Good morning, investors.

This week looks calm on the index level, almost too calm. The S&P 500 is sitting near record highs, inflation has eased, and bond yields have backed off. But the quiet surface hides a busy undercurrent.

The Fed delivers its final decision of 2025, and while a rate cut is expected, the real story is Powell’s tone. At the same time, a cluster of heavyweight earnings: Oracle, Adobe, Broadcom, Costco, Lululemon will tell us how AI spending, enterprise demand and the US consumer are actually holding up.

Institutional money is still shifting between expensive growth and value, making this one of those weeks where a single sentence from the Fed or a single earnings line can recalibrate sentiment.

This issue breaks down what matters most and the large-cap names to watch as we head into the final stretch of the year.

Let’s dive in.

Read more → 3 mins read

The Fear and Greed Index

My Portfolio Performance 🔍

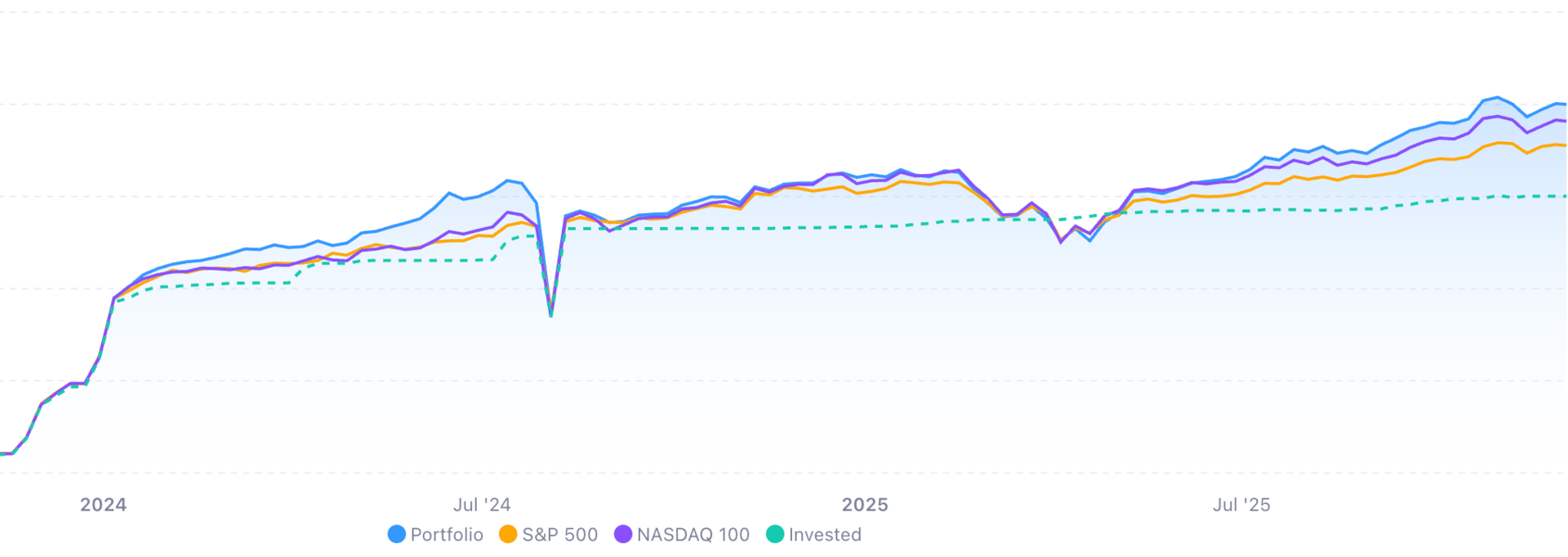

All-time Portfolio Performance (ISA+SIPP)

All-time | Year-to-date | |

|---|---|---|

Total Profit | 47.01% | 18.32% |

vs S&P 500 | 12.59% | 6.85% |

vs NASDAQ 100 | 4.79% | 2.66% |

Must Reads 📌

Top US Stocks to Watch This Week (December 8–12, 2025)

U.S. stocks start the week near all-time highs as investors weigh a potential Fed rate cut, key earnings from Broadcom, Oracle and Adobe.🔗 Portfolio Parrot ↗

The Stocks Positioned for Nvidia and Broadcom-Like Growth by 2030

Exploring the companies sitting in AI manufacturing, silicon and networking bottlenecks that could benefit from the next wave of infrastructure spending.🔗 Portfolio Parrot ↗

Beyond the Magnificent Seven: Unlocking Value in a Concentrated Stock Market

As mega-cap tech dominates market returns, investors can consider diversification across sectors, regions, and smaller equities.

