The Mood on Wall Street

The Federal Reserve finally gave markets what they’ve been hinting at all summer: a rate cut. Not a dramatic one, just 25 basis points, but enough to remind everyone that the Fed still has levers to pull. The federal funds rate now sits at 4.00%–4.25%, the lowest since early 2023.

Traders celebrated. The S&P 500 closed at 6,664.36, its 27th record high of the year. The Dow gained 0.37%, the Nasdaq added 0.72%, and both logged their third straight week of gains. Mega-cap tech carried the party as usual — but beneath the surface, other sectors started to stir.

The optimism rests on a simple equation: growth is rebounding, inflation is cooling, and money just got cheaper. Q2 GDP was revised up to 3.3% annualised, a sharp rebound from Q1’s stumble. Year-to-date, the S&P is up 13.3%, with tech soaring more than 20%. Even utilities — usually the market’s sleepy corner — are holding firm as investors hedge their bets.

Of course, markets don’t climb in straight lines. Technical analysts flagged September 21 and 24 as possible reversal dates. Whether you believe in charts or not, they serve as a reminder: euphoria has a habit of tripping over reality.

The Calendar That Matters

The week ahead isn’t just about vibes — it’s packed with data:

Monday (Sept 22): Chicago Fed Activity Index; Public Policy Survey.

Tuesday (Sept 23): PMIs and Existing Home Sales — a snapshot of economic resilience.

Wednesday (Sept 24): New Home Sales — still one of the most rate-sensitive data points.

Thursday (Sept 25): Durable Goods Orders, Jobless Claims, and final Q2 GDP revision.

Friday (Sept 26): Core PCE Inflation — the Fed’s favourite number, and the week’s biggest potential curveball.

Fed officials will also be on stage throughout the week, and markets will parse every word.

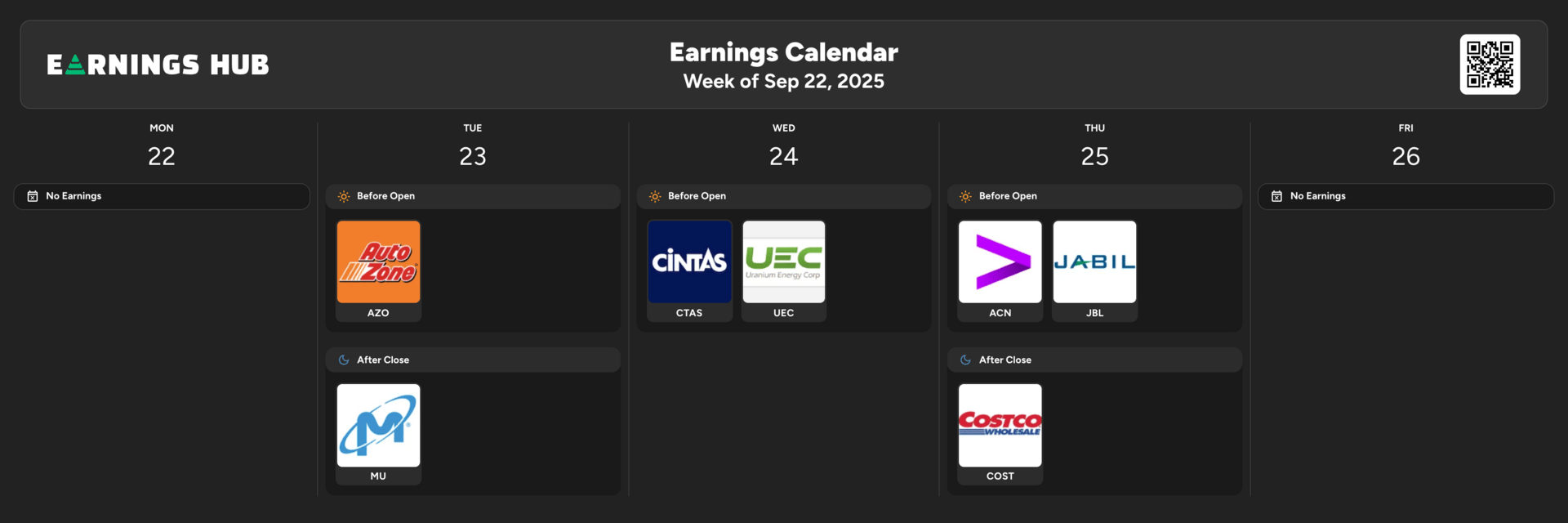

Earnings Calendar - Week of 22 September 2025

Where the Action Is

Technology – The engine of 2025’s rally. Microsoft (+20.2% YTD) and Meta (+26.2%) remain benchmarks for AI-driven growth.

Financials & Communication Services – Lower rates help borrowing and boost ad spending.

Utilities – The unglamorous winner, quietly attracting defensive capital.

Consumer Discretionary & Industrials – Stand to gain if growth momentum holds.

Energy & Health Care – Acting as stabilisers in case volatility returns.

Biotech & Renewables – Insider buying hints at long-term bets being placed.

The Stocks to Watch

Micron $MU ( ▼ 0.86% ): Reports Monday. AI chip demand is hot; guidance will show if supply can keep up.

AutoZone $AZO ( ▲ 0.02% ): Tuesday. A surprisingly good lens on consumer spending — are people maintaining old cars instead of buying new ones?

Cintas $CTAS ( ▲ 0.79% ): Wednesday. Uniforms as an economic barometer: more jobs mean more uniforms.

Accenture $ACN ( ▼ 3.87% ): Thursday. If companies continue to spend on IT consultants, the enterprise story remains intact.

Jabil $JBL ( ▲ 0.73% ): Thursday. Behind-the-scenes tech manufacturing; their supply-chain commentary often ripples across sectors.

Costco $COST ( ▼ 0.83% ): Friday. Memberships and shopping baskets tell you more about consumer health than surveys ever could.

Theravance $TBPH ( ▲ 1.36% ): Healthcare name in focus, especially with rotations into defensive plays.

Other tickers worth keeping an eye on:

Nvidia $NVDA ( ▼ 0.04% ): Still the heartbeat of the AI trade.

Amazon $AMZN ( ▲ 0.03% ): Straddling consumer strength and cloud growth.

Intel $INTC ( ▼ 1.85% ): Got a shot of adrenaline after Nvidia revealed a $5B stake.

The Bigger Picture

The Fed cut was a green light. The market heard: “Cheaper money, stronger growth, inflation under control.” That’s the recipe for new highs. But the most important number of the week comes on Friday morning with Core PCE inflation. If it runs hotter than expected, the story changes fast.

Right now, the narrative is bullish, but stretched valuations leave no margin for error. Markets have priced in smooth sailing. The question is whether the economy and the Fed can deliver it.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always conduct your own research or speak to a qualified professional before investing.

Markets move fast. Savvy investors spot trends early.

Every Monday, get my pre-market cheat sheet:

✅ What’s hot

✅ What’s fading

✅ Where smart money’s flowing

No hype—just data.

👉 Subscribe to stay ahead.