When investing, your capital is at risk. The value of investments can go down as well as up, and you may get back less than you put in. The content of this article is for information purposes only and does not constitute personal advice or a financial promotion.

Pre-Earnings Playbook: What to Watch in Nvidia’s Q3 FY2026

Nvidia’s next checkpoint in the AI cycle lands on Wednesday, 19 November 2025, when the company reports Q3 FY2026 after the U.S. market close. The earnings call will be about one company, but the reaction will echo through AI chips, cloud, semis, and broad equity indices.

Wall Street is looking for roughly $54.6 billion in revenue and about $1.231.25 in non-GAAP EPS for the quarter, both up a little over 50% year on year. The options market is pricing roughly a 68% swing in the share price after the print, one of the larger single-stock moves on traders’ calendars this quarter.

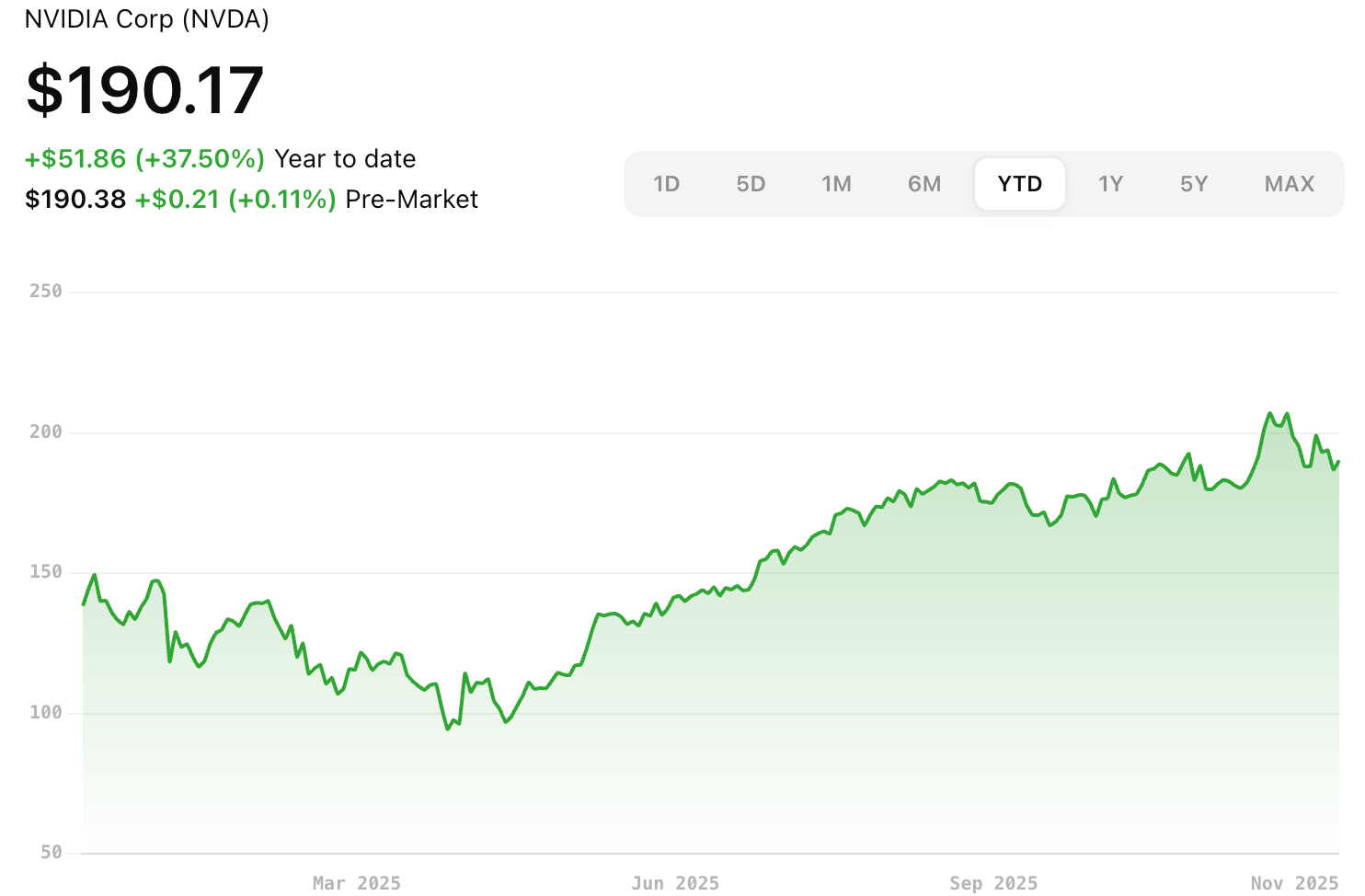

