September has always had a reputation on Wall Street. It’s the month people quietly dread — not because of bad weather or holidays, but because, statistically, stocks tend to stumble here. Since 1950, the S&P 500 has averaged a small loss in September. Nobody knows why, but like superstition in baseball, it lingers.

This year, September begins with a pause — Labor Day on the 1st — and then jumps straight into the kind of week traders live for: fresh jobs numbers, a handful of big earnings, and the endless guessing game of what the Fed will do next.

How August Ended

August closed with the S&P 500 at 6,460, slightly down on the final day but still up 2.2% for the month. That’s four months in a row of gains, not bad for a year that started with tariff drama. The Nasdaq finished at 21,455, weighed down in the final session by tech selling, while the Dow looked steadier thanks to money flowing into old-school sectors like industrials and utilities.

Year to date:

S&P 500: +12.4%

Nasdaq: +15.8%

Dow: +8.1%

Not fireworks, but enough to keep optimism alive.

The Mood

Investors sound hopeful but cautious. Inflation is cooling, the Fed is expected to cut rates this month, finally, and earnings haven’t cracked under pressure. But tariffs are still in play, the dollar has been unpredictable, and the market’s AI obsession is showing signs of fatigue.

Traders are hedging their bets by sliding into defensive names like utilities. Friday’s jobs report will likely set the tone: a gentle slowdown in hiring could be celebrated, but anything sharper might spoil the party.

