When investing, your capital is at risk. The value of investments can go down as well as up, and you may get back less than you put in. The content of this article is for information purposes only and does not constitute personal advice or a financial promotion.

Quick summary for busy investors

What’s happening

US stocks are starting February just under record highs. The S&P 500 is struggling to stay above 7,000.

Why it matters

After three strong years, markets want more than just optimism. Now, they want real results.

What the market is missing

This isn’t just about the index reaching new highs. It’s about fewer stocks leading and money quietly shifting to new areas.

Key risk to watch

AI spending fatigue is a risk. When people question big investments, stock prices can drop faster than company results change.

Investor lens

Pay attention this week. Look for signs and trends, but don’t rush to conclusions.

Market overview: When good news needs to work harder

The S&P 500 finished January just below 7,000. That number matters more for how people feel than for any real calculation. The recent dip has been small, but the mood has changed. After years of gains, markets need more than just good news to keep rising.

Here’s why: the index rose 26.3% in 2023, 25% in 2024, and almost 18% in 2025. That kind of run doesn’t happen often. Usually, it’s not followed by a crash, but by a stretch in which returns slow, things get bumpier, and investors become more cautious.

January was mostly calm. The S&P 500 went up 1.4%, the Dow rose 1.7%, and the Nasdaq gained 1%. But fewer stocks were leading the way. Equal-weight indexes began to outperform, and defensive sectors attracted more attention. The VIX stayed low, but daily swings got bigger. This pattern often happens late in strong market cycles.

February brings another twist. It’s usually a slower month, and early gains often fade after earnings season ends and things quiet down.

