When investing, your capital is at risk. The value of investments can go down as well as up, and you may get back less than you put in. The content of this article is for information purposes only and does not constitute personal advice or a financial promotion.

Quick summary for investors

What’s happening

Tower is seeing growth because AI needs more bandwidth, not more computing power.

Why it matters

AI growth now relies on better optics, radio frequency technology, and power efficiency.

What headlines miss

Timelines for qualifying products and how much they are used are more important than big announcements.

Key risk

Tower is expanding before demand fully arrives, and its stock price does not allow for much delay.

Investor lens

Tower is in a good spot as an infrastructure provider, but its stock price assumes everything goes as planned.

Executive summary

In every market cycle, the popular investments get crowded, and the more interesting opportunities become less noticed.

AI has reached that point.

Compute was the first act. GPUs got faster, racks got denser, and capital flowed accordingly. Now the constraint is less glamorous and more mechanical: how data moves between those chips without burning power or time. That problem lives in optics, RF, and power management.

This is where Tower Semiconductor operates.

There is a real opportunity here, but also a real risk. Tower’s stock price already expects that the needed infrastructure will be built on time.

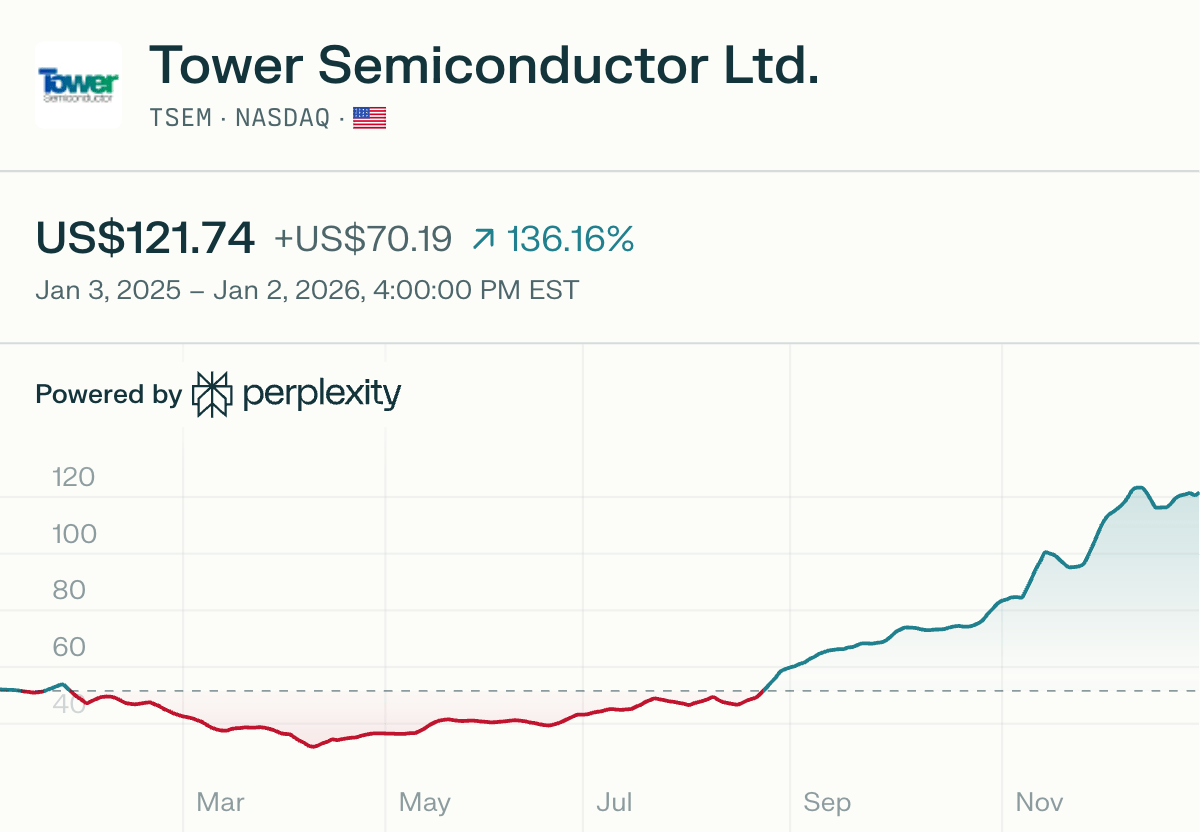

$TSEM ( ▼ 1.94% ) stock price growth from January 3 2025

What Tower is, and what it deliberately is not

$TSEM ( ▼ 1.94% ) is a speciality analogue and mixed-signal foundry. It does not chase the smallest digital nodes or compete head-on with $TSM ( ▼ 0.52% ). Instead, it focuses on process platforms that tend to last longer, change more slowly, and stick once designed in.

