When investing, your capital is at risk. The value of investments can go down as well as up, and you may get back less than you put in. The content of this article is for information purposes only and does not constitute personal advice or a financial promotion.

TL;DR: 9–5 Investor Summary

What’s happening: Major US indices closed lower for the week, with the Nasdaq down 2.1% and defensives sharply higher.

Why it matters: Leadership rotated away from mega-cap tech despite softer inflation and lower yields.

What the market is missing: This was more rotation than collapse. Utilities surged while growth paused.

Key risk to watch: Whether AI capex concerns spread further into earnings guidance.

Investor lens: Watch sector leadership and breadth, not index headlines.

The Week in One Paragraph

U.S. stocks logged their weakest week of 2026 so far. The S&P 500 fell 1.4% to 6,836. The Dow Jones Industrial Average dropped 1.2% to 49,501. The Nasdaq Composite slid 2.1%, extending its recent soft patch. Inflation helped rather than hurt: January CPI came in at 2.4% year on year, and the 10-year Treasury yield eased toward 4.05%. Yet equities still finished lower.

That combination tells you this was not about rates alone. It was about positioning. Investors rotated out of the crowded AI and mega-cap trade and into sectors that look steadier when growth questions creep in.

What Actually Moved the Market

The headline was red. The story underneath was defensive leadership.

Utilities climbed roughly 7% on the week and reached record levels. Real estate and consumer staples also outperformed. Financials and information technology lagged, with financials down close to 5% and tech off around 2%.

That divergence is striking. When utilities outperform tech by this margin in a single week, the market is not panicking. It is reallocating.

Lower long-term yields reinforced the move. A softer CPI print reduced immediate inflation pressure and nudged Treasury yields lower. That tends to benefit dividend-heavy, bond-sensitive sectors. The math checks out.

But yields falling did not rescue growth stocks. Instead, investors used the macro relief to reduce exposure to names that had led much of 2025.

The AI Repricing, Not the AI Collapse

The week’s volatility clustered around companies tied to AI spending and infrastructure. Heavy 2026 capital expenditure guidance from hyperscalers sharpened questions about near-term margins. Earnings reactions in parts of software and networking added fuel.

It is tempting to frame that as “AI enthusiasm fading.” The data does not support that conclusion. What changed was not the long-term adoption curve. What changed was tolerance for short-term uncertainty.

Markets are comfortable with big spending when returns feel immediate. They grow cautious when the payoff stretches further into the future. That tension defined the tape.

Three Highlights That Matter

1. Defensives dramatically outperformed growth

Utilities gaining about 7% in a single week, while tech declined, is not background noise. It signals that investors are adjusting their expectations for growth momentum, even as the broader economic data remains stable.

2. Lower yields did not translate into higher equities

The 10-year yield drifting toward 4.05% would normally provide a valuation cushion. This time, it supported sector rotation instead of lifting indices. Positioning overrode textbook rate logic.

3. Breadth weakened

While Friday saw a bounce in pockets of cyclicals and tech, the broader weekly pattern showed narrow strength concentrated in defensive sectors. That is a shift from the narrow mega-cap leadership that defined much of last year.

What Was Likely Overstated

“AI is over.”

Nothing in this week’s data invalidates multi-year infrastructure build-outs. Capital intensity is rising. That was known.

“Utilities at highs mean recession.”

Utilities benefit mechanically from falling yields and systematic flows into low-volatility assets. A strong week does not equate to a macro collapse.

“Financials down equals systemic stress.”

The move appeared tied to earnings mix and margin sensitivity rather than balance-sheet instability.

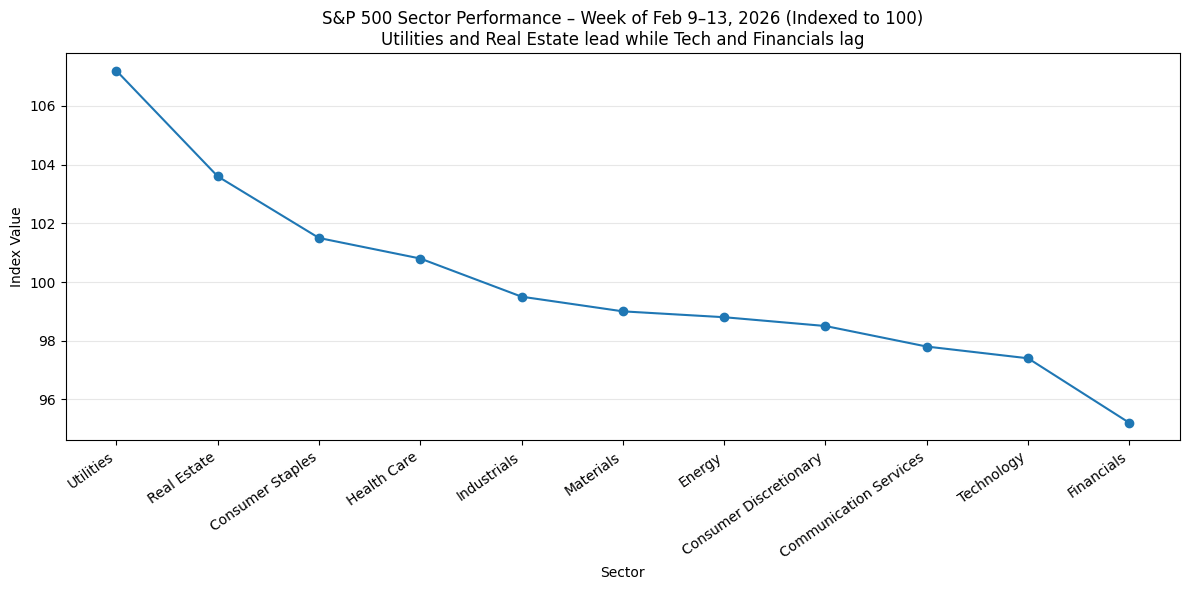

One Chart Worth Seeing

This simple line chart of weekly S&P sector performance tells the story faster than any commentary: utilities at the top, real estate and staples positive, financials and tech clearly negative.

When leadership changes abruptly, it often marks a pause in one narrative rather than its end.

Utilities screaming higher, real estate grinding up, and tech/financials rolling over below the line.

Looking Ahead

U.S. markets close Monday for Presidents’ Day. The rest of the week brings housing data, regional manufacturing surveys, jobless claims, and FOMC minutes. None individually defines the year, but collectively they shape rate expectations.

More important will be earnings commentary from AI-exposed companies. The market is now more sensitive to the timing of returns, not just the magnitude of spending.

For busy investors, the key observation is simple: indices fell modestly, but sector dispersion was significant. The surface looked calm—the currents underneath shifted direction.

Disclaimer: This publication is for general information and educational purposes only and should not be taken as investment advice. It does not take into account your individual circumstances or objectives. Nothing here constitutes a recommendation to buy, sell, or hold any investment. Past performance is not a reliable indicator of future results. Always do your own research or consult a qualified financial adviser before making investment decisions. Capital is at risk.