Good morning.

Extreme greed continues to fuel the markets. Nvidia, Broadcom, Microsoft and Taiwan Semiconductor hit all-time highs last week.

In total, 35 stocks reached all-time highs last week.

The Fear and Greed Index

Here’s a summary of what to expect this week in the markets:

Must Reads 🔍

Top Stocks to Watch: July 21-25, 2025 (Portfolio Parrot)

Why Google Still Matters (Portfolio Parrot)

10 long-term stocks to watch this week 💸

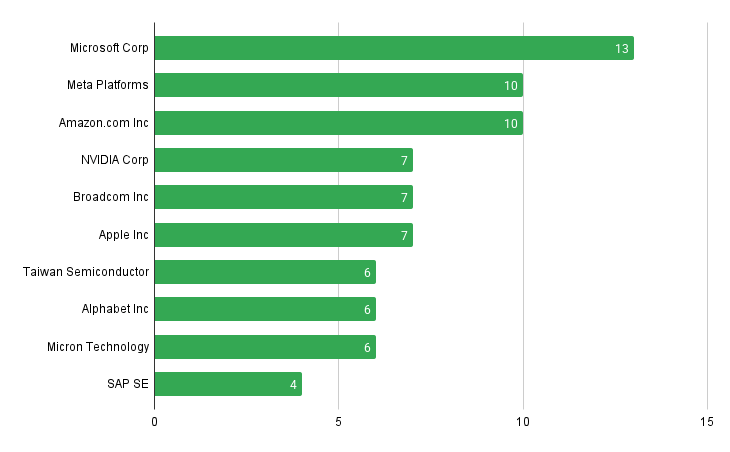

Ranked using weekly data trends, company fundamentals, and market intelligence.

QIQS Data Scores

⚪ 10. SAP SE ($SAP):

SAP's rapid cloud revenue growth of 26–28% in 2025, strong free cash flow, and global leadership in enterprise software offer both stability and long-term upside; however, valuation and sector volatility should be closely monitored.

⚪ 9. Micron Technology ($MU):

Micron reported a record 50% year-over-year revenue growth, driven by demand for AI memory. However, investors should be mindful of recent analyst downgrades linked to expected softness in chip pricing in late 2025.

⬆️ 8. Alphabet Inc. ($GOOGL):

Alphabet’s 12% quarterly revenue growth and major investments in AI and cloud reinforce its position as a digital leader, with analysts forecasting further share price appreciation in the coming months.

🔻 7. Taiwan Semiconductor ($TSM):

TSMC beat Q2 estimates, with profit surging 61% year-over-year, driven by sustained demand for AI chips, underscoring its critical role in global technology supply chains.

⬆️ 6. Apple Inc. ($AAPL):

Despite lagging behind peers in 2025, Apple’s large-scale AI investments and resilient ecosystem may underpin a breakout in the latter half of the year, though regulatory and innovation risks persist.

⚪ 5. Broadcom Inc ($AVGO):

Broadcom’s stock hit an all-time high in July, supported by strong semiconductor and infrastructure software sales, benefiting from ongoing demand in AI and 5G markets.

🔻 4. NVIDIA Corp ($NVDA):

NVIDIA’s dominance in AI chips and data centre markets has driven its shares to new highs, with analysts seeing further upside as AI investment surges through 2025.

🔻 3. Amazon Inc ($AMZN):

Amazon’s cloud and e-commerce businesses continue to expand, with analysts raising price targets following Prime Day gains and the launch of new AI products.

⚪ 2. Meta Platforms ($META):

Meta leverages strong advertising revenue and increased investment in AI and the metaverse, offering robust growth prospects despite sector volatility remaining a factor.

🔻 1. Microsoft Corp ($MSFT):

Microsoft’s leadership in cloud computing and its acceleration of AI integration underpin its reputation as a cornerstone of its portfolio, with strong financials supporting long-term resilience.

Key

⚪ = No changes vs last week

⬆️ = +1 vs last week

🔻 = -1 vs last week

⬆️⬆️ = +2 vs last week

🔻🔻= -2 vs last week

Quantitative Insight Qualitative Screening (QIQS) data has been used to pick these stocks.

NOT FINANCIAL ADVICE.

🔴 Risk Notice: This content summarizes publicly reported data—it is not advice. Consult a qualified advisor before investing.

This content is for informational purposes only and does not constitute financial advice. All investments carry risks. Past performance is not indicative of future results.