Good morning.

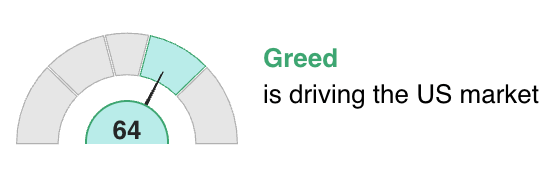

The Fear & Greed Index just flipped to GREED as markets push near record highs. Stocks are now pricier than the dot-com bubble, but AI and big tech keep fueling the rally.

This week, retail earnings (Walmart, Target, Home Depot, Lowe’s) will show if consumers can keep spending — and Powell’s speech at Jackson Hole could shake rate-cut hopes.

The Fear and Greed Index

Read more → 3 mins read

Must Reads 🔍

Top Stocks to Watch: August 18-22, 2025 (Portfolio Parrot)

Why Stocks Keeps Rising—Despite Trump’s Tariff Chaos (Time)

11 long-term stocks to watch this week 💸

Ranked using weekly data trends, company fundamentals, and market intelligence.

Follow the Money. Catch Weekly Trends.

⬆️ 11. Qualcomm ($QCOM):

Sales and profits grew 19% last quarter, boosted by car chips and smart devices. They’re also pushing into AI, but losing Apple as a customer could cause bumps.

⬆️ 10. Walmart ($WMT):

Reports results this week. Expect steady growth, with online sales still climbing 20%+. A safe bet for stability even with tariffs in the news.

⬆️ 9. Visa ($V):

Spending and travel kept Visa strong last quarter. Growth may slow a bit in the short term, but the world is still moving away from cash — and Visa wins from that.

⬆️ 8. AMD ($AMD):

Set a record with $7.7B in sales, thanks to PC and server chips. Even with a hit from export restrictions, they expect more growth next quarter from new AI products.

⬆️ 7. Alphabet ($GOOGL):

Google’s parent grew sales 14% to $96B, with its cloud business up 32%. YouTube and Search remain strong, and AI is giving profits a boost.

🔻 6. Meta ($META):

Facebook and Instagram’s owner grew sales 22% and profits 38%. Ads and AI are powering growth, though rising costs are something to watch.

⬆️ 5. Taiwan Semiconductor ($TSM):

Profits jumped 61% as demand from Apple, Nvidia, and AMD keeps rising. They expect 30% growth this year, though global risks could affect margins.

⬆️ 4. Broadcom ($AVGO):

AI chips drove a 46% jump in sales, and the company hit record revenue. It’s still generating strong cash, though chip demand can swing with cycles.

⬆️ 3. NVIDIA ($NVDA):

Sales exploded 69% to $44B, with data center chips up 73%. They’re the clear leader in AI computing, even with export rules hurting China sales.

⚪ 2. Amazon ($AMZN):

Sales rose 13% to $168B, with cloud up 18%. Profit margins tightened, but AI launches and Prime Day (this quarter) could give a lift.

⚪ 1. Microsoft ($MSFT):

Revenue grew 18% to $76B, powered by cloud (+39%) and new AI tools like Copilot. Still one of the most stable long-term holdings.

Key

⚪ = No changes vs last week

⬆️ = +1 vs last week

🔻 = -1 vs last week

⬆️⬆️ = +2 vs last week

🔻🔻= -2 vs last week

Quantitative Insight Qualitative Screening (QIQS) data has been used to pick these stocks.

NOT FINANCIAL ADVICE.

🔴 Risk Notice: This content summarizes publicly reported data—it is not advice. Consult a qualified advisor before investing.

This content is for informational purposes only and does not constitute financial advice. All investments carry risks. Past performance is not indicative of future results.