When investing, your capital is at risk. The value of investments can go down as well as up, and you may get back less than you put in. The content of this article is for information purposes only and does not constitute personal advice or a financial promotion.

NVIDIA Q3 FY26 Post-Earnings Breakdown: The Quarter That Killed the AI Slowdown Narrative

Every earnings season has a turning point, a moment when the market goes, “Okay, the story has changed.”

For NVIDIA, that moment arrived on November 19, 2025.

Heading into the print, the mood around AI had quietly shifted. Commentators talked about “AI fatigue.” Analysts whispered about capex cooling. Investors braced for the first signs of hyperscalers tightening the purse strings.

Then Jensen Huang walked onto the call and lit those concerns on fire.

The Headline: $57 Billion in One Quarter and a Street-Defying Beat

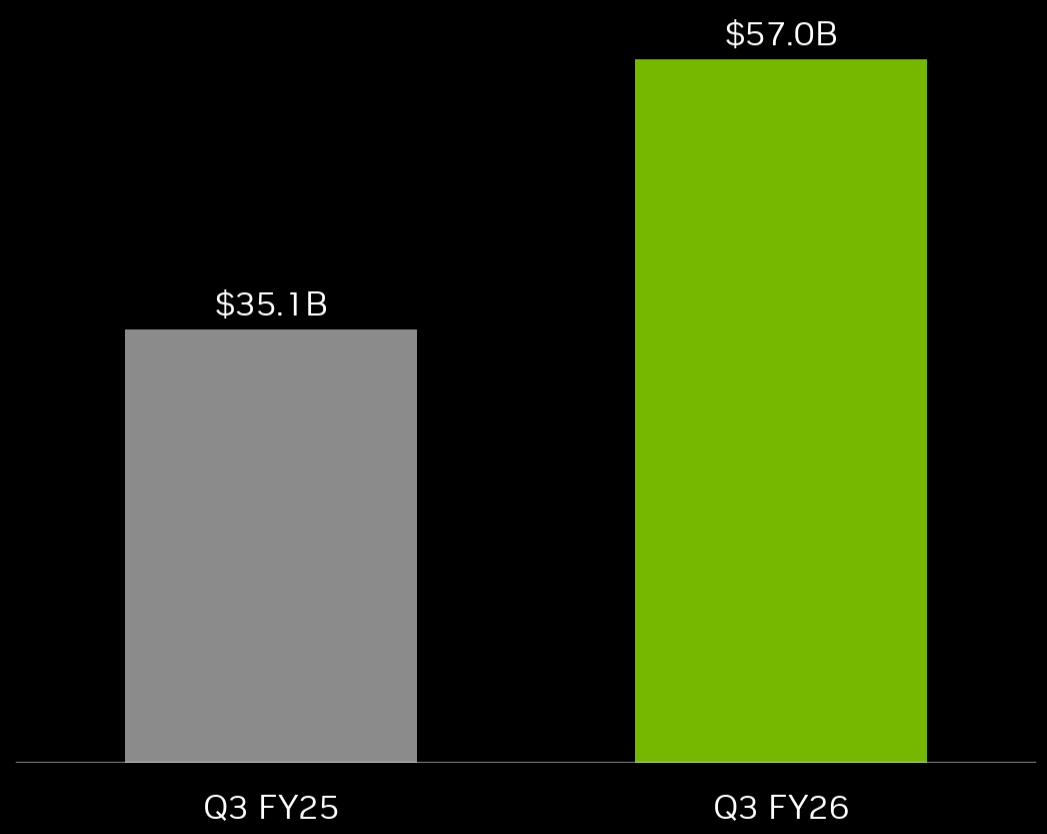

NVIDIA reported $57.0 billion in revenue for Q3 FY26.

Not annual revenue, one quarter.

Revenue $ in billions

That’s a 22% sequential jump and 62% year-over-year growth, powered by demand that makes the dot-com boom look like dial-up internet.