At the time of writing, Nvidia trades around $190.17 per share, implying a multi-trillion-dollar valuation that already accounts for years of elevated AI infrastructure spending.

Nvidia price as of Sunday 16 November 2025

The question in this report is not whether Nvidia is doing well. The question is whether it is doing even better than the very ambitious expectations.

Extra reading:

Is Nvidia still worth its trillion-dollar price tag?

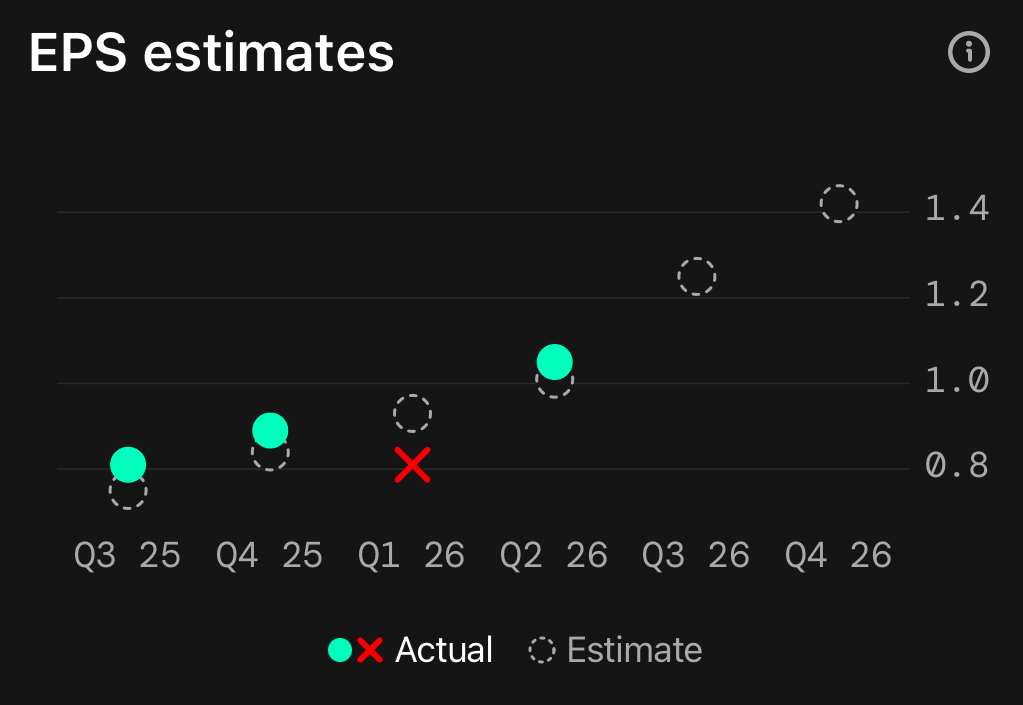

Earnings snapshot: Where the bar is set

EPS Estimates for Nvidia

Nvidia has already guided the market for Q3:

Company guidance:

Revenue: $54 billion ±2%

GAAP gross margin: 73.3% ±50 bps

Non-GAAP gross margin: 73.5% ±50 bps

Street consensus (ranges by source):

Revenue: about $54.655.0 billion

Non-GAAP EPS: $1.231.26

Data Centre revenue: around $4949.5 billion

Q4 FY2026 revenue expectation: about $61.562 billion

Put simply:

A headline beat probably means revenue starting with “55” rather than “54”.

