When investing, your capital is at risk. The value of investments can go down as well as up, and you may get back less than you put in. The content of this article is for information purposes only and does not constitute personal advice or a financial promotion.

Quick Take: 9–5 Investor Summary

What’s happening

US stocks are finishing 2025 near record highs. Trading is slow because of the holidays, and the FOMC minutes are setting the tone for the final week of the year.

Why it matters

With most rate cuts already expected, investors are now paying more attention to company earnings and which sectors might lead in 2026.

What the market is missing

This week isn’t just about the usual Santa Claus Rally. Instead, we’re seeing early signs that investors are shifting from popular AI hardware stocks to platforms, steady-cash-flow companies, and specific cyclical sectors.

Key risk to watch

Cautious messages in the Fed minutes are making the quiet holiday markets more volatile, leading to larger price swings and some misleading moves.

Investor lens

Watch: use the week to refine a 2026 watchlist and observe leadership and yield reactions, not to chase year-end price action.

Top US Stocks to Watch This Holiday Week

Week of 29 December 2025 to 2 January 2026

The final trading days of the year are more of a transition than a proper ending.

Trading volume falls, and rebalancing takes place quietly. A handful of economic reports matter more than usual. As the new year begins, markets are shaped more by current positions than by fresh news.

US stocks are wrapping up 2025 near record highs, with the S&P 500 closing in on 7,000 after a strong year. Seasonal trends help, since the last five days of December and the first two of January often bring small gains.

This is a standard view, but it’s worth asking a better question.

What does leadership look like as the calendar flips to 2026?

Beneath the leading indices, the market is already changing. Popular AI hardware stocks have slowed down, and investors are now looking at companies using AI, those with steady cash flow, and some cyclical sectors. This week won’t set the trend, but it could show if it will last.

Market backdrop: strong tape, thin depth, subtle rotation

Where markets stand

US stocks have had a strong year. The S&P 500 is up by a high-teen percentage in 2025, and the Nasdaq has gained over 20%, depending on the late-December numbers. An intraday high near 6,920 on December 24 put 7,000 within reach.

Recent price changes matter more than the index level. Gains aren’t limited to big tech stocks; financials, materials, and other cyclical sectors have also performed well. This points to broad market strength, not just a shift to safer assets.

The holiday reality

Trading volume is low this week. End-of-year adjustments, tax moves, and fewer orders can make prices swing more than usual. With no major earnings reports, prices depend more on economic data, investor positions, and seasonal trends than on company results.

That doesn’t mean this week isn’t important. Instead, it helps reveal the market’s underlying trends.

The calendar: light data, one real catalyst

Date | Event | Why it matters |

|---|---|---|

Mon, Dec 29 | Pending Home Sales | A clean read on housing sensitivity to rates |

Tue, Dec 30 | Case Shiller Home Prices | Inflation and affordability signal |

Tue, Dec 30 at 2 pm ET | FOMC Minutes | The key event for rates and duration |

Wed, Dec 31 | Jobless Claims, early bond close | Cross-asset signals can get noisy |

Thu, Jan 1 | Markets closed | Year reset |

Fri, Jan 2 | Construction Spending | First industrial pulse of the new year |

Remember, the FOMC minutes come out on Tuesday, not Wednesday. In a quiet market, timing matters.

Macro lens: rate cuts are done, now earnings have to work

The Federal Reserve lowered rates by 25 basis points in December, setting the range at 3.50 to 3.75%. The rate cut was expected, but the Fed's message was more cautious.

Markets noticed the Fed’s caution about future rate cuts. If there are fewer cuts ahead, it will be harder for stock prices to rise just because of higher valuations. Company earnings will matter more.

That's why Tuesday's Fed minutes are the key event this week.

If the Fed minutes sound more positive, software, platforms, and growth stocks could benefit. If the message is more cautious, financials, cyclical stocks, and companies with steady cash flow may perform better.

Watch yields first. Leadership reacts second.