Those platforms include silicon photonics, RF infrastructure, power management, and sensors. They show up in data centres, industrial systems, automotive electronics, medical devices, and defence hardware.

Put simply, Tower does not make the main processors for AI. It makes the parts that connect everything.

Why this matters now

AI data centres are learning a common lesson: when one part of a system improves quickly, another often becomes the new bottleneck.

GPUs have outpaced networking.

At the scale of AI, moving data with wires over short distances is becoming less efficient. Optical connections and, soon, co-packaged optics help solve this. They make data travel shorter, use less power, and allow for more bandwidth.

Tower is already manufacturing into that problem set.

Recent results show this trend. In Q3 2025, revenue was about $396 million. For Q4, the company expects around $440 million, give or take 5 percent. Management says this growth comes from demand for data centre infrastructure and new platforms, not from consumer products.

This is not just a hopeful projection. Real demand is already showing up sooner than expected.

The real question the stock is asking you

The market is not debating whether silicon photonics matters. It is debating timing and discipline.

Three questions matter more than all the rest.

First, can Tower grow silicon photonics, RF, and power fast enough to offset softer areas like automotive when inventory cycles turn?

Second, will increasing production by 300mm improve profits, or will it lead to the classic problem of factories not being used enough?

Third, is Tower turning into a reliable speciality company, or is it still mainly driven by how much its factories are used, just with an AI label?

At its current price, the stock reflects a more positive outlook.

What Tower is doing right

Tower provides bandwidth solutions without trying to make the most advanced chips.

Tower’s role in AI is indirect but useful. Its silicon photonics and radio frequency parts are essential for bandwidth growth. They gain from AI expansion without needing to spend heavily on the latest chip technology.

Tower is increasing its production capacity without building huge, expensive new factories.

Rather than spending billions on brand-new factories, Tower uses a corridor strategy. In New Mexico, $INTC ( ▼ 1.85% ) runs the factory while Tower supplies the equipment. In other places, Tower upgrades and expands existing factories.

The goal is to use money efficiently. The real test is whether these upgraded factories are fully utilised.

Tower continues to improve in areas where ongoing progress is important.

In analogue and power technology, expertise builds up slowly and steadily. Tower’s regular updates to its 300mm power and BCD platforms strengthen its position in areas where experience matters more than the number of transistors.

Catalysts that actually move the story

In the next year to year and a half, a few key factors will be more important than any press release.

Silicon photonics and optical interconnect ramps that translate into shipped volume

Evidence that utilisation improves as speciality platforms scale

Clear movement in the New Mexico corridor from equipment installation to qualified production

None of these developments is flashy, but they all affect profit margins.

Risks that end the conversation early

Tower still operates in the real world of factories and business cycles.

If infrastructure spending slows, factory use can drop. Delays in getting new capacity ready can delay profits by months or years. Spending on expansion can get ahead of revenue. Also, geopolitical risk is real since some operations are in Israel.

The stock price does not need a disaster to fall. It just needs growth to be slower than expected.

Bull, base, and bear cases anchored to $121.74

These are possible scenarios, not guarantees.

Base case: $140 (+15%)

Growth keeps going through 2026. Demand for infrastructure makes up for weaker auto markets. Factory use improves slowly, and profit margins rise, though not quickly.

Bull case: $164 (+35%)

Silicon photonics grows faster than expected. Co-packaged optics is starting to make money instead of just being a plan. The upgraded factories are fully used. The market starts to see Tower as essential infrastructure, not just a cyclical company.

Bear case: $91 (-25%)

Growth slows down. Costs go up before revenue does. Factory use is lower than hoped. The stock price drops faster than the business can recover.

How investors tend to frame it

Buy if you believe optical interconnect demand scales smoothly and Tower executes without drama.

Hold if you want exposure but need confirmation that ramps persist and margins follow.

Avoid if you expect a broad analogue slowdown or think expansion spending caps returns.

These choices are not about right or wrong. They are about timing.

A quick checklist for busy investors

Is the company meeting its quarterly targets, and does management keep focusing on real infrastructure demand instead of just optimism?

Is silicon photonics actually making up more of the company’s revenue, or is it just being talked about?

Are the corridor and expansion projects moving from just being installed to being fully approved and running?

Are profit margins improving as factory use goes up, or are they staying the same?

Disclaimer: This publication is for general information and educational purposes only and should not be taken as investment advice. It does not take into account your individual circumstances or objectives. Nothing here constitutes a recommendation to buy, sell, or hold any investment. Past performance is not a reliable indicator of future results. Always do your own research or consult a qualified financial adviser before making investment decisions. Capital is at risk.

Markets move fast. Savvy investors spot trends early.

Every Monday, get my pre-market cheat sheet:

✅ What’s hot

✅ What’s fading

✅ Where smart money’s flowing

No hype, just data.

👉 Subscribe to stay ahead.