When investing, your capital is at risk. The value of investments can go down as well as up, and you may get back less than you put in. The content of this article is for information purposes only and does not constitute personal advice or a financial promotion.

1. The Week We’re Walking Into

Some weeks feel worse than the numbers suggest. Last week was one of them.

The S&P 500 and Dow both traded roughly 2 percent lower. The Nasdaq did worse, pulled down by a tech selloff that started right after Nvidia posted astonishing results and then… fell anyway. Small caps held up a bit better, which tells you where the de-risking really happened.

Bitcoin’s slide didn’t help the mood. It moved from being up strongly earlier in the year to negative territory, and that shift fed into the cautious tone around anything “speculative.”

And yet while prices were wobbling, money still moved into equities. About $4.36 billion went into U.S. equity funds, mostly into large- and small-cap funds. Mid-caps saw outflows. That quiet detail matters. Price said, “nervous.” Flows said “still buying, but more selectively.”

Welcome to the final week of November: thin liquidity, real macro signals, and a consumer-heavy finish with Black Friday watching from the corner.

2. Key Dates This Week: A Short Calendar That Still Matters

Monday 24 November

No major U.S. data, but two earnings reports offer early clues about business spending:

Zoom – enterprise IT budgets, and whether companies are spending on AI add-ons or sticking with basics.

Agilent – a practical read on research and biopharma demand.

Even without data, price action early in the week tends to carry the emotional hangover from the prior one.

Tuesday 25 November: The Compact Macro Test

At 08:30 ET, three numbers land almost at once:

Producer Price Index (inflation at the factory level)

Retail Sales (a pulse check on consumer demand)

Consumer Confidence at 10:00 ET

This cluster tells you how the “real economy” looks heading into December.

Strong readings tend to push yields up and squeeze high-valuation tech.

Soft readings ease bond yields but bring a different concern: slowing demand.

It’s the classic “pick your problem” scenario.

Wednesday 26 November

A few more data points before markets shut down:

Durable goods orders – business investment appetite

Initial jobless claims – the labour-market heartbeat

Crude oil inventories – the weekly nudge for energy stocks

A strong or weak combination here often shapes the mood going into the holiday break.

Thursday 27 November: Thanksgiving

Markets closed.

Friday 28 November: Black Friday

Short trading session, but probably the most narrative-heavy day of the week.

Retailers, payments firms and logistics names are all dragged into live commentary on foot traffic, promotions and early holiday momentum.

This year, the stakes are higher because both consumer staples and discretionary stocks have been softsomething the market hasn’t seen together since 1990.

