When investing, your capital is at risk. The value of investments can go down as well as up, and you may get back less than you put in. The content of this article is for information purposes only and does not constitute personal advice or a financial promotion.

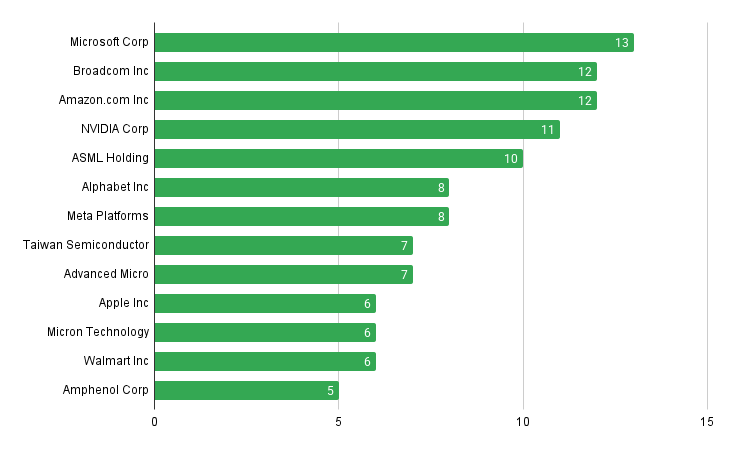

13 stocks to watch 💸

These stocks are ranked based on weekly data trends, company fundamentals, and market insights.

Weekly Stock Power Watchlist

🔻 13. Amphenol Corp ($APH) :

Amphenol Corporation trades around $137.43 with a P/E of about 45, reflecting steady global demand for its connectivity products and a generally bullish near-term forecast. However, some models see a single-digit downside into early 2026.

⬆️ 12. Walmart Inc ($WMT) :

Walmart Inc is priced near $111.74 with a 39× P/E and an almost $891B market cap, combining resilient, defensive cash flows and digital sales growth, while forecasts suggest only modest share price changes through 2026.

⚪ 11. Micron Technology ($MU) :

Micron Technology, Inc. trades around $284.79 with a P/E near 27 after an 80%+ 1‑year run, supported by strong AI memory demand and bullish 2025 forecasts, but cyclical memory pricing and recent volatility remain important risks.

⚪ 10. Apple Inc ($AAPL) :

Apple Inc enters the year-end with a strong Q4 2025 behind it, as iPhone 17 sales rose 6% year-on-year and management guided for a “big” December quarter, underpinning its premium valuation despite pockets of regional softness.

⚪ 9. Advanced Micro ($AMD) :

Advanced Micro Devices, Inc. has December forecasts centring on the low‑$200s and projecting high-double-digit upside by late 2027 as AI and data-centre products ramp. Still, recent gains mean short-term downside is also possible.

⚪ 8. Taiwan Semiconductor ($TSM) :

Taiwan Semiconductor Manufacturing Company Limited recently traded near $292, with long-term models calling for about $302 by end‑2025 and $404 by end‑2026 on continued AI foundry leadership, though such forecasts are inherently uncertain.

⚪ 7. Meta Platforms ($META) :

Meta Platforms, Inc. is around $663.29 with a P/E near 29; current models suggest only a mid‑single‑digit percentage drop over the next month, while 2025 ranges cluster in the low‑$660s as AI-driven ad growth and efficiency support earnings.

⬆️ 6. Alphabet Inc ($GOOGL) :

Alphabet Inc.’s Class A shares are near $315, with a P/E of around 31, and 2025 scenarios place fair value in the high-$270s to high-$280s, reflecting expectations for continued growth in ads, cloud, and AI, balanced by regulatory and macro risks.

🔻🔻 5. ASML Holding ($ASML) :

ASML Holding N.V. remains central to advanced chip production, with forecasts into 2026 pointing to further upside from EUV demand. However, recent gains and a high earnings multiple mean investors should be comfortable with volatility.

⚪ 4. NVIDIA Corp ($NVDA) :

NVIDIA Corporation is supported by multi‑year forecasts that continue to price in strong AI-GPU and data-centre growth, even as some near-term models point to potential pullbacks after a substantial rally.

⚪ 3. Amazon.com Inc ($AMZN) :

Amazon.com, Inc. remains backed by expectations for AWS-led profit growth and improving retail margins through 2026, but high investment needs and macro conditions can still drive meaningful swings in its share price.

⚪ 2. Broadcom Inc ($AVGO) :

Broadcom Inc is viewed in recent forecasts as a key beneficiary of AI infrastructure and software, with solid free-cash-flow growth prospects. At the same time, cyclical chip demand and valuation still warrant careful position sizing.

⚪ 1. Microsoft Corp ($MSFT) :

Microsoft Corporation continues to attract bullish multi‑year projections as cloud and Copilot-driven AI revenues scale, supporting expectations for mid‑teens earnings growth. However, its large size and valuation make it sensitive to any slowdown.

Key

⚪ = No changes vs last week

⬆️ = +1 vs last week

🔻 = -1 vs last week

⬆️⬆️ = +2 vs last week

🔻🔻= -2 vs last week

⬆️⬆️⬆️ = +3 vs last week

🔻🔻🔻= -3 vs last week

Quantitative Insight Qualitative Screening (QIQS) data has been used to pick these stocks.

Disclaimer: This publication is for general information and educational purposes only and should not be taken as investment advice. It does not take into account your individual circumstances or objectives. Nothing here constitutes a recommendation to buy, sell, or hold any investment. Past performance is not a reliable indicator of future results. Always do your own research or consult a qualified financial adviser before making investment decisions. Capital is at risk.

Markets move fast. Savvy investors spot trends early.

Every Monday, get my pre-market cheat sheet:

✅ What’s hot

✅ What’s fading

✅ Where smart money’s flowing

No hype, just data.

👉 Subscribe to stay ahead.