When investing, your capital is at risk. The value of investments can go down as well as up, and you may get back less than you put in. The content of this article is for information purposes only and does not constitute personal advice or a financial promotion.

Five Forces Quietly Shaping the U.S. Stock Market in 2026

Why 2026 Feels Different

A single big story defines most years in the stock market.

2020 was all about the shutdown.

2022 was marked by inflation.

2024 brought a wave of AI optimism.

2026 probably won’t be remembered for just one thing.

The year ahead isn’t about a single story, but about several powerful forces coming together. Capital spending faces policy risks. Productivity gains clash with persistent inflation. Asset prices start to matter more than job numbers. These forces are now deeply connected.

This complexity can feel uncomfortable, but it’s often where investment returns are made.

Below are five structural forces that are already shaping how U.S. equities behave heading into 2026, based on forward-looking research from prominent asset managers and macro forecasters.

1. AI Spending Stops Being a Theme and Starts Acting Like Infrastructure

By 2026, AI no longer lives in pitch decks. It lives on balance sheets.

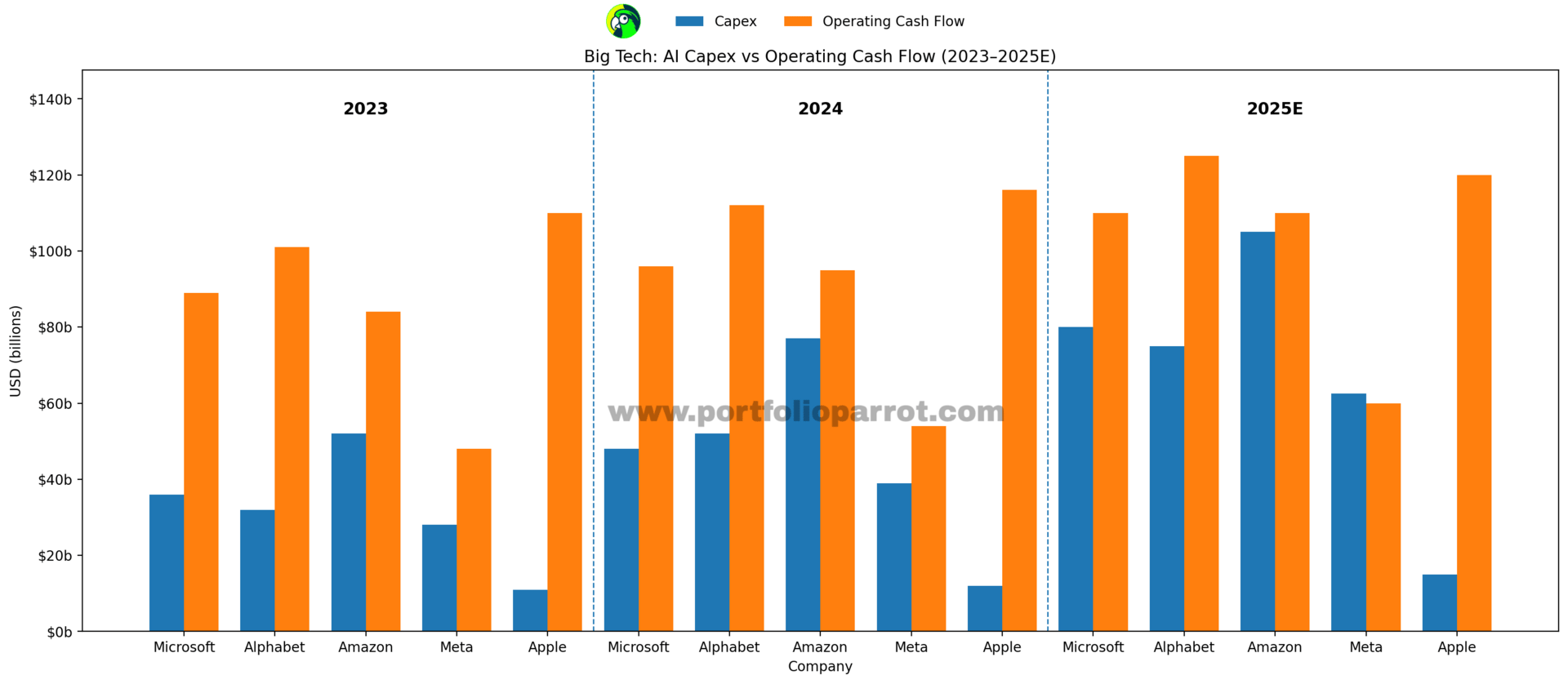

Research from Vanguard and BlackRock shows a clear shift. AI investment is moving away from lightweight software bets and toward heavy, physical spending. Data centres. Power. Networking. Cooling. The unglamorous things that make expensive chips actually useful.

