Market Snapshot

The US stock market began August on a weaker note. On August 1, the S&P 500 closed down 1.6% at 6,238 points following a soft July jobs report and the start of new tariffs.

The US added 73,000 jobs in July, compared with expectations of 102,000.

Job counts for May and June were revised down by a combined 258,000.

The unemployment rate rose to 4.2%.

At the same time, new tariffs took effect, including a 35% tax on Canadian goods and a 50% tariff on copper imports. These measures are expected to raise costs for several industries.

Despite these developments, the S&P 500 remains up 5.5% for the year to date. Sectors showing gains include Communication Services (+12.1%), Industrials (+12.0%), and Technology (+8.9%). According to futures pricing, markets now assign an 84% probability of a Federal Reserve rate cut in September, up from 39% before the jobs report.

Key Dates This Month

August 4 – Palantir (PLTR) reports earnings after more than doubling this year.

August 12 – Deadline for the latest round of US–China trade talks.

August 21–23 – The Fed’s Jackson Hole meeting, where markets will look for clues on September’s policy decision.

August 27 – NVIDIA (NVDA) releases earnings, a major event for tech and AI investors.

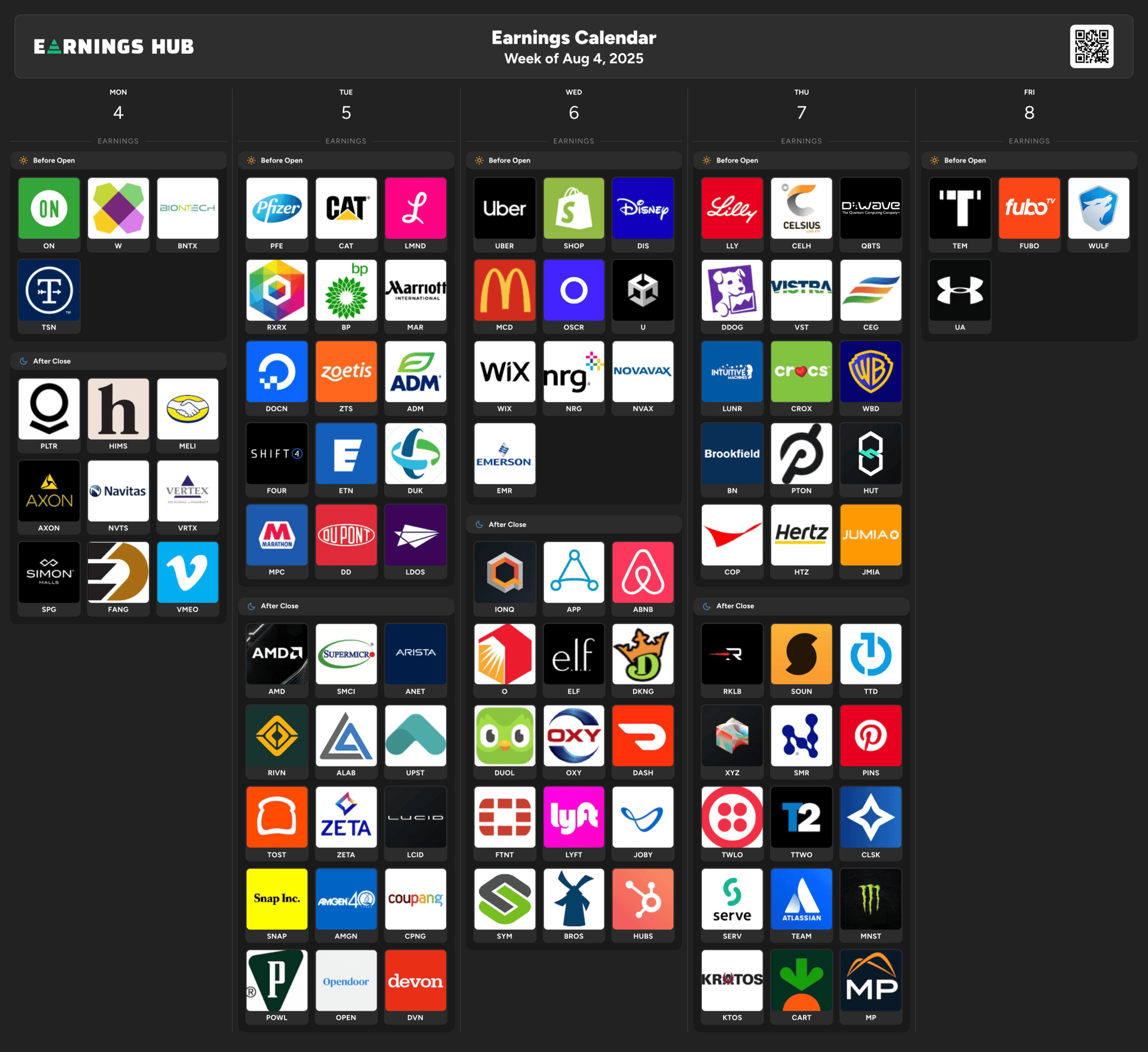

Earnings for week August 4-8 2025

Sector Watch

Technology – Still leading the market, with strong demand for AI, semiconductors, and cloud services. In June alone, the sector rose nearly 10%.

Healthcare – Picking up speed thanks to telehealth and new treatment areas. Hims & Hers is up around 166% so far in 2025.

Financials – Goldman Sachs has climbed 44% over the past year, driven by wealth management and IPO activity; however, tariffs and potential rate cuts could weigh on margins.

Consumer Staples – Often a safer bet during market uncertainty. Campbell Soup is trading at a significant discount to its estimated fair value.

Industrials – Backed by US infrastructure spending and manufacturing growth, but facing higher costs from steel and copper tariffs.

Companies in Focus

Palantir $PLTR ( ▼ 0.36% )

Up 105% this year. Its Q2 earnings on August 4 could be a key test for its strong momentum.NVIDIA $NVDA ( ▼ 0.04% )

A central player in AI and chips. Earnings on August 27 will be closely watched.Hims & Hers $HIMS ( ▼ 0.13% )

Up about 166% this year after Q1 revenue jumped 111%. Expanding into new healthcare services.Campbell Soup $CPB ( ▼ 2.07% )

Trading nearly 50% below fair value estimates. Seen as a defensive stock in uncertain times.Goldman Sachs $GS ( ▼ 1.83% )

44% gain over the past 12 months, supported by steady IPO and wealth management business.

Closing Thoughts

The first whole week of August brings plenty for markets to digest: a weaker jobs picture, new tariffs, and a busy earnings calendar. Palantir’s report, NVIDIA’s upcoming results, and the Jackson Hole meeting later this month are all in the spotlight. While uncertainty is high, sector trends in technology, healthcare, and consumer staples are worth following as the month unfolds.

Disclaimer: This article is for information only and should not be taken as investment advice. Past performance is not a guide to future results.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always conduct your own research or speak to a qualified professional before investing.

Markets move fast. Savvy investors spot trends early.

Every Monday, get my pre-market cheat sheet:

✅ What’s hot

✅ What’s fading

✅ Where smart money’s flowing

No hype—just data.

👉 Subscribe to stay ahead.