The Rally That Wouldn’t Quit

There’s a saying on Wall Street: bull markets climb a wall of worry.

This October, investors ran out of bricks.

Despite a year of geopolitical noise, election headlines, and endless debate over whether the Fed had already cut too far, the market kept rising. The S&P 500 and Nasdaq both hit record highs. The Dow Jones broke through 47,000 for the first time.

Investors didn’t cheer a single piece of news; they cheered the absence of bad ones. Inflation cooled, the Fed cut rates, and corporate earnings were solid enough to make everyone forget about the last twelve months of anxiety.

Market Snapshot

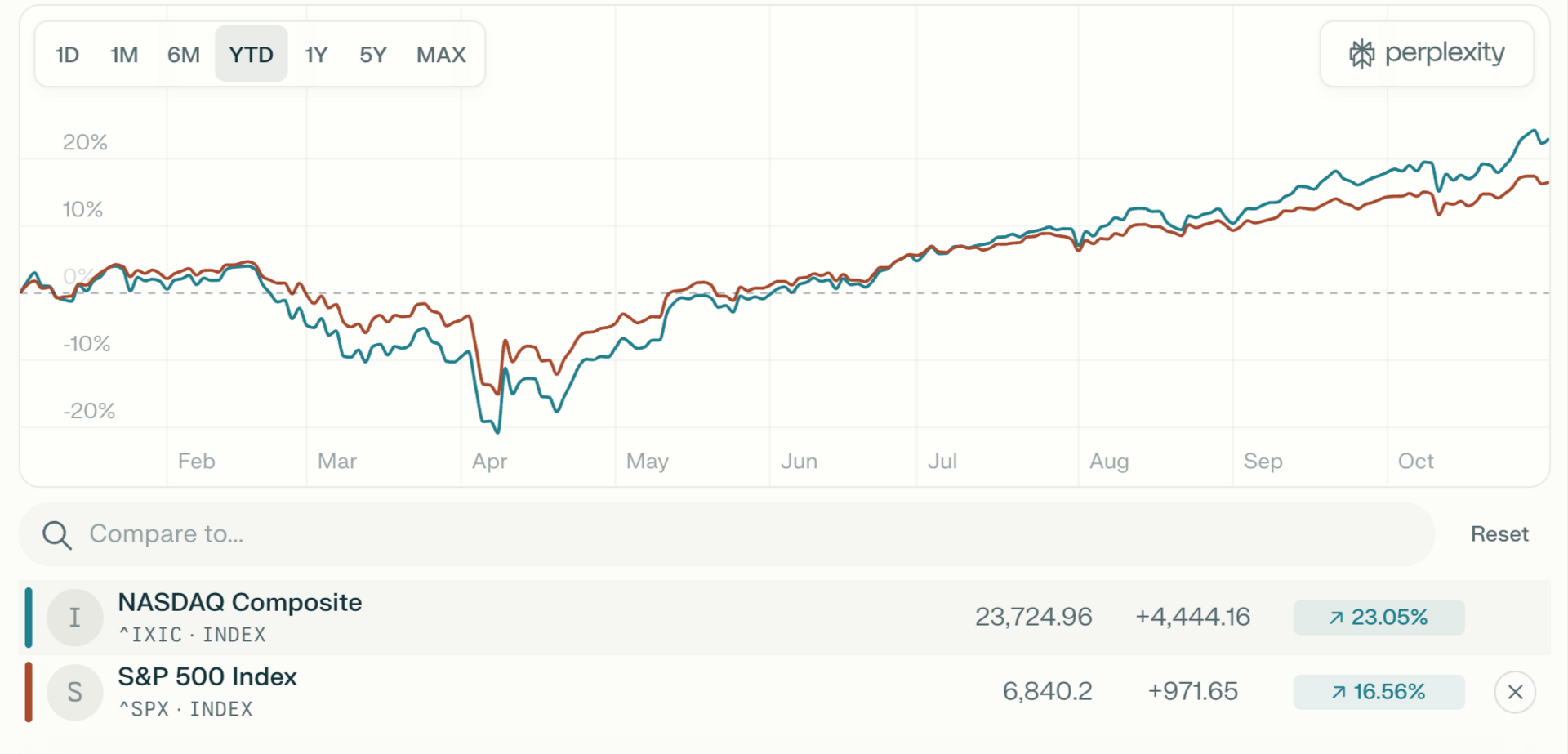

YTD Performance of NASDAQ Composite and S&P 500 Index.