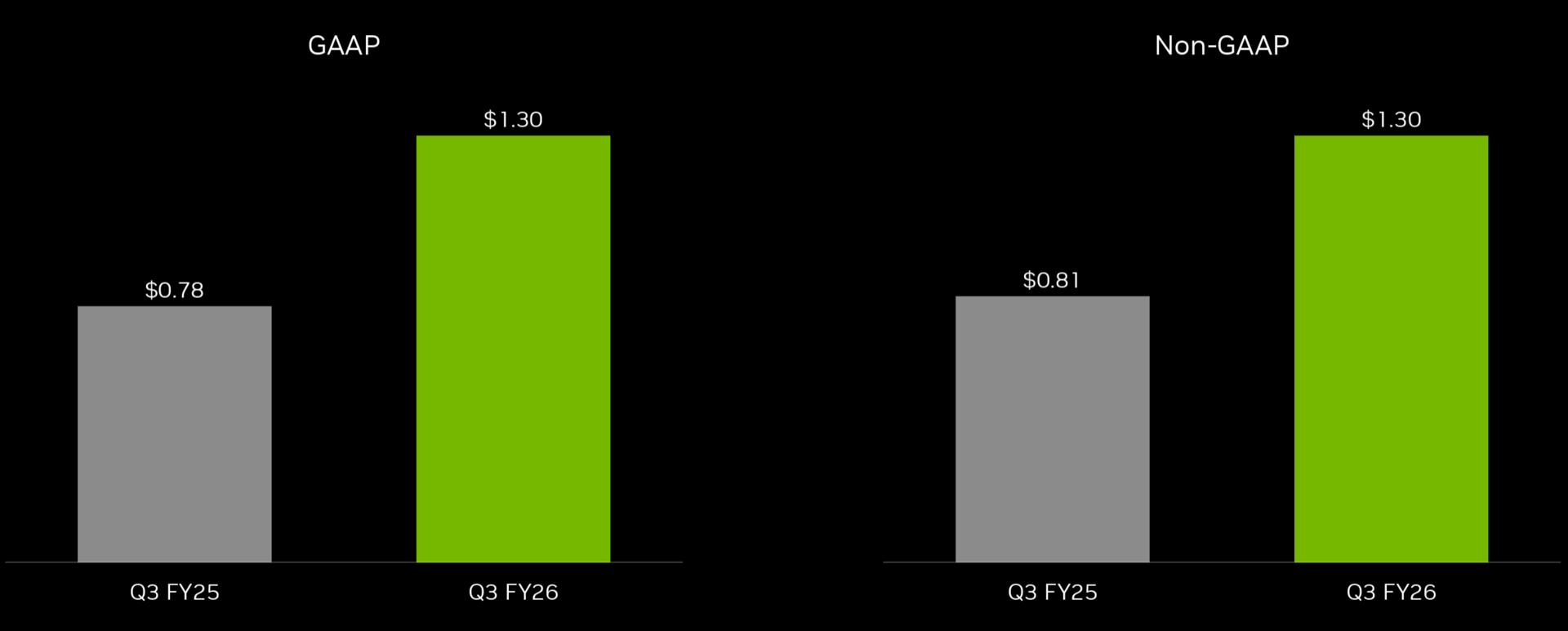

EPS came in at $1.30, up 67% YoY, beating expectations on both GAAP and non-GAAP metrics.

Earnings per Share

This wasn’t a “beat.” It was a re-pricing of reality.

AI isn’t slowing. It’s compounding.

Data Center: The Center of Gravity

If there was any doubt where NVIDIA really makes its money, Q3 erased it.

Data Centre revenue hit $51.2 billion.

That’s 90% of total revenue.

Up 25% sequentially.

Up 66% YoY.

And powered almost entirely by the Blackwell platform.

Data Centre Business is now a $204.8 billion annual run rate segment, up from a $4B ARR segment in 2020

For months, critics said Blackwell would be late, overpriced, or disrupted by custom silicon.

Instead, Jensen delivered this:

“Blackwell sales are off the charts.”

And CFO Colette Kress added:

“The clouds are sold out.”

This is the part of the movie where the main villain, the “AI bubble is bursting” narrative, dies in slow motion.

Blackwell isn’t hypothetical. It’s not a roadmap.

It’s a pipeline that is fully utilised, fully sold out, and expanding faster than NVIDIA can manufacture.