A data centre beat probably means the segment crosses $50 billion for the first time.

A guidance beat would be Q4 revenue pointed clearly above $61.5 billion.

Data Centre already represents close to 90% of total revenue, so the segment effectively is the income statement.

Revenue and Data Centre: How hot is the engine?

Nvidia came into this quarter off a Q2 that delivered $46.7 billion in revenue, with $41.1 billion from Data Centre, up 56% year on year.

For Q3, three questions dominate the top line:

Does total revenue clear the high bar?

A result meaningfully above $55 billion would signal that demand for Blackwell systems is not just strong but accelerating ahead of expectations.

Does Data Centre push toward or above $50 billion?

Consensus clusters just under that mark. A number with “50” in front of it would reinforce the idea that AI capex is still in a high-growth phase, not settling into mid-cycle.

Is sequential growth still convincing?

Markets are more focused on the quarter-on-quarter step than the year-on-year percentage now. If Data Centre growth slows sharply on a sequential basis, investors will start to debate whether hyperscalers are pausing to “digest” existing capacity.

Because Nvidia’s chips sit at the centre of cloud AI build-outs, even a small miss or beat in Data Centre revenue will likely move other names in the supply chain, from TSMC and SK hynix to cloud platforms and AI server makers.

Margins: the moat stress test

Guided gross margins for Q3 are already high by semiconductor standards, in the low to mid-70s on a GAAP and non-GAAP basis.

Investors will be using margins as a quick check on Nvidia’s competitive position:

If gross margins hold near or above 74%:

It signals that Nvidia retains considerable pricing power even as Blackwell ramps and competitors push their own accelerators.If margins slip toward or below 72%:

Markets may infer a mix of early Blackwell production costs, more aggressive pricing, or a richer blend of lower-margin systems relative to standalone GPUs.

The composition between Hopper and Blackwell matters too, even if Nvidia does not fully break it out. Street models already assume that Blackwell revenue is climbing fast across 2025 and 2026, which makes the margin line the cleanest way to see how profitable that architectural transition is in practice.

Q4 guidance: the line that will move the stock

Guidance for Q4 FY2026 will likely drive more of the share price reaction than the Q3 actuals.

