Stock in Focus 🔍

Broadcom (AVGO): A Tech Giant at the Crossroads of AI and Cloud Innovation

At $934B market cap, Broadcom uniquely blends semiconductor leadership with a growing software ecosystem. But is it a buy?

Trend in Focus 🔍

This week, we’re looking at market data and trends in institutions.

1️⃣ US stocks lag global markets under Trump 2.0

Unexpected market dynamics emerge as Trump's policies create uncertainty. Overseas markets outperform, challenging US exceptionalism.

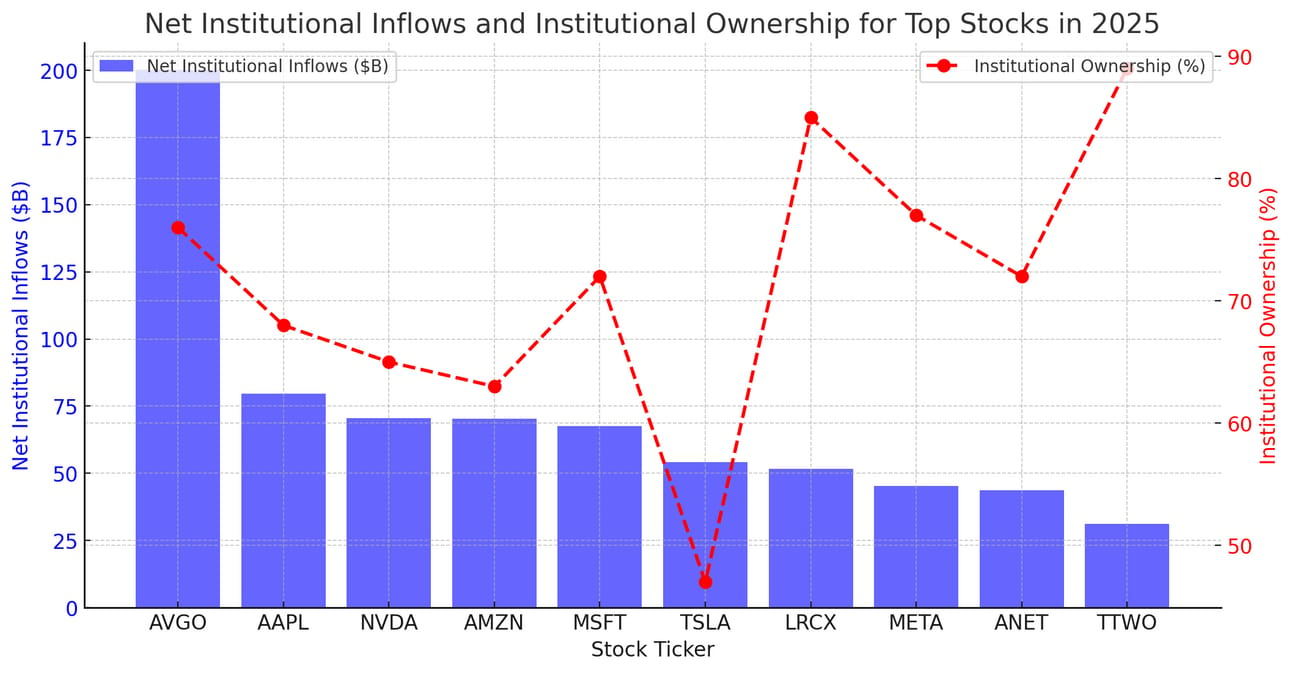

2️⃣ Top 10 Stocks Institutions Are Buying in 2025

These are the most purchased stocks by hedge funds & institutions this year.

3️⃣ How Top-Performing Funds Are Positioning for March

A breakdown of key themes, strategies, and sectors where big money flows based on my QIQS data strategy.

QIQS Stock Picks 💸

13 Stocks Backed by Institutions and Market Data 📈🔍

One-liners and Weekly Trends on why these 13 stocks are considered promising long-term investments using 1048 data points.

Here's a quick rundown of their strengths for 2025:

⬆️ 13. $V: Visa's 12% revenue growth to $9.6B and 8% increase in payments volume demonstrate its strong position in global digital payments3.

⚪ 12. $LLY: Eli Lilly's projected 2025 revenue of $58-$61B, a 32% growth from 2024, showcases its pharmaceutical industry leadership56.

⚪ 11. $WMT: Walmart's e-commerce expansion and consistent revenue growth highlight its adaptability in the evolving retail landscape.

⬆️ 10. $CSCO: Cisco's record $57B revenue and strategic investments in AI and cloud technologies ensure its relevance in future tech trends3.

⚪ 9. $JPM: JPMorgan Chase's strong financial performance and digital transformation efforts reinforce its leadership in the banking sector.

🔻 8. $GOOGL: Alphabet's 15% revenue growth and dominance in digital advertising and AI-driven cloud services anchor its tech sector leadership3.

⚪ 7. $TSM: Taiwan Semiconductor's critical role in advanced chip manufacturing and expansion plans supports its global tech supply chain position.

⚪ 6. $AAPL: Apple's consistent innovation and strong ecosystem of products and services ensure its continued dominance in consumer technology.

⚪ 5. $NVDA: NVIDIA's dominance in AI chips and data center technologies drives its explosive growth in the tech industry.

⚪ 4. $AMZN: Amazon's e-commerce leadership and AWS cloud services fuel its continued market dominance and long-term growth potential.

⬆️ 3. $AVGO: Broadcom's focus on AI-driven semiconductor solutions highlights its potential in the evolving tech landscape.

⬆️ 2. $META: Meta's significant investments in AI and metaverse technologies drive its future growth potential in digital advertising and beyond.

🔻 1. $MSFT: Microsoft's leadership in cloud computing (Azure) and AI integration cement its position as a market leader in the tech industry.

These 13 stocks show strong potential for 2025 and long-term investing due to their robust financial performances, strategic focus on emerging technologies like AI, and leadership positions across various industries.

Quantitative Insight Qualitative Screening (QIQS) data has been used to pick these stocks from institutional investing.

NOT FINANCIAL ADVICE.

Always do your own research and understand your risk tolerance before investing.