Vanguard estimates more than $2 trillion in AI-related commitments through 2027 from firms such as Amazon, Alphabet, Microsoft, and Nvidia. That scale rivals some of the largest investment booms in modern U.S. history.

This matters because productivity gains allow companies to grow their earnings even as hiring slows. That’s rare, and it helps profits without causing wage inflation to rise again.

What changes in markets

Growth is driven more by business investment than by consumer demand

Winners aren’t just in AI software; they include hardware, energy, and systems integration, too

Strong earnings matter more than a good story

Where it can go wrong

Vanguard sees about a 25 percent chance that productivity gains fall short. If revenue doesn’t keep up with infrastructure spending, market leaders could change fast.

The opportunity is real, but so is the competition.

Capex surges as tech giants race to build AI infrastructure.

2. Policy Risk Is Rising While Markets Remain Calm

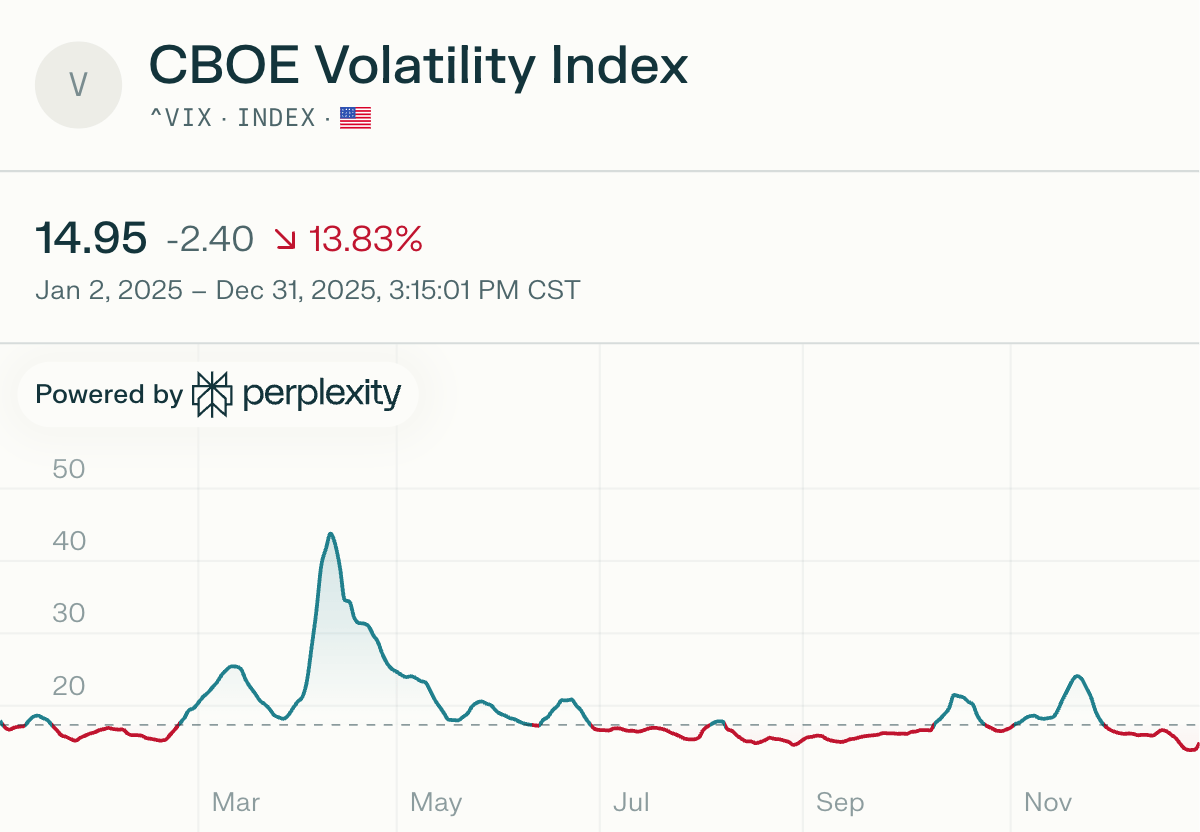

Markets enter 2026 in an odd state.

