Top US Stocks to Watch for the Week of October 20–26, 2025

Disclaimer: This content is for educational purposes only and does not constitute financial advice. Investing involves risk. Always do your own research or consult a qualified adviser.

A Market That Believes in Itself

Every bull market starts with disbelief and ends with faith.

Right now, the US stock market sits somewhere in between believing enough to push prices higher, doubting enough to stay volatile.

The S&P 500 touched 6,753.76 on October 8, brushing fresh highs. Yet, beneath that headline is a quieter truth: economic growth has slowed from 3.8% annualised in Q2 to what forecasters think will be closer to 1.8–1.9% for the year. It’s a reminder that markets don’t need perfection, just progress that feels slightly better than fear.

Consumer spending is holding up. Corporate profits still look solid. And October, historically a positive month for stocks, tends to deliver modest gains. But optimism now trades at a premium, and any disappointment could cost more than usual.

What’s on the Calendar

Monday, Oct 20

Eyes turn east, toward China’s policy updates and any whispers from the People’s Bank of China. Back home, investors await a core inflation report, which could nudge expectations for the Federal Reserve’s next move.

Tuesday – Thursday (Oct 21–24)

Flash PMIs arrive, showing whether manufacturing and services are expanding or just coasting.

Jobless claims on Thursday test how sturdy the labour market still is.

Fed Governor Michael Barr’s speech could add nuance or confusion to policy expectations.

Earnings Week:

Tesla, Netflix, Intel, Procter & Gamble, Coca-Cola and a few others take the stage. Their numbers will say as much about consumers and AI as they do about the companies themselves.