Seasonality: helpful context, not a strategy

The Santa Claus Rally has happened often in the past, but it’s best to see it as a helpful trend rather than a primary strategy.

Low trading volume can cause misleading price moves. Trends that look strong this week should be confirmed when trading picks up in January.

Where leadership is already trying to form

AI platforms and large-scale adopters

AI remains a primary focus for the market, especially if interest rates stay low. The main question now is which companies will benefit most from continued AI spending.

Watch: NVIDIA, Microsoft, Alphabet, Meta Platforms, Amazon

AI infrastructure beyond chips

Investing in networking and custom silicon companies is a less obvious way to get exposure to AI, often at lower prices.

Watch: Broadcom, Arista Networks

Data centres and compute.

Here, AI demand creates real-world needs like power, cooling, and hosting. These investments can be more volatile, but they offer helpful insights.

Watch: Iris Energy, Nebius Group

Healthcare and managed care.

As risk grows in large-cap stocks, investors often turn to healthcare as a defensive choice with more predictable earnings.

Watch: UnitedHealth Group, Elevance Health, Molina Healthcare

Financials and steady cyclicals

When growth is steady, banks with solid finances and reliable returns usually do well.

Watch: JPMorgan Chase

Power and energy transition

AI uses a lot of energy. Investments in power grids and clean energy can quickly rise in value when interest rates aren’t a concern.

Watch: First Solar

Rotation signals are worth watching in real time.

You don’t need special investor data to spot market shifts. A few simple signs are enough.

If big AI stocks rise and equal-weight indices also do well, it shows broad market strength. When cyclical stocks stay strong even as tech slows, it means more sectors are joining in. Quiet gains in healthcare and financials suggest a calm shift in leadership.

These signs matter more than daily price changes.

The watchlist, grouped by role in the market

Core sentiment drivers

NVIDIA, Microsoft, Alphabet, Meta Platforms, Amazon

AI infrastructure picks and shovels

Broadcom, Arista Networks

Higher beta expressions

Tesla, Palantir Technologies, Iris Energy, Nebius Group, SoFi Technologies, AST SpaceMobile, Rocket Lab

