QIQS Market Insights 💸

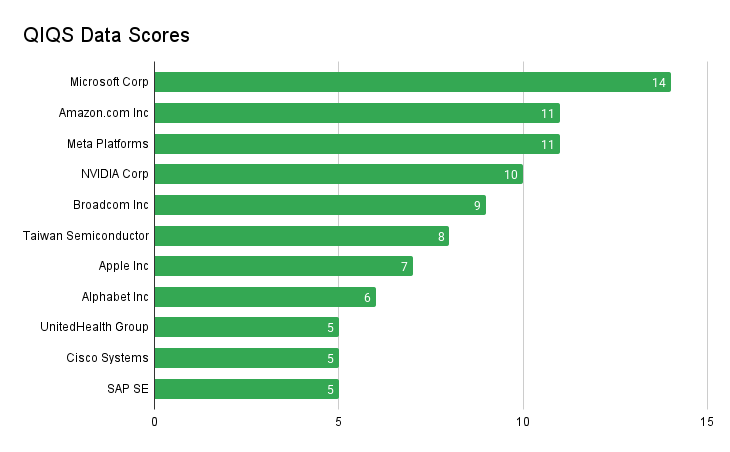

QIQS Data Scores

Below is an overview of recent activities and trends shaping the market landscape.

11. SAP SE ($SAPX):

SAP continues to dominate enterprise software with its cutting-edge cloud solutions, making it a solid choice for long-term growth.

10. Cisco Systems ($CSCO):

Cisco’s advancements in AI-driven networking and security solutions position it as a leader in enterprise technology.

9. UnitedHealth Group ($UNH):

With projected revenue growth of 13%-16% in 2025, UnitedHealth remains a stable player in healthcare services.

8. Alphabet Inc ($GOOGL):

Alphabet’s strategic investments in AI and cloud computing drive consistent growth, cementing its tech sector leadership.

7. Apple Inc ($AAPL):

Apple’s ecosystem loyalty and continuous innovation ensure its position as a consumer tech giant with steady growth potential.

6. Taiwan Semiconductor ($TSM):

TSMC’s critical role in global semiconductor manufacturing makes it indispensable for the AI and tech supply chain.

5. Broadcom Inc ($AVGO):

Broadcom’s focus on AI-driven semiconductor solutions underscores its importance in the evolving tech landscape.

4. NVIDIA Corp ($NVDA):

NVIDIA leads the way in AI chips and data center technologies, driving explosive growth in the tech industry.

3. Meta Platforms ($META):

Meta’s investments in AI and metaverse technologies fuel its future potential in digital advertising and beyond.

2. Amazon.com Inc ($AMZN):

Amazon’s dominance in e-commerce and AWS cloud services ensures sustained market leadership and long-term opportunities.

1. Microsoft Corp ($MSFT):

Microsoft’s leadership in cloud computing (Azure) and AI integration drives strong financial performance and market dominance.

Quantitative Insight Qualitative Screening (QIQS) data has been used to pick these stocks.

Key Takeaways:

AI & Cloud Computing: Companies like NVIDIA, Microsoft, and Alphabet are leading the charge with innovative solutions driving future growth.

Healthcare Innovation: UnitedHealth and Eli Lilly continue to address critical needs with strong fundamentals.

Semiconductor Leadership: TSMC and Broadcom are indispensable players in the global tech supply chain.

Consumer Tech Resilience: Apple’s ecosystem loyalty ensures steady demand across generations.

NOT FINANCIAL ADVICE.

🔴 Risk Notice: This content summarizes publicly reported data—it is not advice. Consult a qualified advisor before investing.

This content is for informational purposes only and does not constitute financial advice. All investments carry risks. Past performance is not indicative of future results.