Must Reads 🔍

Top Stocks to Watch: June 16–20, 2025 (Portfolio Parrot)

I Asked ChatGPT How To Invest Like a Rich Person (NASDAQ)

QIQS Market Insights 💸

Here is an overview of recent trends shaping the market landscape, based on 1187 data points from my data-driven Quant system.

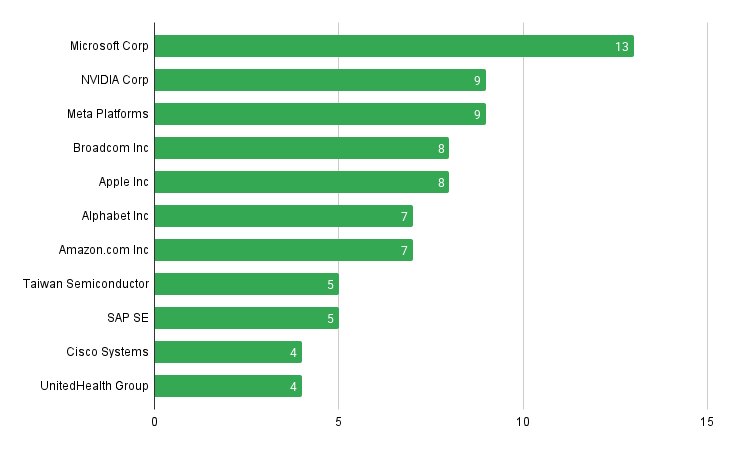

QIQS Data Scores

⚪ 11. UnitedHealth Group ($UNH):

UnitedHealth expects up to 14% revenue growth in 2025 but recently lowered its EPS outlook due to rising medical costs and operational pressures. Investors should watch for volatility through 2025 and signs of recovery in 2026.

⬆️ 10. Cisco Systems ($CSCO):

Cisco’s Q3 2025 revenue rose 11% year-on-year, driven by strong demand for AI infrastructure and security solutions. The company raised full-year guidance and continues to support shareholder value through dividends.

⬆️ 9. SAP SE ($SAP):

SAP forecasts 26–28% cloud revenue growth in 2025, supported by digital transformation and AI adoption. Strong free cash flow and ongoing share buybacks enhance long-term value.

⚪ 8. Taiwan Semiconductor ($TSM):

TSM targets 23–25% revenue growth this year, powered by AI chip demand and its global foundry leadership. Investors should remain mindful of currency exposure and geopolitical risk.

⚪ 7. Amazon Inc. ($AMZN):

Amazon is investing nearly $13 billion in data centre infrastructure in Australia to strengthen AI and cloud capabilities. These investments support growth across e-commerce and tech, though regional cost dynamics should be considered.

⚪ 6. Alphabet Inc. ($GOOGL):

Alphabet’s Q1 2025 revenue rose 12% year-on-year to $90.2B, led by gains in cloud and AI. Operating income also improved, reinforcing its digital advertising and enterprise tech leadership.

⬆️ 5. Apple Inc. ($AAPL):

Apple reported a 5% revenue increase in Q2 2025, with double-digit services growth. However, it continues to face short-term pressure from trade headwinds and valuation, balanced by its long-term ecosystem strength.

⚪ 4. Broadcom Inc. ($AVGO):

Broadcom’s Q2 2025 revenue grew 20% year-on-year, with AI chip sales up 46%. Management is optimistic about continued growth, though its high valuation may prompt short-term caution.

⚪ 3. Meta Platforms ($META):

Meta delivered strong Q1 results and is doubling down on AI investments. While it maintains high profitability, it has not reinstated its dividend. Volatility in tech spending remains a factor to watch.

🔻 2. NVIDIA Corp. ($NVDA):

NVIDIA continues to dominate the AI chip and data centre markets, with Q1 revenue up 69% year-on-year. While growth remains impressive, valuation and cyclical risk should be factored into long-term positioning.

⚪ 1. Microsoft Corp. ($MSFT):

Microsoft’s consistent financial performance and cloud and AI integration leadership position it as a core long-term holding. Its diversified revenue streams and innovation pipeline continue to support durable growth.

Quantitative Insight Qualitative Screening (QIQS) data has been used to pick these stocks.

NOT FINANCIAL ADVICE.

🔴 Risk Notice: This content summarizes publicly reported data—it is not advice. Consult a qualified advisor before investing.

This content is for informational purposes only and does not constitute financial advice. All investments carry risks. Past performance is not indicative of future results.