When investing, your capital is at risk. The value of investments can go down as well as up, and you may get back less than you put in. The content of this article is for information purposes only and does not constitute personal advice or a financial promotion.

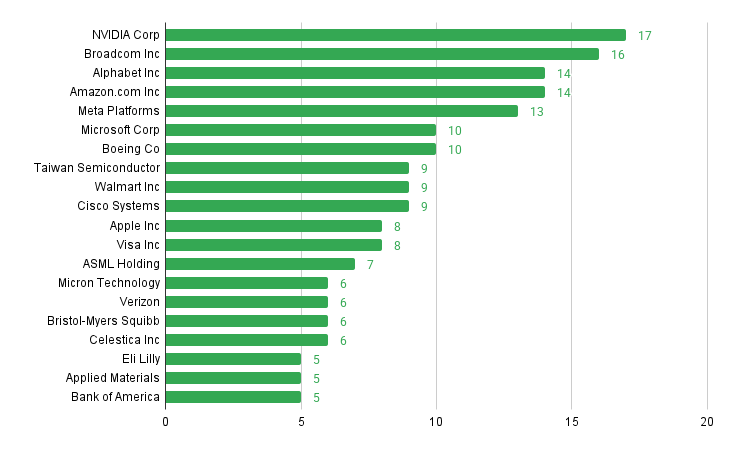

20 Stocks to Watch 💸

The 20 highest-scoring names based on our model.

Weekly Stock Power Watchlist for 23 February 2026

20. Bank of America ($BAC)

Bank of America Corporation offers geared exposure to U.S. interest‑rate and lending trends, with analysts generally modelling steady EPS and dividend growth into 2027, but earnings remain cyclical and sensitive to the rate path and credit quality.

19. Applied Materials ($AMAT)

Applied Materials, Inc. continues to benefit from strong AI and memory wafer‑fab capex, and independent forecasts still point to healthy multi‑year revenue and earnings growth into 2027, though any slowdown in semiconductor investment would likely weigh on both results and valuation.

18. Eli Lilly ($LLY)

Eli Lilly and Company reported Q4 2025 revenue of $19.3B, up 43% year‑on‑year, with non‑GAAP EPS of $7.54 (42% growth) driven mainly by Mounjaro and Zepbound obesity and diabetes treatments, and guides for further strong 2026 sales despite pricing headwinds, but this rapid growth is already reflected in a premium valuation.

17. Celestica Inc ($CLS)

Celestica Inc has been a notable 2025 winner from AI and data‑centre hardware demand, with revenue and margin expansion leading to large share‑price gains; investors now face a more fully valued stock where future returns depend on sustained AI‑related orders.

16. Bristol‑Myers Squibb ($BMY)

Bristol‑Myers Squibb Company is typically owned for income and defensive healthcare exposure, with consensus modelling modest earnings progression as it manages patent expiries and launches, so expectations should centre on stability rather than high growth.

15. Verizon Communications ($VZ)

Verizon Communications Inc offers a high dividend yield supported by telecom cash flows and incremental 5G monetisation, but forecasts generally show limited growth, so it better suits income‑seeking investors willing to accept regulatory and competitive risks.

14. Micron Technology ($MU)

Micron Technology, Inc. stock more than tripled in 2025, up over 240% on AI‑memory optimism, with recent commentary highlighting record revenue, 66% margins in its cloud memory business and sold‑out HBM capacity through 2026, yet analysts still flag near‑term volatility and the industry’s historical cyclicality.

13. ASML Holding ($ASML)

ASML Holding N.V. expects EUV sales to rise about 30% in 2025 on AI and memory demand and sees 2026 net sales at or above 2025 levels despite weaker China, with long‑term plans targeting €44–60B revenue by 2030; however, 2026 valuation debates (forward P/E high‑20s to high‑30s) reflect uncertainty around AI adoption and geopolitics.

12. Visa Inc ($V)

Visa Inc has 2026 forecasts targeting roughly $395 per share, built on revenue estimates around $45B and EPS near $13, but these projections and its mid‑20s–30x P/E depend on resilient global spending and limited regulatory disruption.

11. Apple Inc ($AAPL)

Apple Inc’s strong 2025 results, including better‑than‑expected Q3 and Q4 demand for iPhone 17 and services, support mid‑single‑digit revenue growth assumptions, but regulation and maturing hardware cycles cap long‑term growth in many models.

10. Cisco Systems ($CSCO)

Cisco Systems, Inc. delivers defensive tech exposure through networking and security, with most forecasts now assuming low‑single‑digit revenue growth and a sustainable dividend rather than AI‑style high growth.

9. Walmart Inc ($WMT)

Walmart Inc continues to act as a defensive compounder in models, with mid‑single‑digit sales growth from grocery, value positioning and e‑commerce, plus a reliable dividend, though its share price already reflects much of this resilience.

8. Taiwan Semiconductor ($TSM)

Taiwan Semiconductor Manufacturing Company Limited features in 2026–2036 forecasts, placing its share price in the low‑$300s if it maintains process leadership and AI chip demand, but geopolitical and cycle risks could cause realised returns to diverge significantly.

7. Boeing Co ($BA)

The Boeing Company offers potential multi‑year upside from recovering commercial deliveries and defence programmes, yet ongoing safety, regulatory, and balance‑sheet issues make this a higher‑risk turnaround that may not suit all investors.

6. Microsoft Corp ($MSFT)

Microsoft Corporation is projected by analysts to grow EPS at a mid‑teens rate as Azure and Copilot‑driven AI scale, but its elevated valuation and reliance on enterprise IT budgets mean returns are sensitive to any slowdown in AI or cloud spending.

5. Meta Platforms ($META)

Meta Platforms, Inc. is projected to deliver high‑teens percentage upside over the recent 12-month period as AI‑powered ad tools, Reels monetisation, and cost controls support earnings, although digital‑ad cyclicality and regulatory risk remain key uncertainties.

4. Amazon.com Inc ($AMZN)

Amazon.com, Inc. is widely modelled as a long‑term compounder, with AWS and retail efficiency expected to drive mid‑teens revenue growth and margin expansion into 2027, even though heavy AI and logistics investment can make near‑term free‑cash‑flow choppy.

3. Alphabet Inc ($GOOGL)

Alphabet Inc’s Class A shares appear in 2025–2030 projections showing steady appreciation backed by Search, YouTube, and cloud/AI, but current prediction tools see only mid‑single‑digit near‑term moves, underlining uncertainty around the timing of returns rather than their long‑run direction.

2. Broadcom Inc ($AVGO)

Broadcom Inc is expected in many 2026–2030 forecasts to grow free cash flow from AI networking, custom accelerators and infrastructure software, though its cyclical chip exposure and strong 2025 rally mean actual returns could be more volatile than the smooth trajectories some models show.

1. NVIDIA Corp ($NVDA)

NVIDIA Corporation was trading just under $200 in early January, with one AI‑based scenario placing a late‑January 2026 base‑case range around $240–$260, and longer‑term 2026 forecasts pointing above $300 if AI demand remains very strong. However, these projections are inherently uncertain and sensitive to macro and competitive developments.

Unlock My Current Buy Candidates

Become a Stock Focus member to see the stocks I’m seriously considering for my own portfolio, including the reasoning, risks, and what would need to happen before I act. This is not tips or signals, but a transparent look at real decision-making.

View the 3 Stocks I’m Closest to BuyingInside Stock Focus:

- See the stocks I’m personally considering buying

- Understand why they’re on my radar right now

- The key risks most investors overlook

- What would need to happen before I act

- Follow how ideas evolve from watchlist → buy → pass

- Built for investors thinking in years, not weeks