QIQS Market Insights 💸

Below is an overview of recent activities and trends shaping the market landscape.

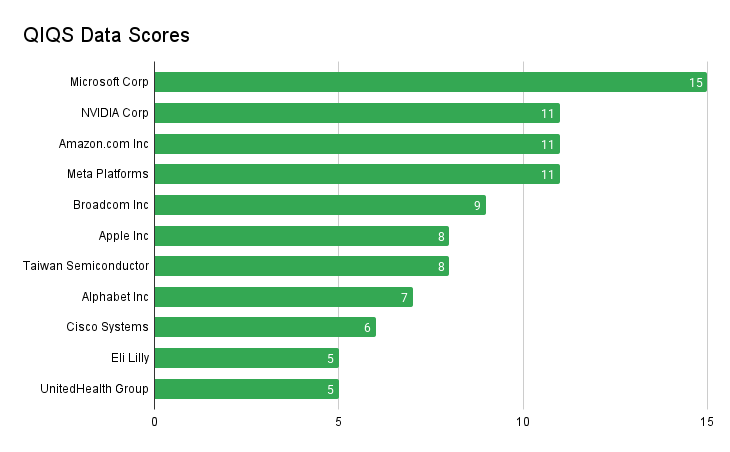

QIQS Data Scores

Healthcare Sector

UnitedHealth Group (UNH): Tim Noel was recently appointed as CEO of UnitedHealthcare, the largest division under UnitedHealth Group. The company is navigating challenges such as increased service demand and rising costs due to demographic shifts.

Eli Lilly (LLY): CEO Dave Ricks has led the company for over eight years, emphasizing innovation in weight-loss treatments and consistent dividend growth. The management team's average tenure is 6.5 years, reflecting stability.

Technology Sector

Cisco Systems (CSCO): Under Chuck Robbins's leadership since 2015, Cisco is leveraging AI and cloud infrastructure to drive growth. Recent acquisitions, such as Splunk, aim to bolster its competitive edge in data analytics.

Alphabet Inc (GOOGL): Alphabet's Q3 revenue grew by 15% year-over-year to $88.3 billion, with Google Cloud contributing significantly through a 35% increase in revenue to $11.4 billion.

Taiwan Semiconductor Manufacturing Co (TSM): TSM remains a global leader in producing advanced semiconductors for AI applications and consumer electronics.

Apple Inc (AAPL): Apple reported a 6% increase in Q4 revenue to $94.9 billion, driven by hardware sales such as iPhones and services like Apple Music and iCloud. Operating cash flow reached $27 billion.

Broadcom Inc (AVGO): Broadcom strengthens its semiconductor portfolio through strategic acquisitions that enhance networking and storage solutions capabilities.

Meta Platforms (META): Meta's advertising revenue grew by 22%, with daily active users increasing by 5%. The company is integrating AI into its platforms to enhance user engagement while facing challenges in monetizing its metaverse investments.

Amazon.com Inc (AMZN): Amazon continues to dominate e-commerce while expanding AWS cloud services globally, contributing to its robust market presence.

NVIDIA Corp (NVDA): NVIDIA's Q3 revenue hit a record $35.1 billion, up 94% year-over-year, fueled by demand for AI computing and data center GPUs.

Microsoft Corp (MSFT): Microsoft's Q1 results showed a 16% rise in revenue to $65.6 billion, supported by Azure's enterprise cloud computing services.

Quantitative Insight Qualitative Screening (QIQS) data has been used to pick these stocks.

NOT FINANCIAL ADVICE.

🔴 Risk Notice: This content summarizes publicly reported data—it is not advice. Consult a qualified advisor before investing.

This content is for informational purposes only and does not constitute financial advice. All investments carry risks. Past performance is not indicative of future results.