Good morning investors,

This is the kind of week where the market puts its feet up.

Not because the economy changed overnight, or because a new AI breakthrough arrived down the chimney, but because liquidity thins, calendars shrink, and price moves start sounding louder than the information behind them.

Christmas week trading is quieter, and that makes selectivity matter more than activity. A few data points can still move everything, especially with half the desks winding down.

So this edition stays tight. Fewer stocks. Clearer catalysts. Tuesday is the main event, with AI infrastructure, defensives, and cyclicals telling the real story.

The watchlist below is built for that Christmas-week reality.

Read more → 3 mins read

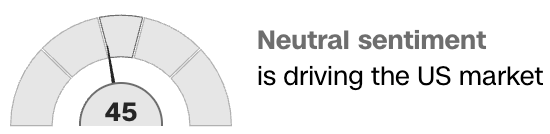

The Fear and Greed Index

My Portfolio Performance 🔍

All-time Portfolio Performance (ISA+SIPP)

All-time | Year-to-date | |

|---|---|---|

Total Profit | 41.85% | 24.99% |

vs S&P 500 | 9.55% | 16.68% |

vs NASDAQ 100 | 2.61% | 12.8% |

Must Reads 📌

Top US Stocks to Watch: Dec 22–26, 2025 Holiday Week

A short, thin-liquidity Christmas week with Tuesday macro risk. Here’s the schedule, sector flow backdrop, and a focused watchlist.

🔗 Portfolio Parrot ↗

Stocks for 9–5 Investors vs Passive Investing: What’s the Difference?

Stocks for 9–5 investors are not passive investing. This guide explains the key differences, the middle ground, and why time-efficient active investing exists.

🔗 Portfolio Parrot ↗

The Mag 7 in Charts: How Big Tech Dominates the Market

From market cap to ETF weightings, these visuals show how much the Magnificent 7 shape today’s market.

🔗 Investopedia ↗

13 stocks to watch 💸

These stocks are ranked based on weekly data trends, company fundamentals, and market insights.

Weekly Stock Power Watchlist

⚪ 13. Marvell Technology ($MRVL) :

Marvell Technology trades around $84 with a P/E of around 30. While one forecast sees a short-term dip to about $80 in December before recovering strongly through 2026–2027 on AI and data-centre demand, this path is not guaranteed.

⚪ 12. Micron Technology ($MU) :

Micron Technology is about $266 with a P/E of 25, after jumping on a blowout AI-memory quarter and guidance for higher margins and capex. However, future results remain sensitive to memory pricing cycles.

⚪ 11. Amphenol Corp ($APH) :

Amphenol Corporation trades near $135 with a P/E of around 45, and a recent forecast expects mostly bullish but modest moves into early 2026, as demand for its connectivity and sensor products remains resilient.

⬆️ 10. Apple Inc ($AAPL) :

Apple Inc reported $416B in fiscal 2025 revenue (up 6% year-on-year) and Q4 net income of $27.46B, with strong iPhone 17 and services momentum underpinning its premium valuation heading into the key December quarter.

⚪ 9. Advanced Micro ($AMD) :

Advanced Micro Devices, Inc. carries a “Moderate Buy” consensus and a 12‑month target implying roughly 40% upside from recent levels as its AI chips ramp. Still, after a 60%+ YTD gain, near-term pullbacks remain possible.

⚪ 8. Taiwan Semiconductor ($TSM) :

Taiwan Semiconductor’s share price recently stood near $292, with one long-term model projecting around $300 by the end of 2025 and further gains as AI and high-performance computing drive foundry demand, though such forecasts are inherently uncertain.

⚪ 7. Meta Platforms ($META) :

Meta Platforms, Inc. trades around $659 with a P/E of about 29, and a recent year‑end projection suggests roughly 19% upside to around $875 if AI‑driven ad strength and efficiency gains persist, but outcomes could diverge materially.

⬆️ 6. Alphabet Inc ($GOOGL) :

Alphabet Inc’s Class A shares have a bullish technical backdrop but at least one model expects a roughly 4% pullback into early 2026, even as Search, YouTube and cloud/AI continue to underpin long‑term earnings growth.

⬆️ 5. NVIDIA Corp ($NVDA) :

NVIDIA Corporation remains the leading AI GPU supplier, with recent forecasts pointing to short-term price volatility but continued multi‑year upside potential if data‑center AI spending remains strong.

⬆️⬆️⬆️⬆️ 4. ASML Holding ($ASML) :

ASML Holding is supported by strong long‑term forecasts as the key EUV lithography provider, with models projecting mid‑single‑digit percentage upside into year‑end and more substantial gains tied to the next semiconductor capex cycle.

⚪ 3. Amazon.com Inc ($AMZN) :

Amazon.com, Inc. continues to be supported by expectations for AWS‑led profit growth and improving retail margins into 2026. However, macro pressures and investment needs can still cause earnings and share price volatility.

⚪ 2. Broadcom Inc ($AVGO) :

Broadcom Inc is viewed in forecasts as a core AI infrastructure and software earner with solid free‑cash‑flow growth prospects over the next few years. Still, cyclical semiconductor demand and high expectations remain key risks.

⬆️ 1. Microsoft Corp ($MSFT) :

Microsoft Corporation benefits from analyst outlooks that see mid‑teens earnings growth supported by cloud and Copilot‑driven AI adoption, making it a widely used long‑term core holding despite valuation sensitivity to growth disappointments.

Key

⚪ = No changes vs last week

⬆️ = +1 vs last week

🔻 = -1 vs last week

⬆️⬆️⬆️⬆️ = +4 vs last week

Quantitative Insight Qualitative Screening (QIQS) data has been used to pick these stocks.

How was today’s newsletter?

NOT FINANCIAL ADVICE.

🔴 Risk Notice: This content summarizes publicly reported data. It is not advice. Consult a qualified advisor before investing.

This content is for informational purposes only and does not constitute financial advice. All investments carry risks. Past performance is not indicative of future results.