Good morning, investors.

The final full trading week of the year rarely makes much noise. That is usually when it matters most.

Markets are heading into year-end with lighter volume, tighter positioning, and a calendar that can still move prices fast. Jobs data, inflation prints, and a handful of earnings reports will quietly shape how investors think about rates, consumers, and growth heading into 2026.

This week is less about bold calls and more about reading the signals hiding in plain sight. Some come from economic releases. Others come from companies whose earnings double as real-time economic reports.

Here’s what I’m watching as we close out 2025.

Read more → 3 mins read

The Fear and Greed Index

My Portfolio Performance 🔍

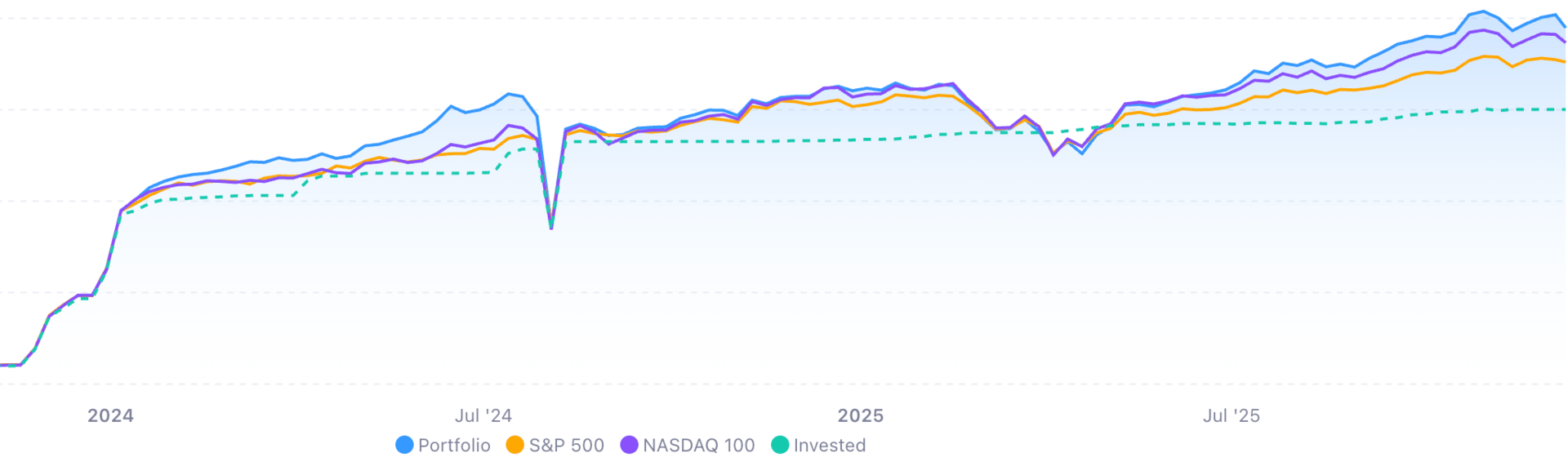

All-time Portfolio Performance (ISA+SIPP)

All-time | Year-to-date | |

|---|---|---|

Total Profit | 43.54% | 15.25% |

vs S&P 500 | 10.63% | 5% |

vs NASDAQ 100 | 4.36% | 2.24% |

Must Reads 📌

Top US Stocks to Watch Dec 15–19, 2025: Key Catalysts

Jobs, CPI and retail sales collide with Micron, Nike and FedEx earnings. A practical look at what is moving markets and sectors this week.

🔗 Portfolio Parrot ↗

How Fed Rate Cuts Ignite Stocks: Macro Shift Powering the Fabulous 8

The Fed’s new easing cycle is reshaping market conditions, lifting valuations and liquidity. Here’s how the shift impacts stocks broadly and the entire Fabulous 8.

🔗 Portfolio Parrot ↗

Investors are dumping stock-market winners and buying almost everything else. Why that’s a good sign.

