In Focus 🔍

1️⃣ April 2025 Stock Market Recap: Winners, Losers, and the AI Surge

April 2025 was a rollercoaster for investors, with AI-driven tech stocks defying broader market turbulence while energy companies faced their worst month in nearly three years.

2️⃣ Apple’s $100 Billion Buyback: What It Means for Your Portfolio

Apple’s latest $100 billion share repurchase program, announced alongside a 4% dividend hike to $0.26 per share, cements its status as a buyback powerhouse.

3️⃣ Palantir Technologies: A Deep Dive for Investors

Palantir Technologies (NYSE: PLTR) has become one of the most talked-about names in the AI and data analytics space.

QIQS Market Insights 💸

Below is an overview of recent activities and trends shaping the market landscape.

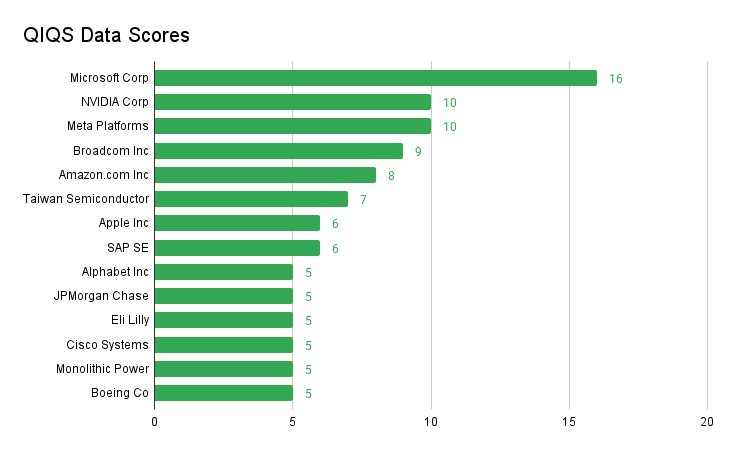

QIQS Data Scores

⬆️ 14. Boeing Co ($BA): Boeing’s $428 billion commercial backlog and ongoing recovery efforts under new leadership provide long-term growth potential, though investors should be aware of industry and company-specific risks.

⬆️ 13. Monolithic Power ($MPWR): Monolithic Power’s 39% year-on-year revenue growth and strategic shift to modular solutions highlight its innovation and resilience in the semiconductor sector, while ongoing expansion outside China helps manage geopolitical risk.

⚪ 12. Cisco Systems ($CSCO): Cisco’s focus on AI-driven networking and security solutions, with strong recurring revenue from enterprise clients, supports its position as a resilient tech infrastructure provider.

⬆️ 11. Eli Lilly ($LLY): Eli Lilly’s robust drug pipeline and continued revenue growth, especially in diabetes and Alzheimer’s treatments, underpin its long-term healthcare sector potential.

⬆️ 10. JPMorgan Chase ($JPM): JPMorgan’s diversified business model and digital transformation efforts reinforce its resilience and leadership in global financial services.

⚪ 9. Alphabet Inc ($GOOGL): Alphabet’s leadership in digital advertising and cloud computing, plus ongoing AI integration, support its strong long-term growth outlook.

⬆️ 8. SAP SE ($SAPX): SAP’s steady cloud revenue growth and enterprise software leadership position it well for digital transformation trends across industries.

🔻 7. Apple Inc. ($AAPL): Apple’s ecosystem loyalty, consistent innovation, and robust services growth provide a foundation for long-term performance.

⚪ 6. Taiwan Semiconductor ($TSM): TSMC’s critical role in advanced chip manufacturing and global expansion plans secure its importance in the AI and tech supply chain.

⬆️ 5. Amazon Inc ($AMZN): Amazon’s e-commerce dominance and AWS cloud leadership offer diversified revenue streams and continued global growth opportunities.

⚪ 4. Broadcom Inc ($AVGO): Broadcom’s strong AI-related revenue growth and leading position in semiconductors support its long-term earnings potential.

⚪ 3. Meta Platforms ($META): Meta’s investments in AI and the metaverse, alongside strong advertising revenue, drive its future growth prospects.

⚪ 2. NVIDIA Corp ($NVDA): NVIDIA’s dominance in AI chips and data centre solutions positions it at the heart of the ongoing digital and AI transformation.

⬆️ 1. Microsoft Corp ($MSFT): Microsoft’s leadership in cloud computing (Azure) and AI integration, backed by consistent financial performance, is a cornerstone for long-term portfolios.

Quantitative Insight Qualitative Screening (QIQS) data has been used to pick these stocks.

NOT FINANCIAL ADVICE.

🔴 Risk Notice: This content summarizes publicly reported data—it is not advice. Consult a qualified advisor before investing.

This content is for informational purposes only and does not constitute financial advice. All investments carry risks. Past performance is not indicative of future results.