When investing, your capital is at risk. The value of investments can go down as well as up, and you may get back less than you put in. The content of this article is for information purposes only and does not constitute personal advice or a financial promotion.

One line take

At around $ 190 per share, the market is already treating Nvidia as a near-monopoly AI infrastructure utility, with years of hyper-growth already priced in. The current valuation can still be justified, but only if two things hold for much longer than a normal tech cycle:

AI capex stays elevated for years, not quarters.

Nvidia defends its moat against AMD, custom silicon and open-source software without a material hit to margins.

If either of those pillars weakens, the downside from here is significant.

Business snapshot: What are you really buying?

Nvidia today is essentially an AI data centre platform plus a software ecosystem: GPUs, networking, systems and CUDA as the operating layer for modern AI.

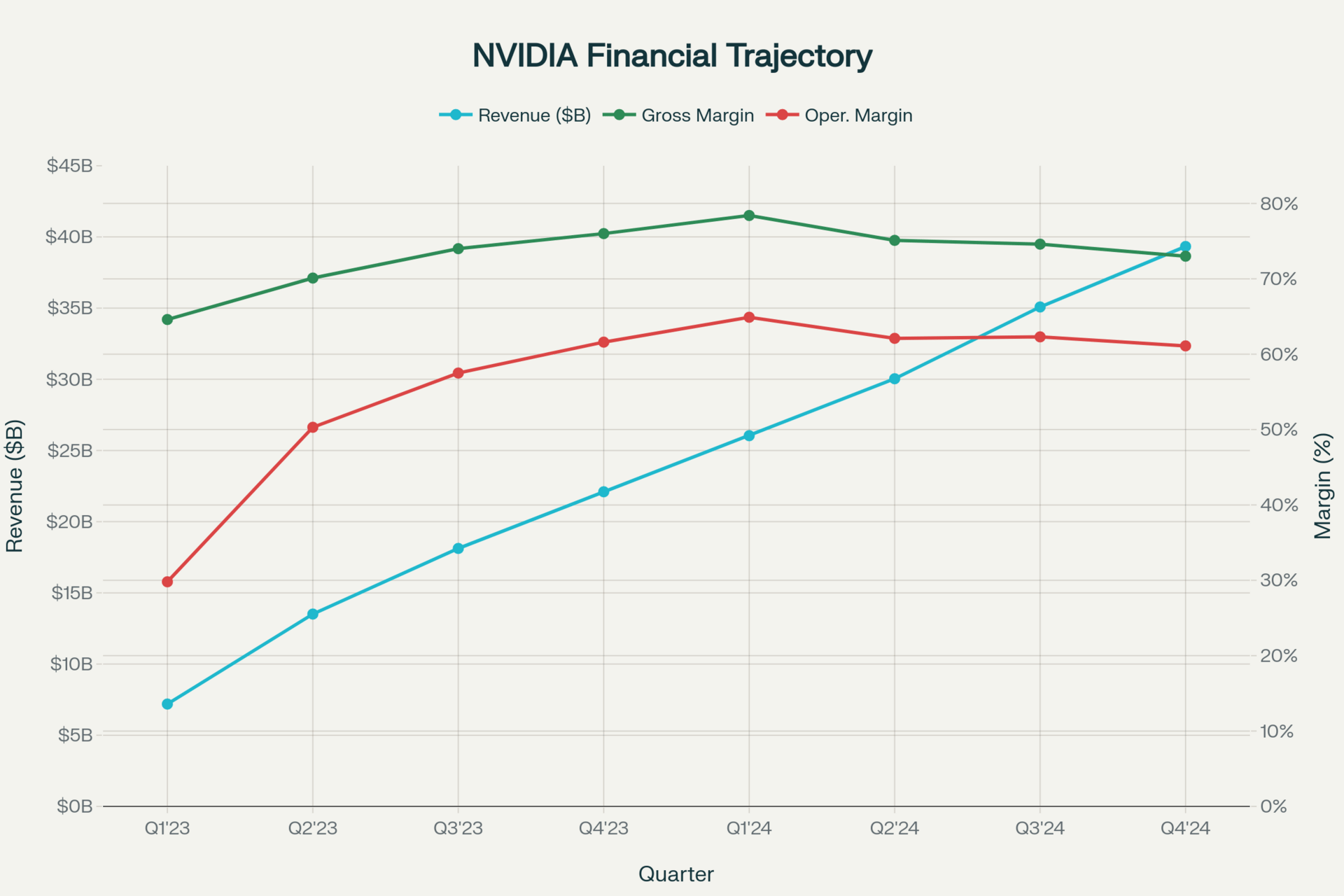

Recent reported numbers illustrate how different this business now looks compared with a traditional chipmaker:

Q4 FY 2025 revenue: 39.3 billion dollars, up 78 percent year on year, with full-year revenue of 130.5 billion dollars.

Q1 FY 2026 revenue: 44.1 billion dollars, up 69 percent year on year.

Q2 FY 2026 revenue: 46.7 billion dollars, up 56 per cent year on year, driven mainly by data centre, where revenue reached 41.1 billion dollars. Non-GAAP gross margin was around 72.7 percent.

Q3 FY 2026 guidance: 54 billion dollars of revenue plus or minus 2 percent, with non-GAAP gross margins in the mid-70s.

On an annualised basis, Nvidia is now running at a revenue rate well above 180 billion dollars, with gross margins above 70 percent. Using Q2 FY 2026 as a simple proxy, 46.7 billion dollars of quarterly revenue implies an annualised run rate close to 187 billion dollars.

Those margins look more like those of a dominant software platform than those of a conventional semiconductor business. That combination of scale and economics underpins the roughly 4.6 trillion dollar valuation.