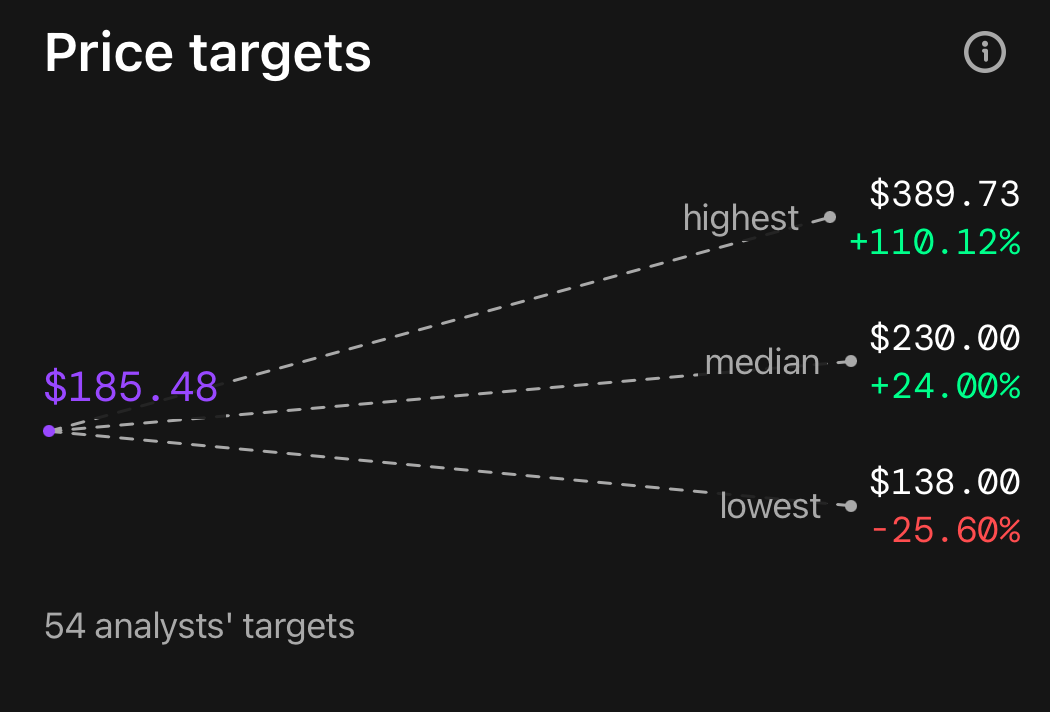

Price targets for Nvidia as of 18 November 2025

Current expectations centre on revenue of about $61.562 billion, implying strong sequential growth from the guided Q3 level.

The shape of guidance matters:

A guide comfortably above the current range (for example, in the mid-62s or higher) would support analyst models that pencil in $200 billion-plus annual revenue in the next couple of years.

A guide only in line, or below $60 billion, would introduce a more cautious narrative about the pace of AI infrastructure build-out.

Nvidia also now talks openly about a $500 billion-plus order book for Blackwell and Rubin through 2026, reflecting visibility into future GPU and system shipments.

Guidance will show how quickly that pipeline converts into recognised revenue.

What to listen for on the earnings call

The income statement gives one version of reality. The call gives another. A few themes will be central.

Blackwell ramp and Rubin visibility

Jensen Huang has framed Blackwell and early Rubin shipments as the next leg of AI infrastructure growth, with millions of units shipping and tens of millions projected.

On the call, markets will be listening for:

How quickly Blackwell systems are ramping relative to prior Hopper cycles

Any colour on GB200 and GB300 rack-scale deployments

How Rubin fits into the revenue mix through 2026

The more concrete the numbers and timelines, the easier it is for analysts to keep pencilling in very high revenue lines.

Supply chain constraints: CoWoS and HBM

Nvidia’s growth is limited as much by supply as by demand.

Advanced packaging capacity at TSMC, especially CoWoS used for high-end GPUs, remains tight.

High-bandwidth memory (HBM) from SK hynix and Samsung is in structurally short supply, with more meaningful HBM4 volume not expected until 2026.

If management suggests that packaging or memory bottlenecks are easing ahead of schedule, that supports the idea that the order book can convert faster. If constraints sound worse, it puts a natural ceiling on guidance and may dampen expectations for 2026 growth.

China, export controls and the B30 story

China’s share of Nvidia revenue has already fallen sharply due to tightened U.S. export controls and Beijing’s own efforts to reduce reliance on U.S. chips.

Key moving parts:

Nvidia has developed a B30 chip, a Blackwell-based variant designed to comply with U.S. rules. Reports suggest it targets significantly lower performance than flagship Blackwell GPUs, so it can qualify for export.

Recent reporting indicates the U.S. is moving to block even this scaled-down B30A variant from China, and Chinese regulators are stepping up efforts to push domestic alternatives.

Management commentary here will clarify whether Nvidia still sees China as a future revenue contributor, or effectively excludes it from medium-term guidance.

Customer concentration

Recent regulatory filings show that two direct customers, “Customer A” and “Customer B”, accounted for 39% of Nvidia’s Q2 FY2026 revenue, up from about 25% a year earlier.

That concentration is commercially attractive while spending is rising, but it increases the impact if any single hyperscaler or system integrator re-phases capex.