🔗 Morningstar ↗

11 stocks to watch 💸

These stocks are ranked based on weekly data trends, company fundamentals, and market insights.

Weekly Stock Power Watchlist

⚪ 11. Applied Materials ($AMAT) :

Applied Materials is trading at $268 with a $213.5B market cap and bullish December forecasts predicting 25.9% gains to $321, driven by surging AI semiconductor equipment demand and a 31 P/E reflecting growth expectations.

⬆️ 10. Marvell Technology ($MRVL) :

Marvell Technology trades near $98.91 with forecasts pointing to a 13.2% December rally to $103.09, then sustained 2026–2027 growth to $178+, as AI and data centre chip demand accelerates despite a high 35 P/E.

⬆️ 9. Apple Inc ($AAPL) :

Apple Inc reported record Q4 fiscal 2025 with CEO Cook guiding for a historic December quarter with 10–12% revenue growth, and December guidance of $137.97B in sales as iPhone 17 demand surges and services expand.

⬆️ 8. Taiwan Semiconductor ($TSM) :

Taiwan Semiconductor trades at $278 with a 29 P/E and a $1.14T market cap; consensus analyst targets of $328.75 reflect 29% upside potential as AI chip demand remains robust through 2026.

⬆️ 7. ASML Holding ($ASML) :

ASML Holding is at $1,099.47 with a $426B market cap and 39 P/E; December forecasts project a 7.7% gain to $1,172 as EUV lithography remains critical to next-generation chipmakers' roadmaps.

🔻 6. Alphabet Inc ($GOOGL) :

Alphabet Inc. is trading near $317 as an AI outperformer, with December forecasts expecting a 4.13% climb to $330.25, underpinned by Gemini adoption and Google Cloud momentum reaching $100B+ quarterly revenue.

⬆️ 5. Meta Platforms ($META) :

Meta Platforms trades at $673.42 with a $1.7T market cap and a 30 P/E; December forecasts signal 19.4% upside to $875.46 by year-end as AI-driven ad efficiency gains bolster earnings.

⚪ 4. NVIDIA Corp ($NVDA) :

NVIDIA Corporation is at $182.41 with a $4.4T market cap and a 45 P/E; December forecasts show a temporary 6.1% pullback to $169, followed by a 2026 recovery to $267+ as AI data centre cycles persist.

⬆️ 3. Amazon.com Inc ($AMZN) :

Amazon.com Inc continues to benefit from AWS scale and Q4 retail strength, with analysts projecting steady margin expansion and over $600B annual revenue, driving long-term investor conviction.

⬆️ 2. Broadcom Inc ($AVGO) :

Broadcom Inc maintains its core position in AI infrastructure and chip-to-software diversification, with strong free cash flow and analyst optimism for sustained growth through 2026 despite cyclical sector risks.

🔻 1. Microsoft Corp ($MSFT) :

Microsoft Corporation anchors long-term portfolios with cloud AI momentum and recurring enterprise revenue, posting solid December technicals and analyst conviction for mid-teens earnings growth into 2026.

Key

⚪ = No changes vs last week

⬆️ = +1 vs last week

🔻 = -1 vs last week

⬆️⬆️ = +2 vs last week

🔻🔻= -2 vs last week

⬆️⬆️⬆️ = +3 vs last week

🔻🔻🔻= -3 vs last week

Quantitative Insight Qualitative Screening (QIQS) data has been used to pick these stocks.

How was today’s newsletter?

NOT FINANCIAL ADVICE.

🔴 Risk Notice: This content summarizes publicly reported data. It is not advice. Consult a qualified advisor before investing.

This content is for informational purposes only and does not constitute financial advice. All investments carry risks. Past performance is not indicative of future results.