Good morning, investors.

Markets don’t correct prices; they correct beliefs. After months of easy gains, last week’s drop reminded investors that confidence, like valuations, can only stretch so far. This week, earnings, inflation data, and geopolitics will test which narratives still hold.

Read more → 3 mins read

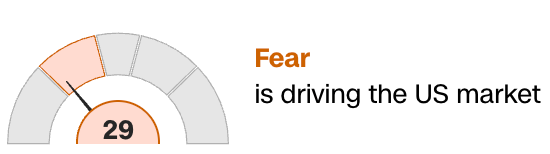

The Fear and Greed Index

My Portfolio Performance 🔍

Total Profit: 40.8%

Ahead of S&P 500 by 12.51% & Ahead of NASDAQ by 5.64%

All-time Portfolio Performance (ISA+SIPP)

Grab your free shares

ISA held in Trading 212 & SIPP held in Freetrade.

Must Reads 📌

What to Expect This Week: Top U.S. Stocks to Watch (Oct 13–19, 2025)

Earnings season, inflation data, and trade tensions set the tone for U.S. markets this week. Here’s what’s moving stocks and where attention is shifting.🔗 Portfolio Parrot ↗

Seizing the Dip: Why Friday’s Pullbacks Can Create Long-Term Opportunities

Friday market dips often spark panic, but history shows they can present opportunities for disciplined, long-term investors focused on fundamentals and process.🔗 Portfolio Parrot ↗

15 long-term stocks to watch this week 💸

Ranked using weekly data trends, company fundamentals, and market intelligence.

Weekly Stock Power Rankings

⚪ 15. Kratos Defense ($KTOS):

Kratos Defense has surged over 180% year-to-date as new defense contracts and a $13 billion+ project pipeline drive bullish analyst sentiment. Still, rapid gains and recent valuation concerns suggest short-term volatility risk.

⬆️ 14. Qualcomm Inc ($QCOM):

Qualcomm is benefiting from AI-enabled edge computing and mobile recovery, with analysts forecasting stronger growth into FY 2026, though shares may trade range-bound in October after recent profit-taking.

⚪ 13. Advanced Micro Devices ($AMD):

AMD’s expanding AI accelerator lineup and partnerships including work with Microsoft and OpenAI have driven price-target upgrades, as analysts expect a strong Q4 2025 for data-center demand.

⬆️ 12. Tesla Inc ($TSLA):

Tesla reported record Q3 deliveries and maintains a solid cash position, but margin pressure, EV price competition, and upcoming earnings volatility could weigh on near-term performance.

⬆️ 11. Philip Morris International ($PM):

Philip Morris’ global leadership in smoke-free products (IQOS) and steady dividend growth underpin long-term stability, though FX headwinds and emerging-market volatility may affect results in late 2025.

⚪ 10. Walmart Inc ($WMT):

Walmart’s roughly 25% one-year gain and record-high share price are supported by digital-sales growth and cost discipline, reinforcing its reputation as a defensive play in uncertain markets.

🔻 9. Alphabet Inc ($GOOGL):

Alphabet’s expanding AI-driven cloud and ad platforms support analyst expectations for a reacceleration into year-end, despite temporary softness in ad budgets this October.

⬆️ 8. Apple Inc ($AAPL):

Apple enters Q4 2025 with resilient iPhone 17 demand and wearables growth, but short-term sentiment may hinge on macro trends and supply-chain data.

⬆️ 7. ASML Holding ($ASML):

ASML’s dominance in EUV lithography and a record order backlog solidify its strategic importance to global semiconductor capacity expansion through 2026.

⬆️ 6. Taiwan Semiconductor Manufacturing Co. ($TSM):

TSMC retains a leading share in advanced AI chip fabrication, with strong revenue momentum reinforcing its central role in global supply chains, though cyclical and geopolitical risks persist.

⚪ 5. Meta Platforms ($META):

Meta’s rally is powered by AI infrastructure spending, ad growth, and improving profitability, but investors should watch for sector rotation-driven volatility.

⚪ 4. Amazon.com Inc ($AMZN):

Amazon’s leadership in e-commerce and AWS cloud continues to expand, with AI-powered efficiency gains and margin recovery driving analysts’ positive long-term outlook.

⚪ 3. Broadcom Inc ($AVGO):

Broadcom’s strength in AI networking chips and infrastructure software underpins robust revenue and upbeat analyst forecasts, though inventory and demand cycles remain watch points for late 2025.

⚪ 2. NVIDIA Corp ($NVDA):

NVIDIA remains the benchmark for AI chip innovation, with continued product launches and hyperscaler demand supporting analysts’ outperformance ratings through year-end 2025.

⚪ 1. Microsoft Corp ($MSFT):

Microsoft’s leadership in AI integration across Azure, Copilot, and Office, combined with consistent cloud and productivity growth, cements its role as a core long-term holding.

Key

⚪ = No changes vs last week

⬆️ = +1 vs last week

🔻 = -1 vs last week

⬆️⬆️ = +2 vs last week

🔻🔻= -2 vs last week

Quantitative Insight Qualitative Screening (QIQS) data has been used to pick these stocks.

NOT FINANCIAL ADVICE.

🔴 Risk Notice: This content summarizes publicly reported data. It is not advice. Consult a qualified advisor before investing.

This content is for informational purposes only and does not constitute financial advice. All investments carry risks. Past performance is not indicative of future results.