Stock in Focus 🔍

Amazon vs Walmart

As retail powerhouses, Walmart and Amazon have carved out dominant positions in their respective domains. However, as physical and digital commerce boundaries blur, these two giants increasingly compete head-to-head.

Amazon vs Walmart Financial Metrics

QIQS Stock Picks 💸

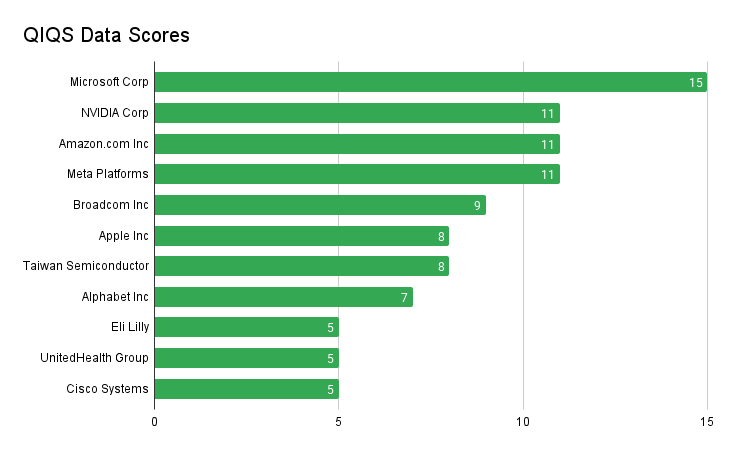

QIQS Data Scores

Portfolio Build using QIQS

11 Stocks Backed by Institutions and Market Data 📈🔍

One-liners and Weekly Trends on why these 11 stocks are considered promising long-term investments using 1056 data points.

Here's a quick rundown of their strengths for 2025:

⬆️ 11. $CSCO: Cisco's AI infrastructure orders of over $1 billion in 2025 and strong growth in security and observability segments position it for long-term AI potential.

⬆️ 10. $UNH: UnitedHealth's projected 2025 revenues of $450-$455 billion and adjusted EPS of $29.50-$30.00 showcase its strong market position in healthcare.

⬆️ 9. $LLY: Eli Lilly's anticipated 2025 revenue of $58-$61 billion, representing 32% growth, highlights its leadership in the pharmaceutical industry.

⚪ 8. $GOOGL: Alphabet's 13% year-over-year revenue growth and strategic investments in AI and cloud computing drive its long-term potential in tech.

⚪ 7. $TSM: Taiwan Semiconductor's critical role in advanced chip manufacturing supports its position in the global AI and tech supply chain.

⚪ 6. $AAPL: Apple's consistent innovation and strong ecosystem of products and services ensure its continued dominance in consumer technology.

⚪ 5. $AVGO: Broadcom's focus on AI-driven semiconductor solutions and 44% year-over-year revenue growth highlight its potential in the evolving tech landscape.

⚪ 4. $META: Meta's significant investments in AI and metaverse technologies drive its future growth potential in digital advertising and beyond.

⚪ 3. $AMZN: Amazon's e-commerce leadership and AWS cloud services fuel its continued market dominance and long-term growth potential.

🔻 2. $NVDA: NVIDIA's dominance in AI chips and data center technologies drives its explosive growth in the tech industry.

⚪ 1. $MSFT: Microsoft's leadership in cloud computing (Azure) and AI integration cement its position as a market leader in the tech industry.

These 11 stocks show strong potential for 2025 and long-term investing due to their robust financial performances, strategic focus on emerging technologies like AI, and leadership positions across various industries.

Quantitative Insight Qualitative Screening (QIQS) data has been used to pick these stocks from institutional investing.

NOT FINANCIAL ADVICE.

Always do your own research and understand your risk tolerance before investing.