Today, we're diving deep into one of the most exciting companies in the semiconductor world: Taiwan Semiconductor Manufacturing Company, or TSMC for short. If you're looking to ride the AI wave and capitalize on the next big tech revolution, TSMC should be on your radar. Let's break down why this chip giant is poised for massive growth in 2025 and beyond.

The AI Powerhouse You've Never Heard Of

First things first: TSMC might not be a household name like Apple or NVIDIA, but it's the secret sauce behind their success. This Taiwanese company manufactures the most advanced chips on the planet, powering everything from the latest iPhones to cutting-edge AI accelerators. And let me tell you, business is booming! 📈

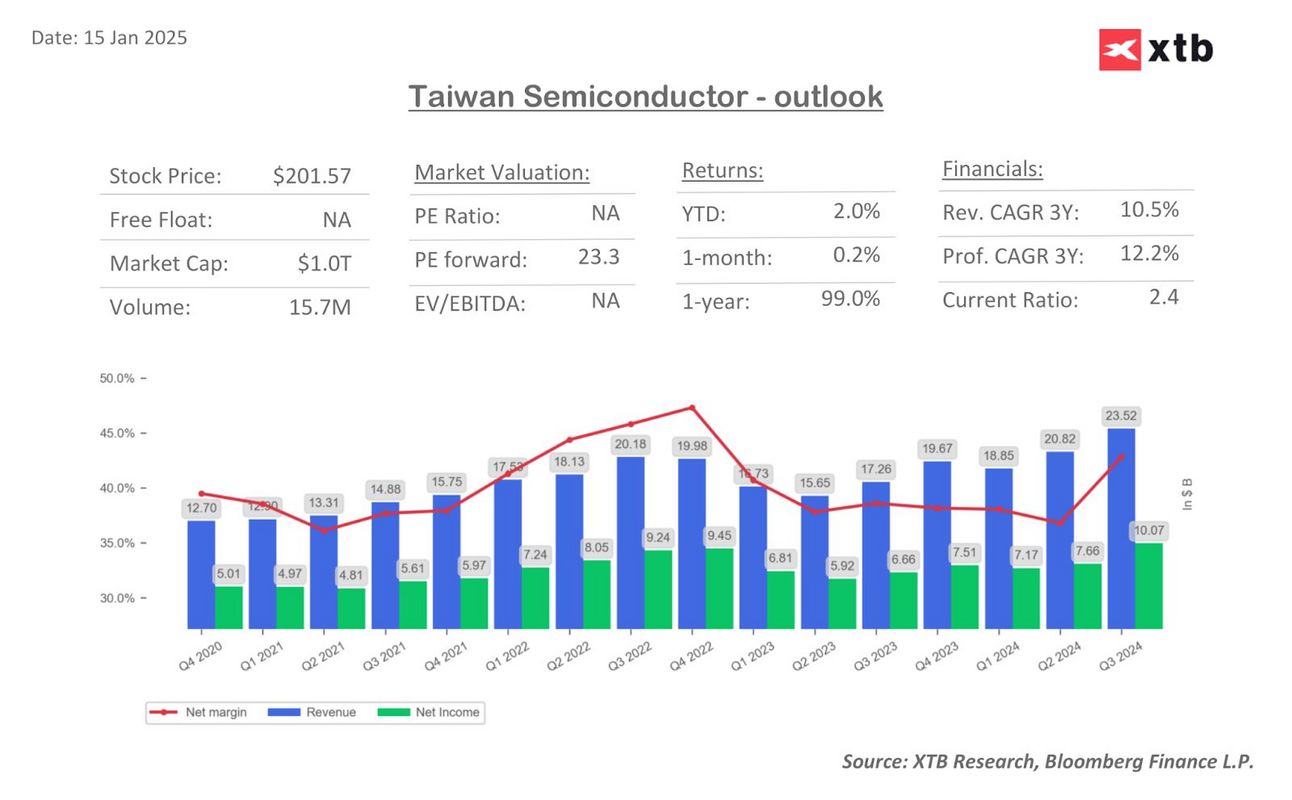

In 2024, TSMC's sales hit a whopping $87.58 billion, up 33.9% from the previous year.

They're forecasting 24-26% growth for 2025. That's insane when you consider the broader chip industry is only expected to grow by 10%.

Why Is TSMC Crushing It? Two Words: Artificial Intelligence

The demand for AI chips is through the roof, and TSMC is the go-to manufacturer for tech giants like NVIDIA, AMD, and Google. We're talking about the chips that power ChatGPT, self-driving cars, and next-gen data centers. TSMC has a mind-blowing 90% market share in AI accelerator production. 🤖

Here's the kicker: TSMC expects its AI-related revenue to double in 2025 and grow at a 45% compound annual growth rate through 2029. That's not just growth; that's hypergrowth!

Investing in the Future: TSMC's Smart Moves

TSMC isn't resting on its laurels. They're pouring billions into staying ahead of the competition:

U.S. Expansion: A massive $165 billion investment in U.S. manufacturing facilities. This move reduces geopolitical risks and strengthens ties with American tech giants.

Cutting-Edge Tech: The launch of 2nm chips in late 2025 will cement TSMC's technological lead for years to come.

Advanced Packaging: TSMC is investing heavily in technologies like Chip-on-Wafer-on-Substrate (CoWoS), which are crucial for next-gen AI chips.

The Cherry on Top: An Attractive Valuation

Here's where it gets really interesting for investors. Despite its dominant position and stellar growth prospects, TSMC is trading at a discount compared to its peers:

TSMC's forward P/E ratio: 18x

NVIDIA's forward P/E ratio: 25x

AMD's forward P/E ratio: 22x

This valuation gap exists mainly due to geopolitical concerns surrounding Taiwan. But as TSMC ramps up its U.S. production, this discount could disappear quickly.

What Could Go Wrong?

No investment is without risks, and TSMC is no exception. Here are the main things to watch out for:

Escalating tensions between China and Taiwan

Potential delays or cost overruns in U.S. expansion plans

Competition from Samsung and Intel (though they're still years behind technologically)

The Bottom Line: TSMC Is a High-Conviction AI Play

If you're looking to invest in the AI revolution, TSMC offers a unique combination of:

Market dominance

Technological leadership

Strong financials

Attractive valuation

Analysts are projecting price targets as high as $255 per share, with consensus estimates around $210 (about 6% upside from current levels). But given the explosive growth in AI, these targets could prove conservative.

My take? TSMC is a strong buy for long-term investors. Consider accumulating shares on any pullbacks, aiming for a $250-$275 price range by late 2025 as those juicy AI earnings start rolling in.

Disclaimer: This post is for informational purposes only and should not be considered financial advice. Always do your own research before making investment decisions.

📈 Want to stay ahead of the market?

Subscribe to my free weekly newsletter, where I break down institutional investing trends, stock picks, and wealth-building strategies for 9-5 investors!