Valuation snapshot: How stretched is it?

Based on current data from major financial sources:

Market cap: ≈ 4.63 trillion dollars

Trailing P/E: ~54 times

Forward P/E: around 30–33 times, depending on the provider

Price to sales (trailing): ~28 times

Price to free cash flow (trailing): ~65 times

FCF yield on current year forecasts: around 1–1.5 percent

Nvidia Valuation Metrics

For comparison, other mega-caps such as Microsoft, Alphabet, and Meta often trade at 20-35 times forward earnings in strong periods. Nvidia currently sits at the top end of that range, despite already being the most valuable listed company in the world.

In other words, the market is not valuing Nvidia as just another semiconductor name. It is valuing it closer to:

A global AI compute toll booth, with a high degree of confidence that this position persists.

What the market is pricing in

Consensus growth expectations

Sell-side estimates from sources such as LSEG, Seeking Alpha and MarketWatch cluster around the following ranges

FY 2026 revenue: roughly 200 to 210 billion dollars

FY 2027 revenue: approximately 280 to 290 billion dollars

Earnings per share: still compounding at high double-digit rates into FY 2027

On the cash flow side, MarketScreener and S&P Global forecasts for free cash flow are in this ballpark, rounded:

2025 FCF: ~61 billion dollars

2026 FCF: ~97 billion dollars

2027 FCF: ~144 billion dollars

2028 FCF: ~180 billion dollars

At a market cap of around 4.6 trillion dollars, that implies:

FCF yield on 2025 forecast: roughly 1–1.5 percent

FCF yield on 2028 forecast: approximately 4 percent

Put simply, the current price is anchored to the cash flows Nvidia is expected to generate several years out, assuming those cash flows will then continue to compound rapidly. That is not inherently unreasonable, but it leaves little room for disappointment.

Scenario framework three-year valuation sanity check

Using the current price of 190.17 dollars as the reference point and a simple three-year horizon, it is possible to frame Nvidia’s valuation with a basic free cash flow and terminal multiple approach.