A crowded calendar that can still surprise

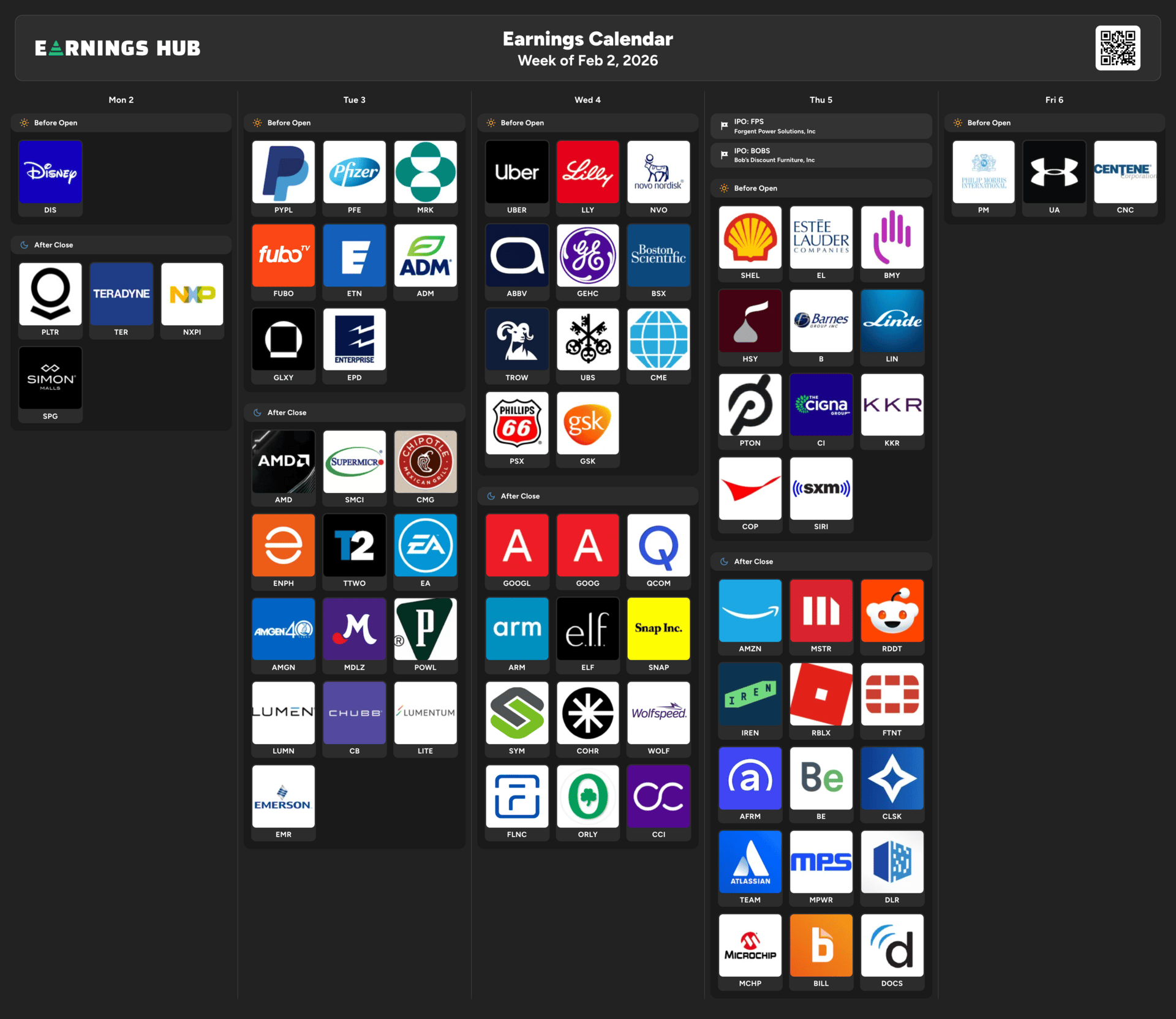

Earnings Calendar for Week of 2 February 2026

This week has plenty of data and earnings reports that could quickly shift investor sentiment.

Monday starts with manufacturing data and earnings from Disney and Palantir. For both, what they say about the future matters more than just the headline numbers.

On Tuesday, we’ll see decisions from global central banks and earnings from AMD, PepsiCo, and PayPal. What’s said about semiconductors now affects the whole market, not just that sector.

Wednesday is the busiest day, with services PMI data and earnings from Alphabet, Eli Lilly, and Uber.

Thursday brings more central bank news, plus earnings from Amazon and big energy companies.

Friday wraps up with the US jobs report, which remains the best way to see whether growth is slowing or just returning to normal.

This is the kind of week where markets can get shaky even without bad news. Uncertainty alone can cause swings.

What is actually driving prices

Earnings quality beats earnings quantity

Beating estimates isn’t a big win anymore; it’s just the starting point. After some companies sold off even when they did everything right, investors now want to know how today’s spending will lead to future cash flow.

Resilience, not acceleration

The US economy seems stable. Growth around 2% helps earnings, but it doesn’t support higher stock prices. This means investors are focusing more on how each company performs.

Rotation, quietly

Investors are moving money out of big tech stocks and into industrials, energy, healthcare, and some small companies. These changes usually happen quietly, but they become important over time.

Policy as background noise

Infrastructure spending and defence budgets continue to support parts of the real economy. At the same time, politics adds uncertainty without changing near-term cash flows. Markets tend to price that as noise until it is not.

Risks that can no longer be ignored

Politics and global events are still unpredictable, especially for trade and energy. A weaker dollar helps exporters but hurts big international companies. February is also a tough month, so patience often pays off more than quick moves.

The biggest risk is within the market. Expectations for AI are high, and companies are planning significant spending. If they can’t explain how this will pay off, stock prices could fall even if sales keep rising.

Where leadership is shifting

Energy

Strong cash flow and careful spending are drawing investors back to companies like Chevron, especially as oil prices level out.

Healthcare

Healthcare offers both safety and real growth, especially in obesity and diabetes treatments led by Eli Lilly.

Industrials

Machinery and aerospace suppliers are still benefiting from better efficiency, infrastructure projects, and defence spending.

Utilities and staples

When fewer stocks are leading, low-volatility sectors become important again.

Small caps

Recent gains show that investors are testing whether growth can spread beyond the biggest companies.

Institutional behaviour tells the quieter story

Recent fund flows show investors are taking profits in big tech and putting more money into financials, industrials, infrastructure, and commodities. These aren’t panic moves; they’re just shifts in where money is going.

This is how markets usually change late in a cycle. The main index stays strong, but the stocks leading it start to shift.

Ten stocks worth watching this week

Palantir. Guidance will matter more than growth rates.

Disney. Streaming profitability versus park stability.

AMD. AI demand and data centre commentary remain pivotal.

Alphabet. Investors want clarity on AI returns, not ambition.

Uber. A clean read on consumer behaviour in a steady economy.

Amazon. AWS trends now influence the entire tech complex.

Chevron. Energy leadership with balance sheet discipline.

Walmart. A defensive lens on the US consumer.

Eli Lilly. Execution and scale in GLP 1 therapies.

Nvidia. Not reporting, but still the sentiment anchor for AI.

Bottom line

Markets aren’t weak; they’re just more demanding now. With stocks near record highs, investors want clear timelines, not just good stories. This week, pay attention to company guidance, money flows, and what the market quietly rewards instead of what gets the most attention.

That’s usually where you find the real insights.

Disclaimer: This publication is for general information and educational purposes only and should not be taken as investment advice. It does not take into account your individual circumstances or objectives. Nothing here constitutes a recommendation to buy, sell, or hold any investment. Past performance is not a reliable indicator of future results. Always do your own research or consult a qualified financial adviser before making investment decisions. Capital is at risk.

Markets move fast. Savvy investors spot trends early.

Every Monday, get my pre-market cheat sheet:

✅ What’s hot

✅ What’s fading

✅ Where smart money’s flowing

No hype, just data.

👉 Subscribe to stay ahead.