When investing, your capital is at risk. The value of investments can go down as well as up, and you may get back less than you put in. The content of this article is for information purposes only and does not constitute personal advice or a financial promotion.

TL;DR (Investor Summary)

What’s happening:

The challenge isn’t AI demand, but capacity. In 2026, progress will rely on having enough compute power, memory bandwidth, network speed, and data centres.

Why it matters:

Cash flow usually appears first where there are real constraints, not just where there’s the most excitement.

What the market is missing:

Data movement and memory are becoming bigger bottlenecks than raw computing power.

Key risk to watch:

If hyperscalers slow down or pause their spending, it will affect infrastructure, semiconductor equipment, and deployment companies before it impacts software firms.

Investor lens:

Focus on bottlenecks, not just stories. Scarcity is what shapes results.

Introduction: AI Is Not Waiting for Ideas

By 2026, AI will be more ambitious than ever. Models will need more parameters, more data, and longer runtimes. But the real challenges are elsewhere.

These challenges appear when racks can’t get power quickly enough, when memory can’t keep up with accelerators, when data moves too slowly between nodes, or when factories design chips faster than they can make them.

Markets are drawn to stories, but businesses deal with real limits. Mispricings often happen in the space between these two.

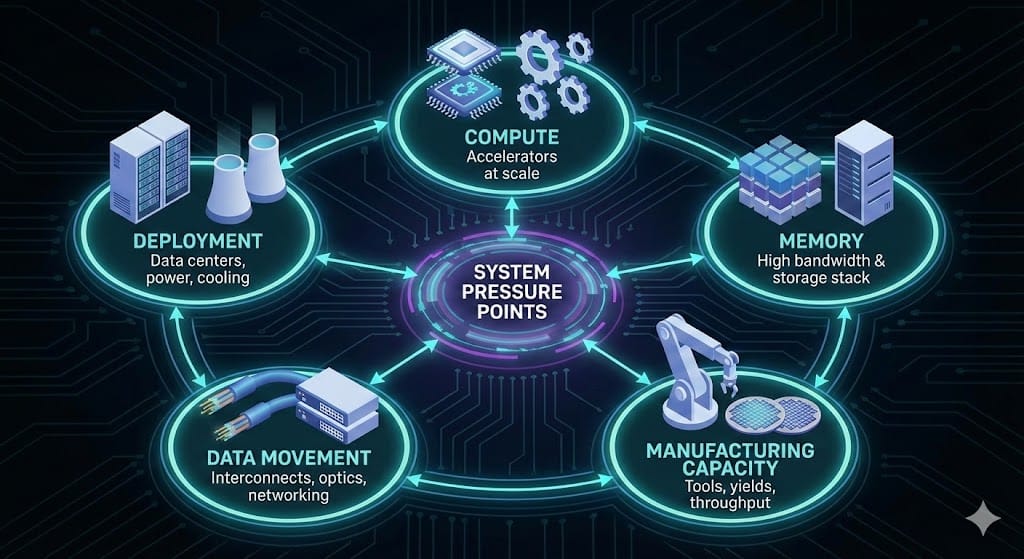

The Bottleneck Map for 2026

AI Pressure Points 2026

Most of the pressure points sit in five places:

Compute

Accelerators that can actually be delivered at scale.Memory

High bandwidth memory and the storage stack that feeds it.Manufacturing capacity

Tools, yields, and throughput that decide how many chips exist.Data movement

Interconnects, optics, and networking inside clusters.Deployment

Data centres, power, cooling, and integration.

Think of it like traffic: faster engines won’t help if the road gets narrow or you run out of fuel.

Three Stocks I’m Watching Closely for 2026

Here’s how these three stocks stack up when it comes to solving real AI bottlenecks in 2026.

Stock | Bottleneck Relevance | Rating (1–5) | Why |

|---|---|---|---|

Celestica (CLS) | High | ⭐⭐⭐⭐☆ | Turns capital spending plans into actual AI infrastructure |

Amphenol (APH) | Medium High | ⭐⭐⭐☆☆ | Connectivity becomes more important as servers get packed closer together |

Tower Semiconductor (TSEM) | Medium | ⭐⭐☆☆☆ | Focuses on speciality nodes, but is less connected to the main AI bottlenecks |

Celestica $CLS ( ▼ 0.02% )

Celestica operates in the less visible middle. Once chips are designed and budgets set, someone needs to build and connect the systems. This work doesn’t get much attention, but delays here can slow down everything else.

Amphenol $APH ( ▲ 2.35% )

Amphenol doesn’t design AI chips. Instead, it ensures signals get through reliably. As speeds rise and racks get denser, connectors become key to overall performance.

Tower Semiconductor $TSEM ( ▼ 1.94% )

Tower is a true foundry, but the main AI bottlenecks are in advanced nodes, packaging, and high-bandwidth memory. Tower is involved, but not at the core of these issues.

Where the Bigger Bottlenecks Sit

It’s helpful to look at the market by grouping companies based on the problems they solve at each layer.

Compute: $NVDA ( ▼ 0.04% ), $AMD ( ▲ 1.62% ), $QCOM ( ▼ 1.38% )

Memory: $MU ( ▼ 0.86% ), Samsung, SK Hynix

Manufacturing: $ASML ( ▼ 0.67% ), $AMAT ( ▲ 0.27% ), $LRCX ( ▼ 1.13% ), $KLAC ( ▼ 0.7% )

Data movement: $AVGO ( ▲ 0.14% ), $MRVL ( ▲ 0.66% ), networking specialists

Deployment: $EQIX ( ▼ 0.67% ), $CLS ( ▼ 0.02% ), power and cooling providers

Each layer acts differently. Compute is highly competitive. Manufacturing gains from complexity. Deployment is the first to react when financing gets tighter.