The latest Fed rate cut is reigniting a ‘rotation trade’ out of trendy AI-linked names. It is a sign investors are feeling more confident about the economy.

🔗 MarketWatch ↗

14 stocks to watch 💸

These stocks are ranked based on weekly data trends, company fundamentals, and market insights.

Weekly Stock Power Watchlist

🔻 14. Marvell Technology ($MRVL) :

Marvell Technology trades near $84, with December forecasts targeting moderate gains to $95, driven by AI and data centre chip demand, despite volatility, and a P/E of around 30.

⚪ 13. Applied Materials ($AMAT) :

Applied Materials is priced around $259, supported by surging AI semiconductor equipment demand and stable earnings forecasts, with a P/E of around 30, indicating growth optimism.

⬆️ 12. Micron Technology ($MU) :

Micron Technology trades near $241 with 13% upside expected into early 2026, boosted by strong memory demand in AI and computing, but earnings volatility remains a consideration.

⬆️ 11. Apple Inc ($AAPL) :

Apple remains strong near $190-$286 with record Q4 forecasts expected on robust iPhone 17 sales and expanding services revenue, supporting long-term premium valuation.

⬆️ 10. Amphenol Corp ($APH) :

Amphenol trades around $129 with slight short-term gains expected, backed by stable demand for electronic connectors and growing exposure to data and telecom markets.

⬆️ 9. Advanced Micro Devices ($AMD) :

AMD is forecast to gain moderately to $217 by January 2026, driven by solid AI product pipelines and data centre share growth amid margin pressure risks.

⚪ 8. Taiwan Semiconductor ($TSM) :

TSMC, at around $292, is expected to rise to the mid-$320s in early 2026 as AI chip demand strengthens its foundry dominance, despite geopolitical uncertainties.

⚪ 7. ASML Holding ($ASML) :

ASML trades near $1,080 with a 38 P/E and forecasted 8.6% December gains, empowered by its critical role in EUV lithography and continued capital spending in semiconductor manufacturing.

🔻 6. Meta Platforms ($META) :

Meta's AI-driven ad improvements and a strong earnings pipeline sustain a positive outlook, with expected near-20 % price appreciation in the medium term, balanced against tech-sector volatility.

⚪ 5. Alphabet Inc ($GOOGL) :

Alphabet, trading near recent highs, benefits from expanding cloud and AI revenues with stable double-digit growth forecasts, making it a core growth name despite regulatory risks.

⚪ 4. NVIDIA Corp ($NVDA) :

NVIDIA remains a leader in AI GPU technology with a strong near-term outlook tempered by expected short-term price corrections, supported by growing data centre demand.

⬆️ 3. Amazon.com Inc ($AMZN) :

Amazon is set to leverage continued AWS growth and retail recovery into 2026, with earnings outlook suggesting margin improvement amid investments in AI and logistics.

⬆️ 2. Broadcom Inc ($AVGO) :

Broadcom maintains a strong position in AI semiconductor solutions and software, balancing cash flow growth and market cyclicality to support analyst confidence.

⚪ 1. Microsoft Corp ($MSFT) :

Microsoft anchors growth portfolios with AI-powered cloud offerings, sustained recurring revenues, and an optimistic multi-year earnings outlook, reinforcing its blue-chip status.

Key

⚪ = No changes vs last week

⬆️ = +1 vs last week

🔻 = -1 vs last week

⬆️⬆️ = +2 vs last week

🔻🔻= -2 vs last week

⬆️⬆️⬆️ = +3 vs last week

🔻🔻🔻= -3 vs last week

Quantitative Insight Qualitative Screening (QIQS) data has been used to pick these stocks.

How was today’s newsletter?

NOT FINANCIAL ADVICE.

🔴 Risk Notice: This content summarizes publicly reported data. It is not advice. Consult a qualified advisor before investing.

This content is for informational purposes only and does not constitute financial advice. All investments carry risks. Past performance is not indicative of future results.