There’s more uncertainty around government policy than usual.

At the same time, market volatility is low.

That mix usually doesn’t last long.

Trade realignments, tariffs, and fiscal experimentation are already feeding into global supply chains. Research from Goldman Sachs suggests U.S. trade actions could create a front-loaded drag on growth in early 2026, even if domestic demand remains resilient.

Outside the U.S., governments are adapting instead of standing still. Germany is speeding up infrastructure projects. Argentina is changing its tax system and selling state assets. Emerging markets are finding new supply routes instead of pulling back.

What changes in markets

Volatility appears as shifts between sectors, not as a market crash

Investments based on just one story become riskier

The fundamentals of individual stocks matter more again

Where it can go wrong

Tariffs or sudden changes in government spending could raise inflation just as central banks try to lower rates.

In this case, volatility isn’t a warning; it’s just part of the market environment.

CBOE Volatility Index in 2025

3. The Fed Has Less Room Than It Used To

Monetary policy in 2026 is constrained by math.

Headline inflation has cooled, but core inflation remains sticky. Wages, tariffs, AI-related capital demand, and high debt servicing costs all contribute. Vanguard projects U.S. core inflation around 2.6 percent in 2026, still above the Federal Reserve target.

Goldman Sachs expects only small rate cuts, not a return to easy money.

Meanwhile, both governments and companies have much more debt than in past cycles. Bond markets are less forgiving now, and sudden jumps in yields can cause stress quickly.

What changes in markets

Rate cuts help a little, but not much

Assets with long time horizons are still sensitive to changes

Strong balance sheets are important again

Where it can go wrong

If inflation picks up again, policymakers will have less flexibility.

This is not a cycle built on cheap money. It is built on stability.

Consumer Price Inflation

4. The World Outside the U.S. Matters Again

U.S. stocks still get most of the attention, but valuations in other markets are looking more attractive.

Vanguard, Fidelity, and Deloitte all point to better starting conditions outside the U.S. with lower valuations, helpful currency trends, and less risk from AI concentration.

Vanguard expects about 6 percent returns for developed markets outside the U.S. There are stronger growth areas in India, parts of Southeast Asia, and some emerging-market exporters. Europe’s growth is modest, but government spending helps. China’s growth depends on exports and tech upgrades, which are uneven but still significant.

What changes in markets

U.S. market leadership shrinks but doesn’t disappear

Diversifying helps improve returns for the level of risk taken

Currency changes can quietly boost returns

Where it can go wrong

Trade disputes and global tensions tend to affect international markets first.

The goal isn’t to give up on U.S. stocks, but to avoid relying on them too much.

5. Asset Prices Are Driving the Economy More Than Jobs

One of the least discussed forces shaping 2026 is the wealth effect.

Spending is increasingly driven by ownership of assets such as dividends, capital gains, rents, and investment income. This leads to a two-speed economy: higher earners keep spending, while lower-income households feel wage pressure and rising costs.

AI widens this gap by increasing returns to capital faster than wages can keep up.

What changes in markets

Market drops hurt confidence faster than job numbers do

Asset prices are playing a bigger role in driving the economy

Financial conditions can tighten quickly after market corrections

Where it can go wrong

A sudden drop in stock prices could slow economic growth more quickly than policymakers expect.

When asset prices drive growth, diversification becomes a way to protect yourself.

What This Means for the 9–5 Investor

2026 isn’t a year for making all-or-nothing bets.

Instead, it’s a year when:

AI helps drive growth, but punishes investors who don’t adapt

Policy changes create more noise, but don’t break the markets

Rate cuts benefit strong companies more than weak ones

Investing globally helps make your portfolio more resilient

Asset prices are now shaping the economy itself

The advantage does not come from prediction. It comes from preparation.

In 2026, markets probably won’t reward certainty. Instead, they favour portfolios built to handle several forces moving at once, sometimes in unexpected ways.

Disclaimer: This publication is for general information and educational purposes only and should not be taken as investment advice. It does not take into account your individual circumstances or objectives. Nothing here constitutes a recommendation to buy, sell, or hold any investment. Past performance is not a reliable indicator of future results. Always do your own research or consult a qualified financial adviser before making investment decisions. Capital is at risk.

Markets move fast. Savvy investors spot trends early.

Every Monday, get my pre-market cheat sheet:

✅ What’s hot

✅ What’s fading

✅ Where smart money’s flowing

No hype, just data.

👉 Subscribe to stay ahead.