Good morning, investors ☀️

This week feels less about where the market is and more about who is actually doing the work underneath it.

After January’s choppy finish and a quiet push to new highs in the Dow, leadership is shifting again. Mega-cap tech is no longer carrying the tape on its own. Cyclicals, healthcare, financials, and smaller names are starting to matter, even if they are not grabbing headlines.

That shift gets tested immediately.

We have delayed jobs data landing midweek, CPI on Friday, and a steady run of earnings from companies that sit closer to the real economy than the AI hype cycle. This is the kind of week where markets stop trading narratives and start trading numbers.

Below, I break down what matters, which stocks are in focus, and where institutional positioning suggests the next moves may come from.

Read more → 6 mins read

The Fear and Greed Index

Quick Poll 🗳️

Would you like an extra Weekend Market Recap edition?

This week’s partner is worth a look

Investor-ready updates, by voice

High-stakes communications need precision. Wispr Flow turns speech into polished, publishable writing you can paste into investor updates, earnings notes, board recaps, and executive summaries. Speak constraints, numbers, and context and Flow will remove filler, fix punctuation, format lists, and preserve tone so your messages are clear and confident. Use saved templates for recurring financial formats and create consistent reports with less editing. Works across Mac, Windows, and iPhone. Try Wispr Flow for finance.

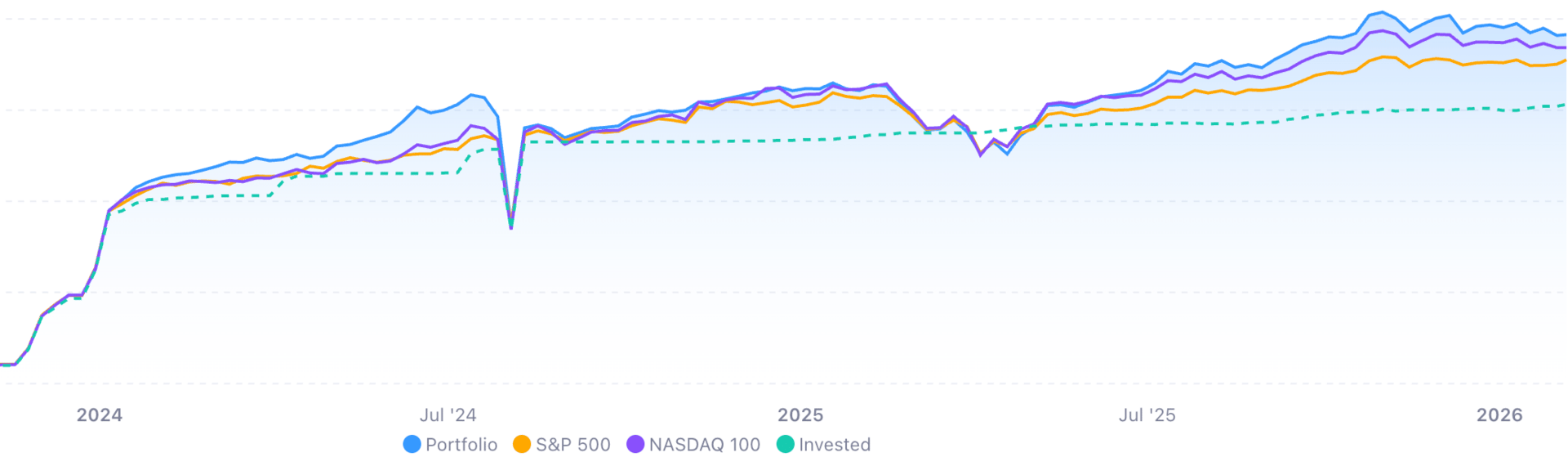

My Portfolio Performance 🔍

All-time Portfolio Performance (ISA+SIPP)

All-time | Year-to-date | |

|---|---|---|

Total Profit | 39.15% | 3.3% |

vs S&P 500 | 7.82% | 3.81% |

vs NASDAQ 100 | 3.85% | 1.56% |

Must Reads 📌

Top US Stocks to Watch This Week: February 9–13, 2026

A heavy week of macro data and earnings is reshaping market leadership, as investors look beyond Big Tech toward breadth, cash flows, and pricing power.🔗 Portfolio Parrot ↗

Weekend Market Recap: Dow Hits 50,000 as AI Panic Turns to Relief Rally

A volatile week saw AI capex fears hit tech, cyclicals quietly lead, and the Dow break 50,000 as investors rotated rather than retreated.🔗 Portfolio Parrot ↗

Stock Market Week: Mapping Out A Deeply Divided Rally

The Dow punched above 50,000, the Nasdaq broke technical support, leaving the stock market split heading into a busy week of news and events.

🔗 IBD ↗

23 Stocks to Watch 💸

These stocks are ranked based on weekly data trends, company fundamentals, and market insights.

Stock Power Watchlist for Week of 9 February 2026

The chart shows what changed. The breakdown explains why.

Paid subscribers can see the exact stocks I’m currently considering adding to my own portfolio.

What I’m Looking at This Week 👀

Stocks moving from watchlist to potential buys.

Each week, some stocks move from “interesting” to serious consideration.

In this section, I share what I’m personally looking to buy, why it’s on my radar, and what could still stop me from acting.

This isn’t a tip or recommendation — it’s a transparent look at how I think about allocating my own capital.

Included with the Paid Subscription 🔒

See the exact stocks before they become portfolio decisions.

Inside this week:

AI infrastructure name near support

██████████ signal

One wildcard outside semis

How was today’s newsletter?

NOT FINANCIAL ADVICE.

🔴 Risk Notice: This content summarizes publicly reported data. It is not advice. Consult a qualified advisor before investing.

This content is for informational purposes only and does not constitute financial advice. All investments carry risks. Past performance is not indicative of future results.