Margins Hold Steady: A Silent Flex Against Competitors

Despite shipping enormous volumes of incredibly complex systems, NVIDIA posted:

73.4% GAAP gross margin

73.6% non-GAAP gross margin

Gross Margin

Marginal compression was minimal, and guidance says Q4 margins move back toward 75%.

AMD isn’t taking pricing.

Custom silicon isn’t taking pricing.

Competition is noise. NVIDIA still sets the price of the world’s most valuable commodity: AI compute.

The Guidance Bomb: $65 Billion Next Quarter

If you want to understand why tech stocks ripped after earnings, it’s this line:

Q4 Revenue Guide: $65.0B ±2%

Another 14% sequential jump.

That’s not a slowdown.

That’s a runaway train.

Even more staggering: NVIDIA now claims $500 billion in visibility for Blackwell + Rubin through 2026.

Visibility like that doesn’t exist in semiconductors.

This is what demand looks like when you’re building the next computing era.

Market Impact: AI Bubble Talk Suffocated

There are moments where narratives shift instantly.

This was one.

For weeks, AI stocks were dragged by fears of:

A capex plateau

Custom ASIC threat

Blackwell delays

China export rules

Macro slowdown

NVIDIA’s numbers didn’t just refute those fears; they erased them.

Tech ripped in after-hours:

Meta jumped. Microsoft jumped. Amazon jumped. Google jumped.

If NVIDIA is the heartbeat of the AI cycle, this quarter was a defibrillator shock.

The Strategic Read: The Moat Deepens, Not Weakens

This quarter tells us three things:

1. AI demand is accelerating, not peaking.

Inference workloads are exploding.

Training isn’t slowing.

Sovereign AI is adding a second demand curve.

2. NVIDIA’s supply is the only bottleneck.

Not demand.

Not pricing.

Not competition.

3. The moat is wider than ever.

Software + hardware + networking + CUDA + ecosystem lock-in

= a fortress built on compounding returns.