Rotation anchors

UnitedHealth Group, Elevance Health, Molina Healthcare, JPMorgan Chase

How Wall Street frames 2026

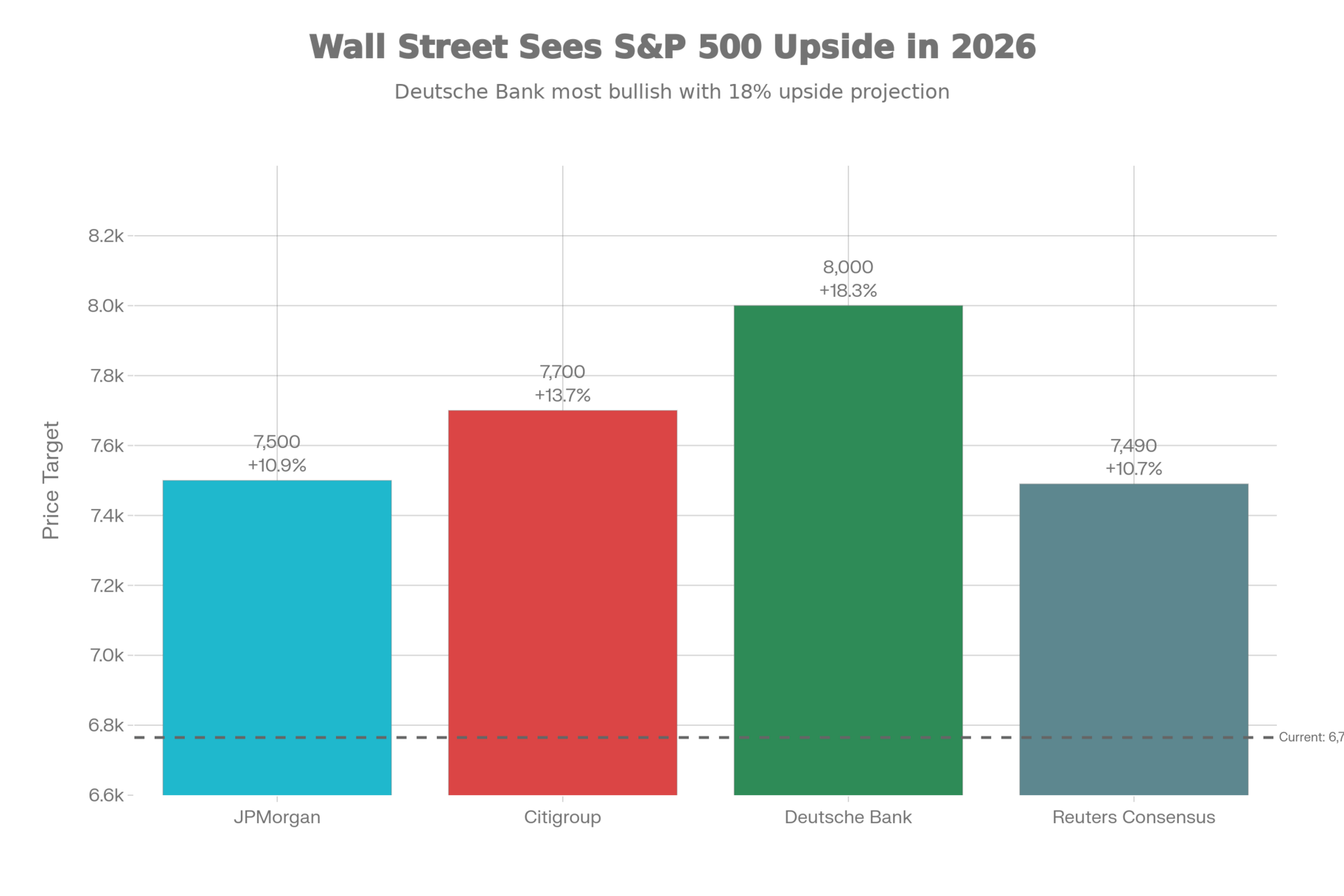

Strategist outlooks are broadly constructive. JPMorgan has outlined a path toward roughly 7,500 on the S&P 500 by the end of 2026. Deutsche Bank has floated an even more optimistic 8,000 scenario. Polls of strategists cluster around the mid-7,000s.

S&P 500 Upside Predictions in 2026

The standard view is that not only will stock prices rise, but earnings will keep growing, and more sectors, not just the most popular ones, will take the lead.

That idea is now being tested.

Risks to keep in view

In the short term, low holiday trading can create misleading signals. If investors focus too much on AI leaders, there’s little room for error if the Fed sounds cautious.

Looking ahead to early 2026, bigger risks could appear. If companies miss earnings targets, it matters more when stock prices are high. AI spending growth could slow, even if total spending stays high. Policy and tariff issues could also come back quickly.

These aren’t reasons to make big moves this week, but they are reasons to watch the market closely.

A simple way to approach the week

Pay attention on Tuesday.

Watch rates before stocks.

Notice who leads, not just what rallies.

Treat holiday strength as information, not confirmation.

The real test comes when volume returns.

Bottom line

This isn’t a week for chasing moves. It’s a week for building your 2026 list.

The real value comes from seeing where investors are testing new leaders and where they’re pulling back. These signals usually matter more than year-end numbers once the new year starts.

Disclaimer: This publication is for general information and educational purposes only and should not be taken as investment advice. It does not take into account your individual circumstances or objectives. Nothing here constitutes a recommendation to buy, sell, or hold any investment. Past performance is not a reliable indicator of future results. Always do your own research or consult a qualified financial adviser before making investment decisions. Capital is at risk.

Markets move fast. Savvy investors spot trends early.

Every Monday, get my pre-market cheat sheet:

✅ What’s hot

✅ What’s fading

✅ Where smart money’s flowing

No hype, just data.

👉 Subscribe to stay ahead.