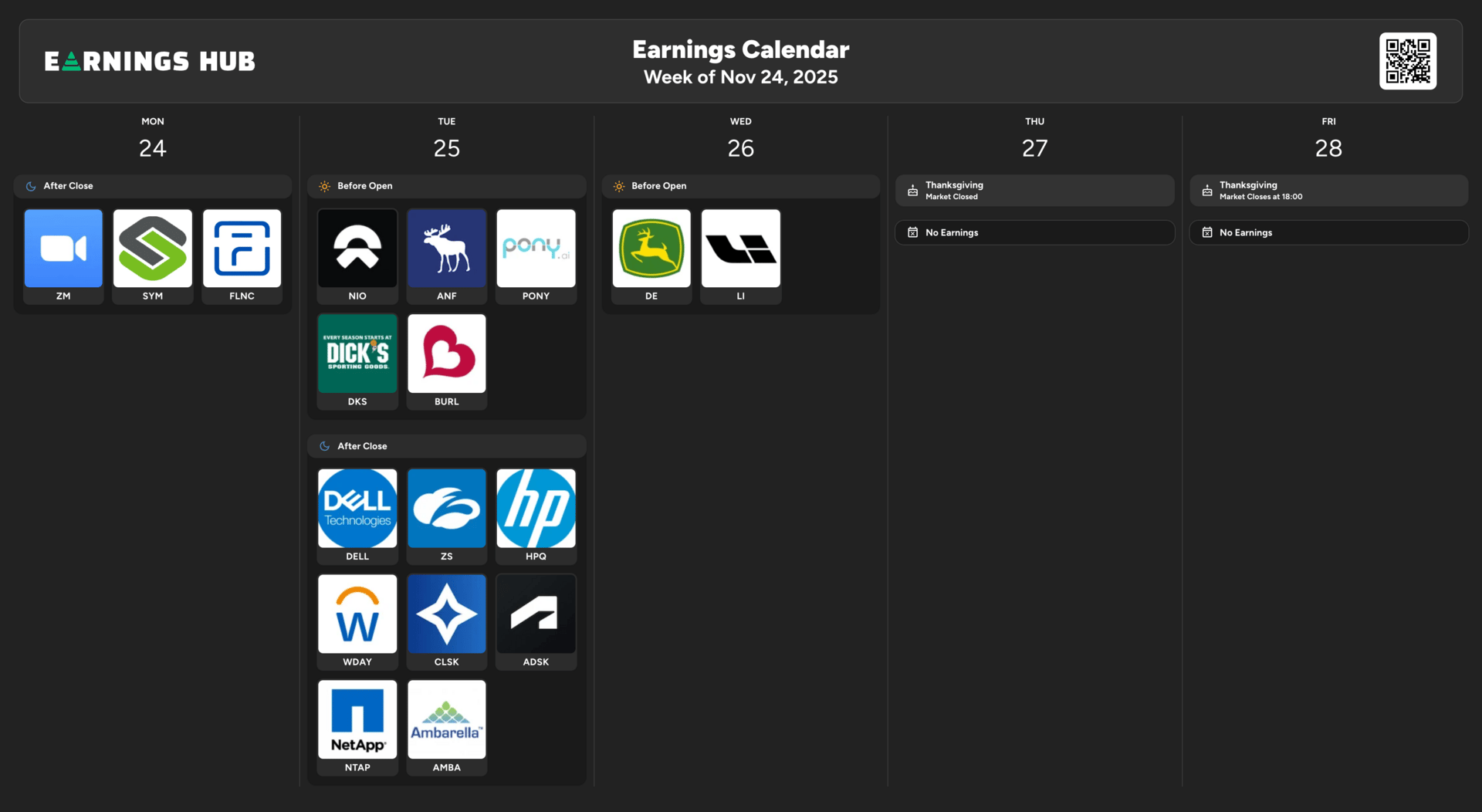

Earnings for Week of 24 November 2025

3. What Big Money Is Actually Doing

The interesting thing about last week was not that tech fell. It was how investors moved around it.

Tech & AI: A Controlled Pullback

Tech was the worst-performing sector. AI names, including the ones that didn’t report earnings, followed Nvidia lower.

But this didn’t look like capitulation.

It looked like investors were cutting position size in the most crowded trades.

Nvidia’s numbers were still huge. Expectations were just louder than reality for a moment.

Healthcare: Quietly Becoming Market Leadership

While tech caught all the attention, healthcare went on one of its calm, steady runs.

Up roughly five percent this month.

That’s not the behaviour of a defensive sector hiding from volatility, it’s the behaviour of investors allocating capital into earnings that don’t lurch around like a meme chart.

Consumers: Weak at the Top and Bottom

It’s rare to see dollar stores, big-box retailers, lifestyle brands and basic staples all under pressure at the same time.

But that’s where the market sits now.

Higher-income households are still spending. Lower-income households are showing fatigue.

Black Friday will make this divide visible very quickly.

Size Matters: Large + Small > Mid

Flows into large caps and small caps, out of mid caps, tell a simple story:

Investors want liquidity at the top end and optionality at the small end.

Mid-caps are stuck in the middle with no narrative wind at their back.