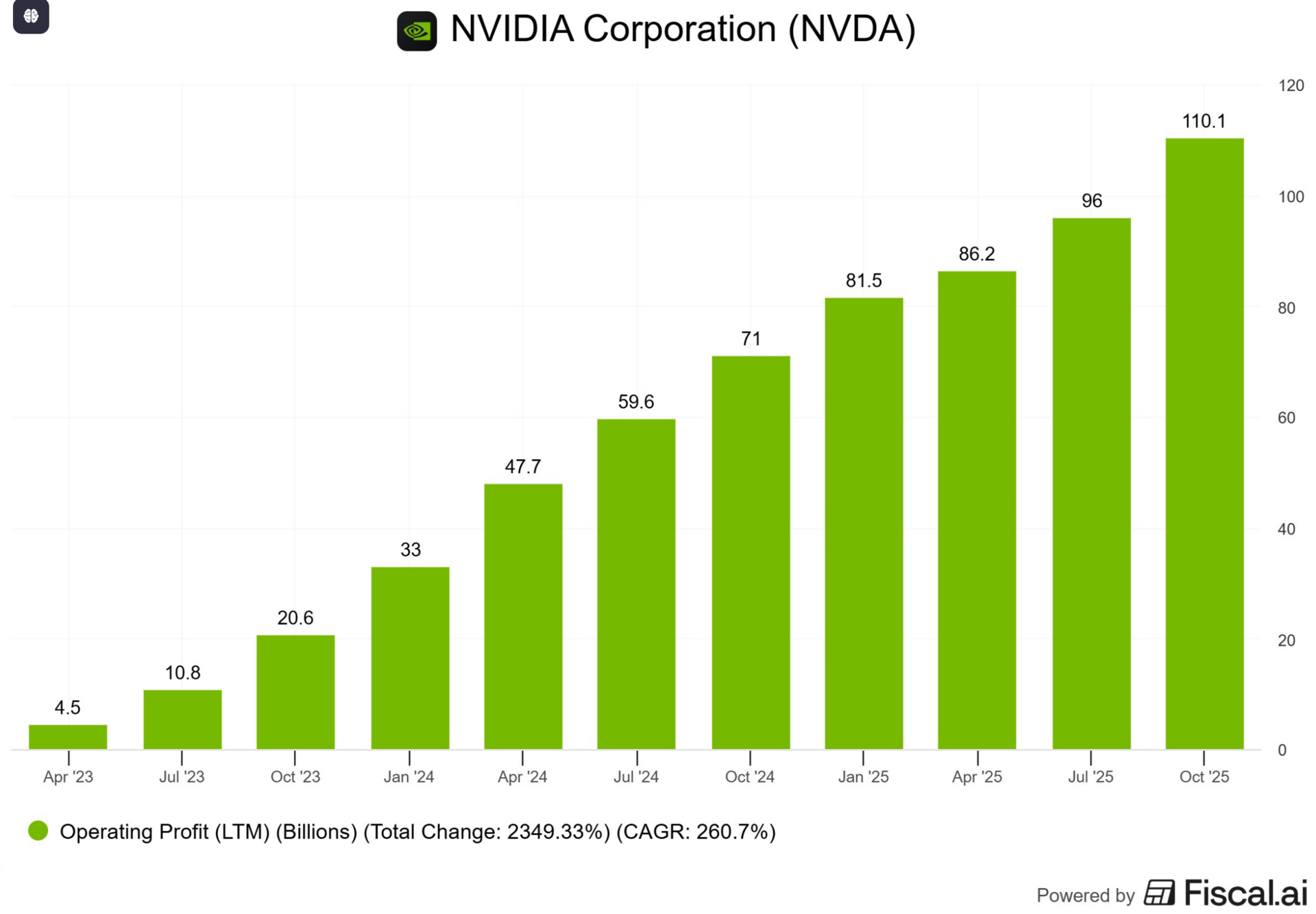

The Financial Engine: Cash Printing Mode Activated

Operating income: $36.0B (+110% YoY)

Net income: $31.9B (+65% YoY)

YTD shareholder return: $37B

Buyback authorization remaining: $62.2B

Operating Profit

NVIDIA is no longer just a semiconductor company.

It’s a global utility for AI compute with margins that look like luxury software.

Risks? Yes, and They Matter

Even the strongest earnings need context. For 9–5 investors, here are the real risks:

• Concentration Risk (90% of revenue in Data Centre)

Great when AI is booming.

Painful if AI ever pauses.

• Valuation Risk

The stock trades like a monopoly.

It needs a monopoly-like execution to justify it.

• Supply Constraints

NVIDIA’s biggest risk isn’t competition, it’s physics.

• Geopolitics

China is still a wildcard.

Nothing here derails the story, but investors should size their positions realistically, not on hype.

What This Means for Investors

NVIDIA’s results confirm two things:

1. AI is not a fad; it’s an economic supercycle.

And NVIDIA remains the picks-and-shovels provider of that era.

2. But the stock now lives in a high-expectation universe.

Every quarter needs to be excellent.

Good isn’t enough.

If you own NVDA, this quarter is a validation of your position.

If you’re building a portfolio, NVDA is no longer a “high-risk bet”; it’s a structural pillar of the AI economy.

Just size it wisely.

The Bottom Line: NVIDIA Just Rewrote the AI Story Again

This quarter wasn’t about beating estimates.

It was about resetting the narrative.

AI capex isn’t slowing; it’s accelerating.

Blackwell isn’t delayed; it’s sold out.

Margins aren’t collapsing, they’re expanding.

The moat isn’t shrinking, it’s deepening.

The story isn’t peaking, it’s compounding.

For a decade, NVIDIA has been the most important company in AI.

This quarter proved it still is and that 2026 could be even bigger.

Disclaimer: This publication is for general information and educational purposes only and should not be taken as investment advice. It does not take into account your individual circumstances or objectives. Nothing here constitutes a recommendation to buy, sell, or hold any investment. Past performance is not a reliable indicator of future results. Always do your own research or consult a qualified financial adviser before making investment decisions. Capital is at risk.

Markets move fast. Savvy investors spot trends early.

Every Monday, get my pre-market cheat sheet:

✅ What’s hot

✅ What’s fading

✅ Where smart money’s flowing

No hype, just data.

👉 Subscribe to stay ahead.