assume:

The 2025 EPS base is around 27 dollars, adjusted for the Q3 tax charge and a reasonable estimate for Q4.

From there, sketch three paths out to fiscal 2028.

1. Bull case

Earnings per share grow roughly 18 percent a year.

EPS in 2028 is expected to land near 44.4 dollars.

The market is comfortable paying about 28 times earnings, assuming Meta looks like a core AI and ad platform with strong optionality.

Implied price: about 1,242 dollars.

2. Base case

EPS growth is closer to 14 percent a year.

EPS in 2028 is around 40 dollars.

Valuation multiple settles near 22x, in line with a large, profitable, still-growing platform.

Implied price: 880 dollars.

3. Bear case

EPS growth slows further, to around 10 percent a year.

EPS in 2028 is about 35.9 dollars.

The market assigns around 16 times earnings, as AI returns disappoint and spending looks high relative to outcomes.

Implied price: 575 dollars.

From today’s 647.95 dollars:

Scenario | 3-year price | Change vs today |

|---|---|---|

Bull | 1,242 | about plus 91.7 percent |

Base | 880 | about plus 35.8 percent |

Bear | 575 | about minus 11.3 percent |

The exact numbers matter less than the shape:

At current prices, the market already assumes healthy double-digit EPS growth.

Strong AI returns and new products create room for big upside.

Disappointing AI economics and heavier regulation still allow earnings growth, but with a real risk of negative share price returns if the multiple compresses.

What gives Meta a moat

If you tried to copy Meta from scratch, these are the parts that are hardest to replicate.

The attention reservoir

Billions of daily users across multiple apps, wired together by social graphs and interest graphs built up over the years. New platforms can grow fast, but they start from zero.

The data and the models

Engagement at Meta’s scale feeds the models that rank content and optimise ads. Smaller competitors can build models, but they do not have the same volume and variety of feedback loops.

The AI infrastructure

A large GPU fleet, bespoke networking, and a team of researchers working on Llama and related systems. That does not automatically translate to profit, but it does create a barrier to entry.

Distribution across apps

Meta can route attention: from Facebook to Instagram, from Instagram to WhatsApp, from Threads back into the main feed. It can also ship new AI features across all of them at once.

Balance sheet and cash engine

High margins and strong cash flow give Meta room to make long, expensive bets that would be difficult for a weaker company to sustain.

Where the story can go wrong

None of this is risk-free. A few pressure points matter more than others.

1. Spending ahead of returns

Capex of 70 to 72 billion dollars in 2025, with a higher level in 2026, is a bold choice.

The key things to watch:

Does revenue keep growing at a pace that matches or exceeds that investment?

Does ad revenue per user continue to rise as AI is rolled out?

Do Meta AI and Llama infrastructure start to show up as meaningful, direct revenue drivers?

If the top line slows while spending stays high, free cash flow can shrink and the valuation can decline at the same time.

2. Regulation and legal friction

Meta sits in the middle of several regulatory debates:

Market power and antitrust.

Youth mental health and algorithm design.

Privacy and the use of personal data.

New rules around AI, including how chat data can be used.

The policy to use AI chat interactions for personalisation outside the UK, EU and South Korea is a good example. For Meta, it is another useful signal. For regulators, it is another potential line in the sand.

New rules tend to work in three ways:

Reduce the data that can be used.

Change defaults that previously worked in Meta’s favour.

Add fines and compliance costs.

Each change might be modest on its own, but they can add up.

3. Competition for time and attention

TikTok, YouTube and others still compete fiercely for younger users and creators.

Meta is not short of users, but if usage mixes shift too strongly toward formats that are harder to monetise, or away from Meta apps entirely, that affects the long-term value of its ad inventory.

Platform risk also matters. Changes in Apple’s or Google’s rules, as seen with iOS tracking changes in 2021, can quickly affect targeting and measurement.

4. Reality Labs as a permanent drag

If AR, VR and AI glasses take off, Reality Labs could transform from a cost centre into a growth engine.

If that does not happen, long-lived losses remain. In that case, the division is effectively a tax on the ad business.

5. Cyclical ad exposure

Finally, Meta is still tied to the advertising cycle. Recessions, regional downturns or shock events tend to hit ad budgets fast.

Where opinions diverge

Reasonable people can look at the same set of facts and tell very different stories about Meta.

A more optimistic view might say:

AI will materially lift ad yields for years.

Meta will be able to monetise Llama and AI infrastructure enough to justify the capex.

WhatsApp and business messaging are under-monetised assets that can add another leg of growth.

A more cautious view might say:

AI infra and models end up more commoditised than investors hope.

Regulators push back on some of the more aggressive uses of data, including AI chatbots.

Reality Labs continues to absorb capital with limited payoff.

The current valuation sits between those readings. It recognises the strength of the existing business but leaves room for both upside and disappointment on the AI side.

The simple version

Meta today is two stories running simultaneously.

Story one is a highly profitable, huge advertising business that reaches billions of people and continues to grow revenue at a healthy clip.

Story two is an expensive attempt to turn that position into an AI platform, with heavy investment in hardware, models and new products like Meta AI and Llama.

The numbers show that story one easily funds story two for now. What they cannot yet show is whether the bill for story two ends up looking like a bargain or a very costly lesson in how hard it is to buy the future.

Disclaimer: This publication is for general information and educational purposes only and should not be taken as investment advice. It does not take into account your individual circumstances or objectives. Nothing here constitutes a recommendation to buy, sell, or hold any investment. Past performance is not a reliable indicator of future results. Always do your own research or consult a qualified financial adviser before making investment decisions. Capital is at risk.

Markets move fast. Savvy investors spot trends early.

Every Monday, get my pre-market cheat sheet:

✅ What’s hot

✅ What’s fading

✅ Where smart money’s flowing

No hype, just data.

👉 Subscribe to stay ahead.