Nvidia Financial Trajectory

Key inputs

Shares outstanding: ~24.3 billion

Discount rate: 10 percent, typical equity hurdle

Base 2028 FCF: 180 billion dollars, aligned with current Street-style forecasts

From there, the two main levers are:

How much free cash flow does Nvidia actually generate in 2028?

What multiple is the market willing to pay for that cash flow at that point?

Bull case: AI supercycle, moat holds

2028 FCF: 220 billion dollars, around 20 percent above current forecasts.

Terminal multiple: 35 times FCF, reflecting a still unique position in AI infrastructure.

Horizon and discounting: three years, discounted at 10 percent.

This produces an implied value of roughly 238 dollars per share, about 25 percent above today’s price.

For this to make sense, several things need to be true:

AI data centre demand does not follow a typical capex cycle.

Nvidia maintains a dominant share against AMD and custom accelerators.

Gross margins remain around the 70 percent level, with some operating leverage on top.

Base case: Strong but normalising

2028 FCF: 180 billion dollars, broadly in line with current consensus.

Terminal multiple: 30 times FCF, treating Nvidia as an elite, but not unique, growth compounder.

Discount rate: 10 percent.

That framework gives an implied value of around 167 dollars per share, about 12 percent below the current price.

In this scenario, Nvidia still hits today’s optimistic numbers, but enthusiasm around AI cools and the market applies a less exceptional multiple.

Bear case: Cycle rolls over, competition bites

2028 FCF: 140 billion dollars, roughly 20 to 25 percent below current forecasts.

Terminal multiple: 20 times FCF, more in line with a high-quality but cyclical hardware leader.

Discount rate: 10 percent.

This yields an implied value of roughly 87 dollars per share, which is around 54 percent below today’s price.

This case reflects conditions such as:

Hyperscalers accelerate the shift to in-house or alternative accelerators.

AI workloads become less compute-intensive than current trajectories suggest, due to efficiency gains.

Regulatory or export pressures limit access to key markets or force companies to adopt less profitable product mixes.

Summary: Three-year horizon vs today’s 190.17 dollars

Case | 2028 FCF (assumed) | FCF multiple | Implied value | Versus today |

|---|---|---|---|---|

Bull | 220 billion dollars | 35× | 238 dollars | +25 percent |

Base | 180 billion dollars | 30× | 167 dollars | −12 percent |

Bear | 140 billion dollars | 20× | 87 dollars | −54 percent |

These are not forecasts. They are simple arithmetic checks on what must go right, or wrong, for today’s valuation to be sensible.

1. AI computing as a new kind of “infrastructure layer”

Nvidia sits at the centre of AI infrastructure. Its GPUs power both training and inference for leading foundation models, while its networking and systems offerings increasingly wrap around the entire stack.

External estimates for AI chips used in data centres and cloud infrastructure suggest a total addressable market that could reach roughly $400 to $500 billion by 2030.

If two things happen together:

AI becomes embedded in a broad range of business workflows.

Compute intensity per unit of economic output rises structurally.

Then Nvidia’s economics look less like a one-off capex cycle and more like a recurring tax on AI progress.

2. Moat = CUDA, ecosystem and supply chain

Nvidia’s defensibility is not only about chip performance. It is about the entire system:

CUDA and software stack models, tools and operations pipelines are tuned for Nvidia hardware. Porting those workloads away has meaningful costs.

Ecosystem partnerships with cloud providers, integrators, and enterprise vendors reinforce Nvidia's position as the default choice for AI projects.

Supply chain capacity at partners such as TSMC and Foxconn is being built with Nvidia’s roadmap in mind. Foxconn, for example, has highlighted the potential for AI server shipments to double, with Nvidia as a central beneficiary.

This is why some analysts and commentators still outline scenarios in which Nvidia compounds into a 9–10 trillion-dollar company by the end of the decade.

Key valuation risks

The same factors that justify a premium also make the downside more severe if the narrative breaks.

1. AI capex turns out to be cyclical

Commentary around an AI capex bubble is becoming more frequent, especially as hyperscalers accelerate spending ahead of clear monetisation for some workloads.

