When investing, your capital is at risk. The value of investments can go down as well as up, and you may get back less than you put in. The content of this article is for information purposes only and does not constitute personal advice or a financial promotion.

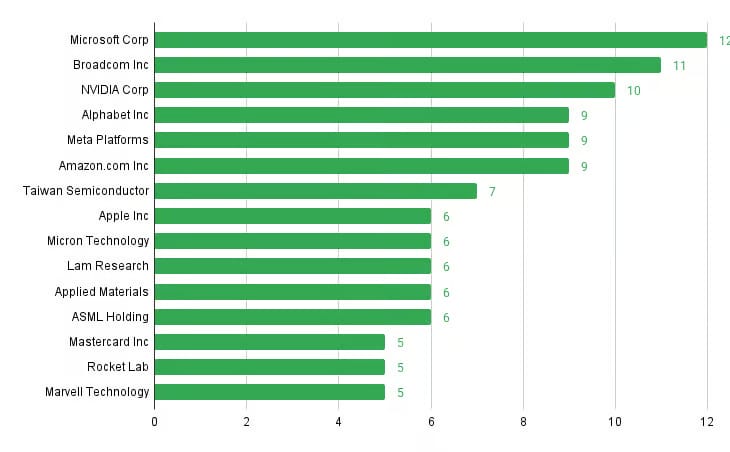

15 stocks to watch 💸

Ranked using weekly data trends, company fundamentals, and market intelligence.

Weekly Stock Power Watchlist

⚪ 15. Marvell Technology ($MRVL) :

Marvell Technology trades at $77.45 with a $66.78B market cap, strong analyst buy ratings, and 12-month price targets 20% above current levels, making it a popular AI chip play despite recent share price volatility and elevated P/E.

⬆️ 14. Rocket Lab ($RKLB) :

Rocket Lab, trading near $40, has over 100% YTD gains on commercial launch growth with high volatility; long-term outlook is bullish for space exposure, but price swings remain a significant risk.

⬆️ 13. Mastercard Inc ($MA) :

Mastercard Inc., currently at $540, continues to grow via global payments expansion, fintech partnerships, and reliable dividends, underpinning long-term stability for defensively minded investors.

🔻🔻 12. ASML Holding ($ASML) :

ASML Holding dominates advanced chipmaking with a record order backlog and EUV technology, supporting strong performance through sector cycles as demand for cutting-edge semiconductors grows.

⬆️⬆️ 11. Applied Materials ($AMAT) :

Applied Materials benefits from robust AI/memory chip demand and stable industry positioning for ongoing growth, even as cyclical risks remain.

⬆️ 10. Lam Research ($LRCX) :

Lam Research rides strong wafer equipment and AI demand through 2025, making it a core holding for semiconductor infrastructure exposure.

⬆️⬆️ 9. Micron Technology ($MU) :

Micron Technology leads in AI memory, supported by rising revenues and forecasts for sector tailwinds, but historical earnings volatility warrants prudent sizing.

⬆️ 8. Apple Inc ($AAPL) :

Apple Inc. remains resilient in demand and innovation, trading near $271, and is favoured for portfolio core strength as its global brand power endures.

🔻🔻🔻 7. Taiwan Semiconductor ($TSMC) :

Taiwan Semiconductor delivers sector-leading chip foundry scale for AI hardware, underpinning profit growth and global tech supply chains.

⚪ 6. Amazon.com Inc ($AMZN) :

Amazon.com Inc. remains a leader in e-commerce and cloud, delivering strong margins and positive analyst momentum for long-term appreciation.

⚪ 5. Meta Platforms ($META) :

Meta Platforms continues expanding its AI-driven advertising base, with revenue momentum and active user growth sustaining multi-year price performance.

⬆️ 4. Alphabet Inc ($GOOGL) :

Alphabet Inc.’s innovative cloud and ad businesses fuel recurring earnings and long-term value for diversified investors.

🔻 3. NVIDIA Corp ($NVDA) :

NVIDIA Corp sets the pace in AI chips, with robust analyst forecasts and continued innovation, leading sector growth into 2026.

⚪ 2. Broadcom Inc ($AVGO) :

Broadcom Inc. delivers diversified earnings upside, balancing AI chip growth and software supply reliability in the technology infrastructure market.

🔻 1. Microsoft Corp ($MSFT) :

Microsoft Corp anchors blue-chip portfolios with recurring high-margin cloud/AI revenue and solid analyst forecasts for multi-year outperformance.

Key

⚪ = No changes vs last week

⬆️ = +1 vs last week

🔻 = -1 vs last week

⬆️⬆️ = +2 vs last week

🔻🔻= -2 vs last week

⬆️⬆️⬆️ = +3 vs last week

🔻🔻🔻= -3 vs last week

Quantitative Insight Qualitative Screening (QIQS) data has been used to pick these stocks.

Disclaimer: This publication is for general information and educational purposes only and should not be taken as investment advice. It does not take into account your individual circumstances or objectives. Nothing here constitutes a recommendation to buy, sell, or hold any investment. Past performance is not a reliable indicator of future results. Always do your own research or consult a qualified financial adviser before making investment decisions. Capital is at risk.

Markets move fast. Savvy investors spot trends early.

Every Monday, get my pre-market cheat sheet:

✅ What’s hot

✅ What’s fading

✅ Where smart money’s flowing

No hype, just data.

👉 Subscribe to stay ahead.