As we enter a new month, savvy investors closely monitor where the biggest funds place their bets. Understanding institutional moves can give you an edge, helping you align your portfolio with high-conviction strategies backed by deep research and strong capital flows.

Based on my QIQS data strategy, this breakdown will highlight the key themes, sectors, and strategies that top-performing funds focus on. These insights can help you refine your approach and position yourself for success.

QIQS quant analysis for March

10 Key Areas to Watch

Institutional investors and hedge funds are making significant shifts in the following areas:

1️⃣ Technology Sector

Tech continues to dominate, with major funds maintaining or increasing exposure to high-growth areas like cloud computing, software, and cybersecurity. With innovation at the forefront, this sector remains a key driver of market performance.

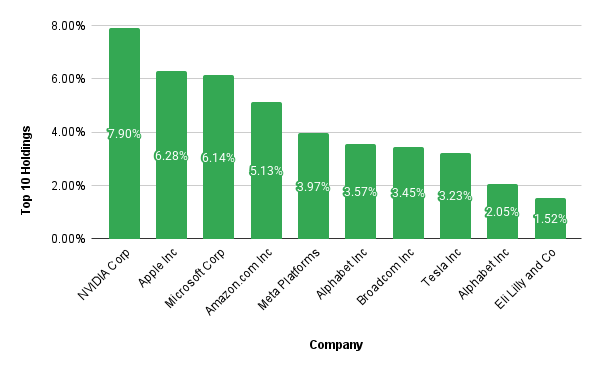

2️⃣ Artificial Intelligence

AI is not just a trend—it’s a revolution. From machine learning algorithms to AI-powered automation, leading funds are heavily investing in companies that will shape the future of artificial intelligence.

3️⃣ Semiconductors

Semiconductors are in high demand as the backbone of modern technology. Top funds are allocating capital to leading chipmakers, AI-focused semiconductor firms, and companies involved in the global supply chain.

4️⃣ Global Equities

Institutional investors are diversifying beyond the U.S., looking at opportunities in emerging markets and developed economies with strong growth potential. International exposure can provide a hedge against domestic volatility.

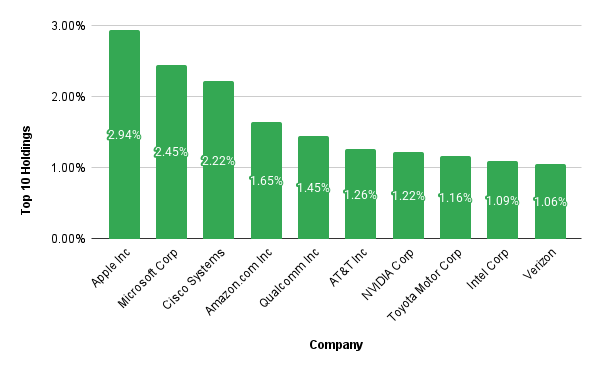

5️⃣ Global Income & Dividends

Dividend-paying stocks remain a core focus for those prioritizing cash flow and stability. Funds are positioning themselves in high-yield global income strategies, favoring companies with strong balance sheets and consistent dividend growth.

6️⃣ Growth Stocks

Despite market uncertainty, growth stocks remain attractive to institutional investors. Top funds carefully select high-quality companies with strong revenue expansion and competitive advantages.

7️⃣ Value Investing

Value stocks are gaining renewed interest as investors seek undervalued opportunities with strong fundamentals. Funds are targeting companies trading below intrinsic value, offering long-term appreciation potential.

8️⃣ U.S. Momentum Stocks

Momentum investing is a key strategy, with funds chasing stocks that exhibit strong price trends. U.S. market leaders in technology, healthcare, and consumer discretionary sectors continue to attract institutional capital.

9️⃣ Non-U.S. Momentum Stocks

Global momentum plays are gaining traction beyond the U.S. Institutional investors are identifying high-performing stocks in Europe, Asia, and emerging markets and capitalizing on regional growth trends.

🔟 MOAT Stocks

Competitive advantage is everything. Funds prioritise companies with strong economic moats—businesses with durable competitive advantages, pricing power, and industry leadership.

Positioning for the Month Ahead

Understanding how top-performing funds position their portfolios can help you make more informed investment decisions. Whether you’re looking for growth, value, income, or momentum plays, tracking institutional moves provides valuable insights into market trends.

As always, research, stay disciplined, and invest with a strategy that aligns with your financial goals.

📈 Want to stay ahead of the market?

Subscribe to my free weekly newsletter, where I break down institutional investing trends, stock picks, and wealth-building strategies for 9-5 investors!