Investors will be alert for signs that:

This concentration is stabilising or drifting down as more customers scale up

There are multi-year commitments that reduce the risk of sudden order cuts

Power, data centres and the physical limits of AI

There is a growing debate about whether power and cooling infrastructure can keep pace with the AI build-out across the rest of the decade. Estimates from banks and consultancies point to large increases in data centre power demand by 2030.

Any remarks about power constraints, data centre site availability, or the need for more energy-efficient architectures will inform longer-term expectations for how quickly AI capex can scale.

Risk map: what can go wrong in this print

Nvidia has beaten consensus in most quarters over the last five years, but high expectations cut both ways. A few downside scenarios stand out.

Revenue under guidance band

A print below about $53 billion would suggest either weaker demand or more severe supply issues than currently assumed.

Gross margin clearly below the guided midpoint

A move down toward 72% or lower would raise questions about pricing, competitive dynamics, or the cost of new architectures.

Q4 guidance below roughly $60 billion

That would imply a slower trajectory into 2026 than many models assume and could trigger a broader rethink of AI infrastructure growth profiles.

China commentary that rules out meaningful revenue recovery

If management effectively writes China out of the plan for the medium term, analysts will adjust addressable market estimates.

Signals of stronger competitive traction

Any explicit acknowledgement that AMD, custom ASICs or large cloud customers’ in-house chips are displacing Nvidia in key workloads would tighten the valuation lens.

None of these outcomes is guaranteed, but they outline why the options market is assigning a wide post-earnings range.

How the market might react

Without making any prediction, it is useful to have a basic reaction framework.

Strong beat with confident guidance

Revenue and Data Centre both clear consensus by a comfortable margin

Gross margins stay robust

Q4 guidance points clearly above current expectations

Commentary backs a large, visible order book through 2026

In this case, a sharp relief rally in Nvidia and the wider AI complex is plausible, with sentiment reset toward “AI cycle still in full flight”.

Solid numbers, cautious tone

Headline results are around consensus, or slightly above

Guidance is roughly in line

Management language turns a bit more careful on hyperscaler capex or power constraints

Here, the headline might look fine, but the narrative shifts toward “growth normalising”. Price action could be choppy, with short-term swings as investors digest the new tone.

Soft print or underwhelming guidance

Either a miss on the top line or clear underperformance in the Data Centre

Guidance that materially undercuts Q4 expectations

Margin pressure that looks structural rather than temporary

That combination would likely hit Nvidia and spill over into other AI beneficiaries, with renewed debate about whether AI spending expectations have run ahead of realised returns.

Takeaways for 9-5 investors

For a busy investor who might catch the headline on their commute and the details later in the week, the core checkpoints are straightforward:

Does Q3 revenue land noticeably above guidance, and where does Data Centre land relative to the roughly $4950 billion bar?

Do gross margins stay near the guided low to mid-70s, or do they show early signs of pressure?

Is Q4 guidance comfortably ahead of the current consensus, or does it hint at a slower trajectory?

Does management reinforce the idea of a $500 billion-plus Blackwell and Rubin order pipeline, or does that language become more tentative?

How does Nvidia describe China, export controls, customer concentration and power constraints, given their growing impact on the business model?

Those answers will do more to shape Nvidia’s path into 2026 than any single headline number.

Disclaimer: This publication is for general information and educational purposes only and should not be taken as investment advice. It does not take into account your individual circumstances or objectives. Nothing here constitutes a recommendation to buy, sell, or hold any investment. Past performance is not a reliable indicator of future results. Always do your own research or consult a qualified financial adviser before making investment decisions. Capital is at risk.

Markets move fast. Savvy investors spot trends early.

Every Monday, get my pre-market cheat sheet:

✅ What’s hot

✅ What’s fading

✅ Where smart money’s flowing

No hype, just data.

👉 Subscribe to stay ahead.