Index | Close (31 Oct 2025) | YTD Change |

|---|---|---|

S&P 500 | 6,840.20 | +16.3% |

Dow Jones Industrial Average | 47,562.87 | +11.8% |

Nasdaq Composite | 23,724.96 | +22.9% |

Russell 2000 | 2,479.38 | +11.2% |

Stocks didn’t just rise; they rose despite reasons not to.

What Drove the Week

1. The Fed Blinked But Softly

The Federal Reserve trimmed rates by 25 basis points, a move both expected and nervously anticipated. Inflation data from September suggested progress without panic, and that alone was enough to justify the pivot.

Ten-year Treasury yields stayed around 4%, but equity markets heard one message loud and clear: the Fed is now playing defence, not offence.

2. Earnings Spoke Louder Than Words

Around 82% of S&P 500 companies beat profit forecasts.

Amazon and Apple posted solid results, while Meta, Microsoft, and Google all reinforced the same message: building the digital backbone of the AI era is profitable—but capital-intensive.

Qualcomm surged 18% after unveiling new AI chips, proving once again that in this market, selling the shovels in the AI gold rush still pays.

3. Trade Talks Lightened the Mood

U.S.–China negotiations produced modest tariff relief and renewed import commitments. No one called it a breakthrough, but it was enough to remind investors that progress, however incremental, moves markets.

Sectors in Motion

Sector | Move | Key Driver |

|---|---|---|

Technology | +2.9% | AI and semiconductor strength kept the sector leading. |

Energy | +2.4% | Oil up 7.5% to around $61.83 amid supply constraints. |

Consumer | Mixed | Travel and retail remained firm; streaming struggled. |

Healthcare & Staples | Weaker | Investors rotated into risk and cyclicals. |

Gold fell 7.6% to $4,008.80 as investors rediscovered optimism.

Bitcoin climbed 5.8% to roughly $114,765, helped by institutional buying into new Bitcoin ETNs.

Beyond Wall Street

Europe’s STOXX 600 slipped 0.5% as earnings and inflation painted a mixed picture.

The FTSE 100 in London hit a record before easing on profit-taking, driven by strength in property and energy names.

Across Asia, the markets in Shanghai and Tokyo rose as trade optimism lifted export sentiment.

For a change, the global narrative aligned: cautious optimism replaced coordinated worry.

Three Things Worth Remembering

Earnings, not excitement, are leading this rally.

Markets are rewarding companies that make money, not just headlines.Volatility isn’t gone, it’s just being ignored.

Investors are tired of overreacting. They’ve seen too many false alarms to panic at every headline.Diversification still works, quietly.

U.S. tech is the showstopper, but Europe and Asia are quietly compounding in the background.

Looking Ahead

The next act will be about confirmation.

Investors will watch upcoming Fed speeches for hints on how long the easing bias lasts, while the U.S. jobs report and GDP revisions will test whether the “soft landing” story is real or just wishful thinking.

Volatility remains low, but the market’s calm depends on one assumption: that inflation doesn’t come back wearing a different mask.

Portfolio Parrot View

October was a reminder that markets don’t reward perfection; they reward progress.

Inflation is falling, growth is steady, and companies are finding ways to make money in a higher-rate world.

That combination of moderation, not mania, is what fuels durable bull markets.

For investors, the rule remains simple:

Focus on quality, ignore the noise, and let time do what forecasts can’t.

Disclaimer: This publication is for general information and educational purposes only and should not be taken as investment advice. It does not take into account your individual circumstances or objectives. Nothing here constitutes a recommendation to buy, sell, or hold any investment. Past performance is not a reliable indicator of future results. Always do your own research or consult a qualified financial adviser before making investment decisions. Capital is at risk.

Markets move fast. Savvy investors spot trends early.

Every Monday, get my pre-market cheat sheet:

✅ What’s hot

✅ What’s fading

✅ Where smart money’s flowing

No hype, just data.

👉 Subscribe to stay ahead.