Dates That Matter

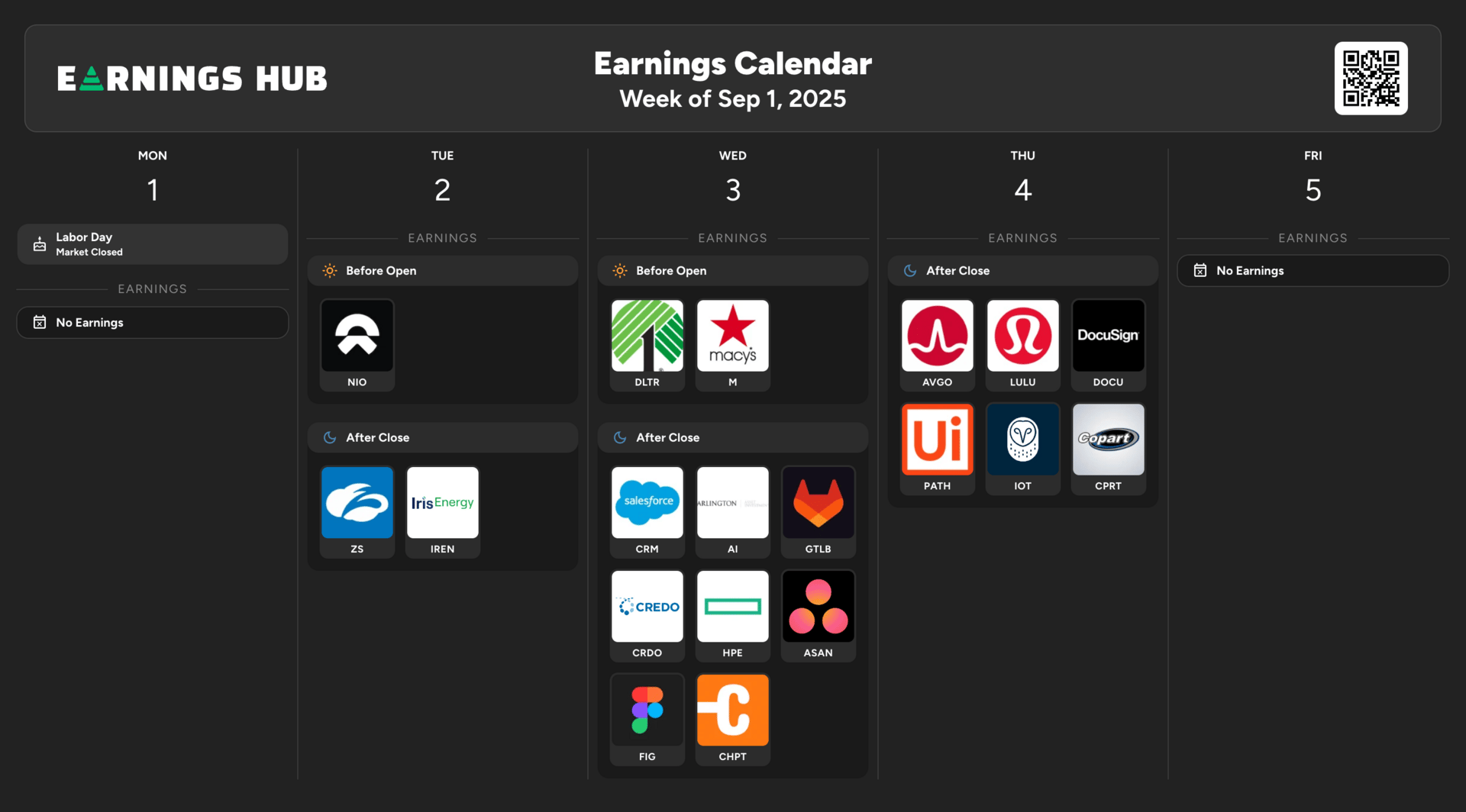

Tuesday, Sept 2: Manufacturing data, earnings from Zscaler (ZS).

Wednesday, Sept 3: Job openings, earnings from Salesforce (CRM), Dollar Tree (DLTR), Dick’s Sporting Goods (DKS).

Thursday, Sept 4: Payrolls and services data, earnings from Broadcom (AVGO), Lululemon (LULU), DocuSign (DOCU).

Friday, Sept 5: Jobs report — the headline act.

What’s Hot

Tech: AI is still the story, but chipmakers like Broadcom now wrestle with tariff headlines as much as product launches.

Utilities: Suddenly interesting, as falling yields make steady dividends look good again.

Consumer: Lululemon vs. Dollar Tree tells you everything about two different Americas — one splurging, the other stretching.

Financials: Banks will get more clarity on margins if cuts begin.

Energy: Oil is still the wild card, tied to geopolitics more than supply and demand math.

Stocks in Focus

Nvidia $NVDA ( ▲ 1.02% ): Still riding the AI wave, though tariffs hang in the air.

Broadcom $AVGO ( ▼ 0.4% ): Earnings Sept 4; a litmus test for chips and AI infrastructure.

Salesforce $CRM ( ▼ 0.07% ): Earnings Sept 3; cloud growth and AI pitches under the microscope.

Lululemon $LULU ( ▲ 2.42% ): Earnings Sept 4; testing the appetite for high-end retail.

Zscaler $ZS ( ▼ 5.47% ): Earnings Sept 2; cybersecurity is still one of the few “must-spend” items for companies.

Dollar Tree $DLTR ( ▲ 0.7% ): Earnings Sept 3; a window into how stretched consumers really are.

DocuSign $DOCU ( ▲ 0.82% ): Earnings Sept 4; subscription renewals in a slower SaaS world.

Microsoft $MSFT ( ▼ 0.31% ): No earnings, but as always, the anchor for AI + cloud sentiment.

PayPal $PYPL ( ▼ 0.19% ): Cheap fintech, waiting for proof it can grow again.

CrowdStrike $CRWD ( ▼ 7.95% ): Cybersecurity leader, with comparisons drawn to Zscaler.

The Takeaway

September usually trips up the market, but this week’s mix of jobs data and Fed signals could rewrite the script. The market feels like a tightrope: growth names like Nvidia, Broadcom, and Salesforce on one side, defensive plays like Dollar Tree and utilities on the other.

The story of the month isn’t whether September is “bad.” It’s whether the economy slows just enough to justify rate cuts without breaking anything else.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always conduct your own research or speak to a qualified professional before investing.

Markets move fast. Savvy investors spot trends early.

Every Monday, get my pre-market cheat sheet:

✅ What’s hot

✅ What’s fading

✅ Where smart money’s flowing

No hype—just data.

👉 Subscribe to stay ahead.