If capacity is overbuilt and major customers slow or pause spending for a year or two, revenue growth could fall from 50–60 percent to single digits. On a lower free cash flow base, a more typical semiconductor multiple in the high-teens or low-20s would make today’s valuation look demanding.

2. Competition and custom chips

Competitive risk does not require Nvidia to lose its lead entirely. It only needs to lose some of its pricing power. Key elements include:

AMD is narrowing the performance and total cost of ownership gap, especially in high-volume inference workloads, while projecting very large AI chip markets of its own.

Custom accelerators from hyperscalers such as Google, Amazon and Microsoft are taking a larger share of specific workloads.

Alternative architectures and specialised inference hardware targeting narrower, but high-volume, use cases.

Even a modest erosion of market share and pricing power can simultaneously compress margins and valuation multiples.

3. Regulatory, geopolitical and export controls

Export restrictions on advanced GPUs to China and other regions are already a tangible headwind. Nvidia has disclosed revenue impacts from specific China-focused products, and guidance has had to adjust for these limits.

Any escalation, whether through broader export controls or new regulatory frameworks for AI, could remove profitable markets or alter the product mix, reducing returns on capital.

How many investors frame Nvidia at today’s price

Putting the pieces together:

Fundamentals: Nvidia remains a clear leader in AI infrastructure, with exceptional margins and a scale advantage that continues to expand.

Valuation: Current pricing is consistent with a prolonged AI supercycle and sustained quasi-monopoly economics.

Scenario arithmetic: If growth normalises to strong, but not extreme, levels, today’s price sits slightly ahead of a conservative base case. If AI capex disappoints or competition intensifies more than expected, the bear case involves a material downside.

In practice, many market participants treat Nvidia as a high-quality, high-risk growth franchise within broader AI or semiconductor exposure, often pairing it with names such as AMD, TSMC and ASML. Others prefer to access the theme through diversified indices and funds where Nvidia is already a top weight.

The common thread is that the investment debate is no longer about whether Nvidia is a great business. The question is how much perfection is already priced in, and how comfortable different investors are with that level of embedded expectation.

Key metrics snapshot

Metric | Current level (approximate) | Interpretation |

|---|---|---|

Share price | 190.17 dollars | Reference point for scenarios |

Market cap | ~4.63 trillion dollars | Reflects AI infrastructure leadership |

Trailing P/E | ~54 times | At the high end of mega-cap tech history |

Forward P/E | around 30–33 times | Premium, but closer to other mega-cap leaders |

Price to sales (TTM) | ~28 times | Highly elevated for a company of this size |

FCF yield (2025 forecast) | ~1–1.5 percent | Market is paying up for future, not current, cash flow |

FCF yield (2028 forecast) | ~4 percent | Relies on hitting multi-year growth forecasts |

Revenue growth (Q2 FY26) | +56 percent year on year | Growth still exceptional, but slowing vs earlier phases |

Non-GAAP gross margin | ~72–75 percent | Consistent with a software-like economic profile |

Important disclaimer

This article is for information and educational purposes only. It reflects a general, high-level view of Nvidia’s valuation based on publicly available data at the time of writing. It is not investment advice, does not consider any individual investor’s objectives, financial situation or needs, and is not a recommendation to buy, sell or hold any security. Capital is at risk. Past performance and forward-looking estimates are not reliable indicators of future results.

Disclaimer: This publication is for general information and educational purposes only and should not be taken as investment advice. It does not take into account your individual circumstances or objectives. Nothing here constitutes a recommendation to buy, sell, or hold any investment. Past performance is not a reliable indicator of future results. Always do your own research or consult a qualified financial adviser before making investment decisions. Capital is at risk.

Markets move fast. Savvy investors spot trends early.

Every Monday, get my pre-market cheat sheet:

✅ What’s hot

✅ What’s fading

✅ Where smart money’s flowing

No hype, just data.

👉 Subscribe to stay ahead.