4. Institutional Rotation In One Line

The market is not running from stocks.

It’s running from concentration.

Money has been drifting away from the hottest AI and mega-cap names and toward:

Healthcare

Select defensives

Small caps

Large, profitable cyclicals

It’s rotation, not retreat.

5. Catalysts and Risks: The Real Drivers This Week

Catalysts

1. Tuesday’s triple data drop

The market rarely gets three major pieces of macro information in such a tight window.

PPI + Retail Sales + Consumer Confidence can swing expectations for both Q4 earnings and the Fed’s next step.

2. Wednesday’s business and labour read

Durable goods and jobless claims may not trend on X, but they often move markets more than headline numbers.

3. Crude inventories

Energy stocks have been directionless for weeks. One surprise build or draw can easily become the week’s story.

4. Black Friday commentary

A softer consumer shows up in three places: discount levels, return rates and traffic patterns. Investors will be watching every rumour.

5. Earnings from names with good read-through

Zoom, Agilent, Best Buy, Dick’s, Burlington, Kohl’s, Smucker, Deere, Alibaba, NIO.

Each tells a slightly different story about the economy.

6. Flows moving out of cash

Another week of money-market outflows would confirm that institutions are nudging risk back onto the table.

Risks

1. Hot data

If Tuesday’s numbers come in strong, yields may rise again, and tech may feel that instantly.

2. Cold data

The opposite problem: yields fall, but growth fears rise.

Markets don’t love either extreme.

3. AI valuation pressure

Nvidia showed that even great results can get sold if positioning is stretched.

4. Weak Black Friday signals

Retailers have a short leash this year. One line about “soft traffic” can hit both discretionary and staples.

5. Holiday liquidity

Thin markets move more than thick ones. A single headline can push a stock further than usual.

6. Fed communication drift

If officials speak this week, even casually, it may reset expectations for December.

6. Stocks To Watch, Grouped by What They Tell You

AI & Mega-Cap Tech

Nvidia, Alphabet, Microsoft, Amazon, Meta, Broadcom

This group isn’t just about stock prices. They tell you how the market feels about growth, rates and risk appetite all at once.

Healthcare Leaders

Eli Lilly, Regeneron, UnitedHealth

These names represent steadiness in a market that’s been anything but steady.

Retail & Consumer

Amazon, Walmart, Best Buy, Dick’s, Burlington, Kohl’s, J.M. Smucker, Alibaba, NIO

Black Friday will shape expectations for Q4 almost immediately.

Cyclicals & Small Caps

iShares Russell 2000 (IWM), Deere, Exxon, Chevron

If the rotation is real, this is where you see it.

Bitcoin-Linked Equities

Coinbase, MicroStrategy, MARA, RIOT

All high-beta reflections of liquidity. When risk appetite picks up, they tend to notice first.

7. A Practical Way For 9–5 Investors To Follow This Week

You don’t need to stare at screens all day. A simple structure works:

Group your watchlist by theme

AI, healthcare, retail, cyclicals, crypto-levered.Check markets only around key times

Tuesday morning

Wednesday morning

Friday’s midday retail chatter

Watch behaviour, not headlines

Markets often reveal the truth before commentary does.

Pay attention to:

Which stocks hold support

Where buyers step in

Which sectors attract real volume

Those signals usually show where institutions are placing their bets long before the data becomes obvious.

Disclaimer: This publication is for general information and educational purposes only and should not be taken as investment advice. It does not take into account your individual circumstances or objectives. Nothing here constitutes a recommendation to buy, sell, or hold any investment. Past performance is not a reliable indicator of future results. Always do your own research or consult a qualified financial adviser before making investment decisions. Capital is at risk.

Markets move fast. Savvy investors spot trends early.

Every Monday, get my pre-market cheat sheet:

✅ What’s hot

✅ What’s fading

✅ Where smart money’s flowing

No hype, just data.

👉 Subscribe to stay ahead.