The Core Constraint Solvers

NVIDIA

NVIDIA is still the leading player in AI computing. When demand outpaces supply, shortages appear here first, often before they show up in other companies’ revenue forecasts.

Micron Technology

As models get bigger, AI is increasingly looking like a memory challenge. High-bandwidth memory is now a key constraint, not just a nice-to-have.

Broadcom and Marvell Technology

At a large scale, moving data is more challenging than creating it. Interconnects and custom chips determine if costly computing power is used efficiently or left idle.

ASML

You can only make advanced chips with the right tools. As chips get more complex, manufacturing equipment stays essential, even if production levels change.

Infrastructure Is Where AI Becomes Real

Arista Networks and Cisco Systems

As AI clusters grow, networking becomes a key performance factor, not just a basic utility.

Equinix

No matter which chips come out on top, AI needs space with power. The speed at which physical infrastructure is set up often determines who meets demand first.

Vertiv

As rack density increases, cooling and power aren’t optional anymore. They become critical limits.

AI Bottleneck Stocks, Scored for 2026

To make this practical, the table below rates each stock on three key factors.

Impact: How directly it removes a real constraint

Catalyst strength: Likelihood of visible demand or revenue change in 2026

Risk profile: Execution, valuation, or cyclicality

These picks are meant for medium to long-term strategies, not quick wins.

Company | Bottleneck Solved | Impact | 2026 Catalysts | Catalyst Score | Risk Profile |

|---|---|---|---|---|---|

NVIDIA (NVDA) | Compute | ⭐⭐⭐⭐⭐ | Blackwell ramp, inference scale | ⭐⭐⭐⭐⭐ | Medium |

Micron (MU) | Memory bandwidth | ⭐⭐⭐⭐ | HBM3E and HBM4 tightness | ⭐⭐⭐⭐ | Medium |

Broadcom (AVGO) | Interconnect | ⭐⭐⭐⭐ | Hyperscaler ASIC wins | ⭐⭐⭐⭐ | Low Medium |

AMD | Accelerators | ⭐⭐⭐⭐ | MI300 and MI400 adoption | ⭐⭐⭐⭐ | Medium |

ASML | Manufacturing tools | ⭐⭐⭐⭐ | EUV backlog conversion | ⭐⭐⭐ | Low |

Lam Research (LRCX) | Wafer capacity | ⭐⭐⭐⭐ | Memory and logic recovery | ⭐⭐⭐ | Medium |

KLA (KLAC) | Yield control | ⭐⭐⭐⭐ | Advanced node complexity | ⭐⭐⭐ | Low |

Marvell (MRVL) | Data movement | ⭐⭐⭐⭐ | Custom AI networking | ⭐⭐⭐⭐ | Medium |

Arista (ANET) | AI networking | ⭐⭐⭐⭐ | 800G and 1.6T Ethernet | ⭐⭐⭐⭐ | Low Medium |

Celestica (CLS) | System build out | ⭐⭐⭐ | Hyperscaler scaling | ⭐⭐⭐ | Medium |

Equinix (EQIX) | Deployment | ⭐⭐⭐ | AI colocation demand | ⭐⭐⭐ | Medium |

Cisco (CSCO) | Enterprise networking | ⭐⭐⭐ | Switching refresh | ⭐⭐ | Low |

Qualcomm (QCOM) | Inference | ⭐⭐⭐ | AI PC and inference | ⭐⭐⭐ | Medium |

Amphenol (APH) | Connectivity | ⭐⭐⭐ | Server density growth | ⭐⭐⭐ | Low |

Applied Digital (APLD) | AI data centres | ⭐⭐⭐ | Tenant signings | ⭐⭐⭐ | High |

Vertiv (VRT) | Power and thermal | ⭐⭐ | Liquid cooling | ⭐⭐⭐ | Medium |

How Investors Might Use This

Core constraint exposure

NVDA, MU, AVGO, ASML, MRVL

These companies are most exposed to areas with scarce resources.

Scaling and deployment exposure

ANET, CLS, EQIX, APH

They gain when AI shifts from pilot projects to permanent infrastructure.

Higher torque exposure

AMD, QCOM, APLD

There’s potential for gains if capital spending picks up, but timing and execution are important.

Risks That Actually Change the Picture

Memory oversupply that weakens pricing

Hyperscalers internalising more of the stack

Valuation compression in crowded infrastructure trades

Capex pauses that show up first in deployment and equipment

Closing Thought: Follow the Constraint

Markets debate stories, but businesses focus on solving real problems.

In 2026, the key AI question isn’t who has the most innovative model, but who can remove the obstacles that keep those models from running at scale.

Pay attention to the constraints. That’s usually where the first signs appear.

Disclaimer: This publication is for general information and educational purposes only and should not be taken as investment advice. It does not take into account your individual circumstances or objectives. Nothing here constitutes a recommendation to buy, sell, or hold any investment. Past performance is not a reliable indicator of future results. Always do your own research or consult a qualified financial adviser before making investment decisions. Capital is at risk.

Markets move fast. Savvy investors spot trends early.

Every Monday, get my pre-market cheat sheet:

✅ What’s hot

✅ What’s fading

✅ Where smart money’s flowing

No hype, just data.

👉 Subscribe to stay ahead.