Trends in Focus 🔍

Since Trump's tariffs, the market's been wild! Dividend attention has been growing on Wall Street.

I have been looking at solid dividend ETFs and mutual funds to weather the storm and have pulled the best stocks from them.

Dividends can help outperform during times when the market experiences negative returns

QIQS Market Insights 💸

Below is an overview of recent activities and trends shaping the market landscape.

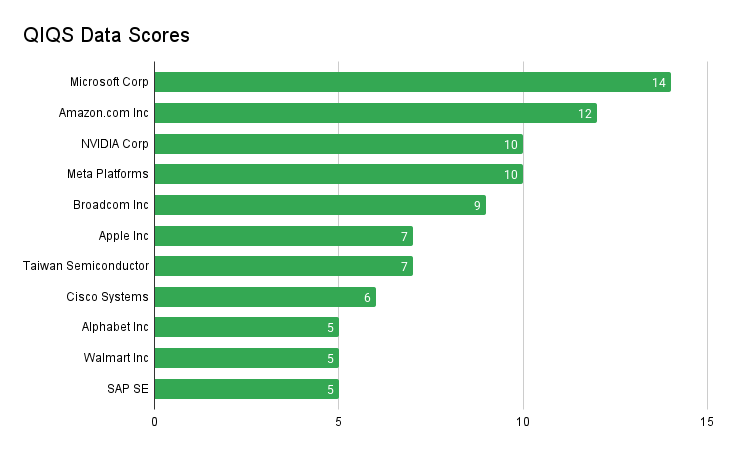

QIQS Data Scores

⚪ 11. SAP SE ($SAPX): SAP’s strong cloud revenue growth of 26%-28% and focus on AI-driven enterprise solutions make it a resilient long-term choice.

⬆️ 10. Walmart Inc ($WMT): Walmart’s omni-channel strategy and automation investments drive consistent sales growth and improved operating margins.

🔻 9. Alphabet Inc ($GOOGL): Alphabet’s strategic acquisitions and AI integration across its products position it for sustained growth in advertising and cloud services.

⬆️ 8. Cisco Systems ($CSCO): Cisco’s focus on AI-driven networking and security solutions ensures its relevance in enterprise technology.

🔻 7. Taiwan Semiconductor ($TSM): TSMC’s critical role in advanced chip manufacturing supports its dominance in the global semiconductor supply chain.

⚪ 6. Apple Inc ($AAPL): Apple’s ecosystem loyalty and continuous innovation ensure steady demand for its products and services.

⚪ 5. Broadcom Inc ($AVGO): Broadcom’s leadership in AI-driven semiconductor solutions highlights its potential in the evolving tech landscape.

🔻 4. Meta Platforms ($META): Meta’s investments in AI and metaverse technologies drive its future potential in digital advertising and beyond.

⚪ 3. NVIDIA Corp ($NVDA): NVIDIA’s dominance in AI chips and data center technologies cements its position at the forefront of the AI revolution.

🔻 2. Amazon Inc ($AMZN): Amazon’s e-commerce leadership and AWS cloud services ensure sustained market dominance and long-term opportunities.

⚪ 1. Microsoft Corp ($MSFT): Microsoft’s leadership in cloud computing (Azure) and AI integration drives strong financial performance and market dominance.

Quantitative Insight Qualitative Screening (QIQS) data has been used to pick these stocks.

NOT FINANCIAL ADVICE.

🔴 Risk Notice: This content summarizes publicly reported data—it is not advice. Consult a qualified advisor before investing.

This content is for informational purposes only and does not constitute financial advice. All investments carry risks. Past performance is not indicative of future results.