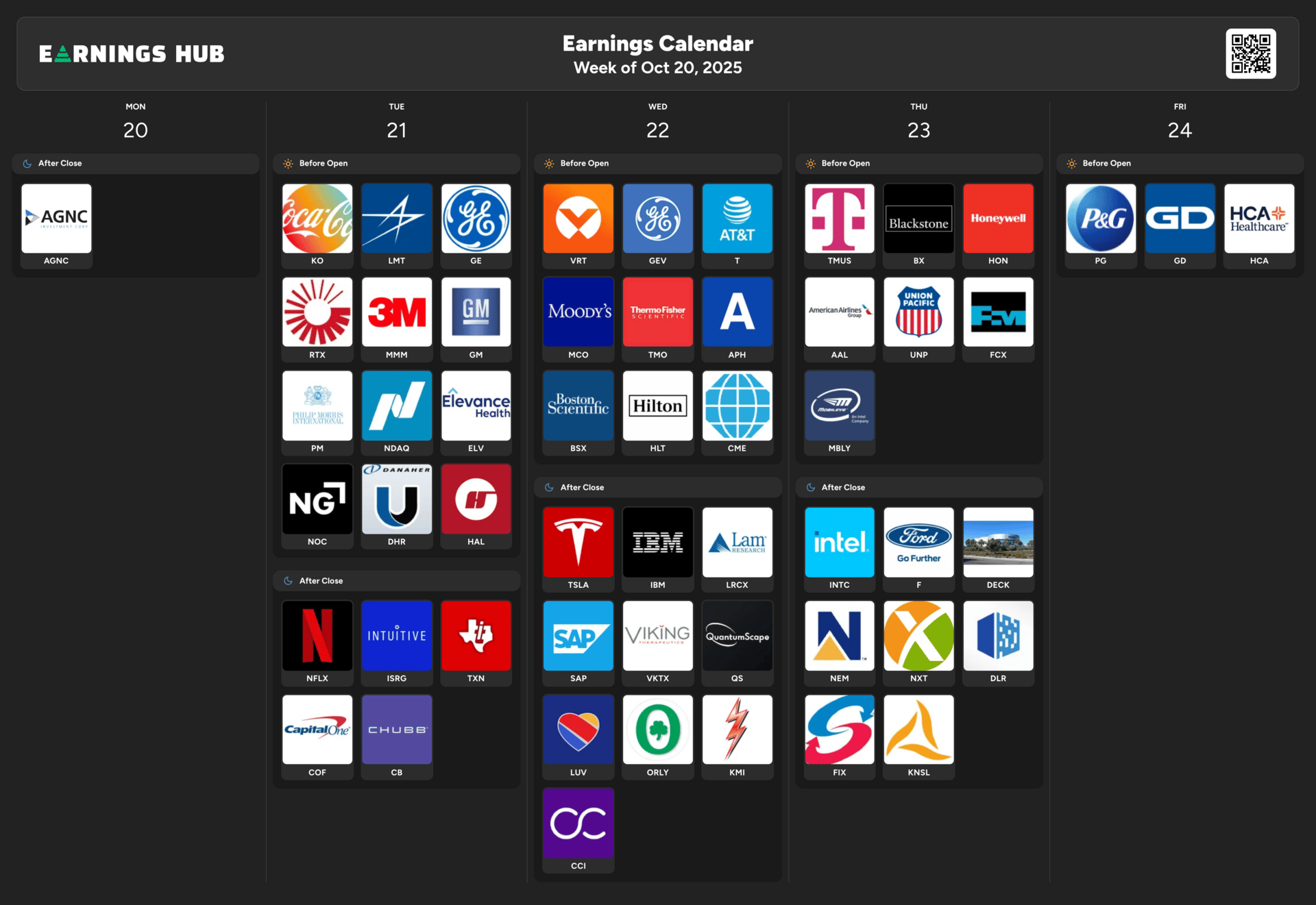

Earnings Calendar for Week of 20 October 2025

What Could Move Markets

The bullish script is familiar but still works.

Earnings strength: If profits beat expectations, the “earnings-led” rally can extend.

Fed tone: Even a whiff of dovishness matters more than a decimal on CPI.

Seasonality: October’s reputation as a mild tailwind helps.

Economic stamina: The US remains the outlier among major economies, slower, yes, but not stalling.

Where It Can Go Wrong

Markets are a confidence game that occasionally reminds you it’s a game.

Here’s where that reminder might come from:

Sticky inflation: Keeps the Fed from cutting and bonds from cheering.

High valuations: When optimism is expensive, reality gets priced as risk.

China tensions: Trade headlines are the ghosts that refuse to stay buried.

Debt stress: Credit-card balances are up, and delinquencies are whispering louder.

Growth fatigue: The second half of the year could look less like momentum, more like digestion.

Sectors That Matter

Technology & Semiconductors

AI remains the market’s obsession and justification. Nvidia, AMD, Broadcom, and Intel still define whether this boom is substance or story.

Healthcare

The sector is doing quiet, boring work that matters. Johnson & Johnson and biotech names mix defensiveness with innovation.

Industrials & Energy

GE Aerospace and peers benefit from an industrial comeback tied to global travel and infrastructure demand.

Consumer Discretionary

Spending is strong, but the cracks are showing. Watch Procter & Gamble and major retailers for early signs of strain.

Commodities & Mining

Inflation, electrification, and resource security keep this space relevant even if it rarely makes headlines.

Stocks to Keep an Eye On

Ticker | Company | Why It Matters |

|---|---|---|

Tesla Inc. | Q3 results, Cybertruck rollout, and China demand. | |

Netflix Inc. | Subscriber growth and pricing strategy. | |

Intel Corp. | Foundry updates and AI roadmap credibility. | |

Alphabet Inc. | Cloud growth vs. ad spend softness. | |

Broadcom Inc. | Semiconductor margins and AI infrastructure sales. | |

Johnson & Johnson | Earnings mix and pharma pipeline updates. | |

General Electric Co. | Aerospace backlog, industrial margins, and spin-off clarity. |

Reading Between the Headlines

Earnings season isn’t just numbers; it’s a mood board.

A company “beats expectations” not because it sold more widgets, but because it sold slightly more than people feared it wouldn’t.

Markets trade on these tiny emotional victories.

Tesla’s delivery count tells a story about ambition meeting scale. Netflix’s churn tells us what boredom costs. Intel’s margins show how long it takes to rebuild relevance. These aren’t data points, they’re stories with balance sheets attached.

The Bigger Picture

The US market in late 2025 is less about where things stand and more about what investors believe will last. AI is still the shiny new promise. Consumer resilience is the quiet, enduring one. Inflation is the uninvited guest who hasn’t quite left.

It’s not a crisis. It’s a test of conviction.

The difference between confidence and complacency is usually just one bad earnings call.

Bull Case:

Earnings keep surprising, inflation softens, and the S&P 500 pushes beyond 6,800.

Base Case:

Range-bound between 6,600–6,750 optimism and caution in a draw.

Bear Case:

Disappointing inflation or weak guidance drags the index back toward 6,450.

Final Thought

Every earnings season feels like an exam. The grades come in numbers, but the lessons come in tone.

The week ahead isn’t about predicting who passes; it’s about understanding how markets react when confidence gets marked to reality.

Disclaimer: This publication is for general information and educational purposes only and should not be taken as investment advice. It does not take into account your individual circumstances or objectives. Nothing here constitutes a recommendation to buy, sell, or hold any investment. Past performance is not a reliable indicator of future results. Always do your own research or consult a qualified financial adviser before making investment decisions. Capital is at risk.

Markets move fast. Savvy investors spot trends early.

Every Monday, get my pre-market cheat sheet:

✅ What’s hot

✅ What’s fading

✅ Where smart money’s flowing

No hype, just data.

👉 Subscribe to stay ahead.