Good morning, investors.

We’re heading into a short trading week that isn’t as quiet as it looks. Tech just came off a sharp pullback after Nvidia’s post-earnings reversal, Bitcoin slipped into negative territory for the year, and both staples and discretionary names showed signs of strain. Yet U.S. equity funds still saw fresh inflows, especially into large- and small-cap funds.

Now the real signals arrive fast: Tuesday brings PPI, retail sales and consumer confidence in one burst, followed by jobless claims and durable goods on Wednesday. After that, the market shuts for Thanksgiving and reopens for a Black Friday session focused on early consumer demand.

Thin liquidity, heavy data and a fragile consumer.

A small window, but an important one.

Read more → 3 mins read

The Fear and Greed Index

My Portfolio Performance 🔍

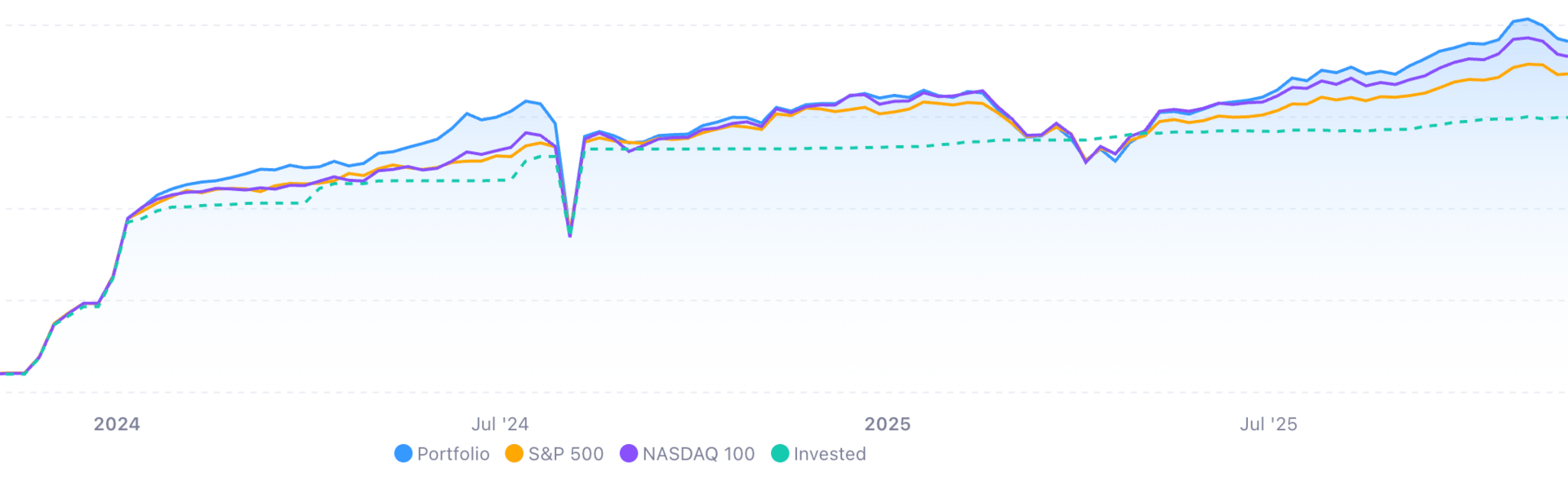

Total Profit: 41.5%

Ahead of S&P 500 by 10.21% & Ahead of NASDAQ by 4.49%

All-time Portfolio Performance (ISA+SIPP)

Must Reads 📌

Top U.S. Stocks To Watch This Week: 24–28 November 2025

How AI giants, healthcare leaders and Black Friday retail could shape a short but important week for U.S. markets.🔗 Portfolio Parrot ↗

How to Handle Market Downturns: A Practical Guide for Investors

A data-driven guide to navigating volatility, understanding historical patterns, and using simple frameworks to make better long-term investing decisions.🔗 Portfolio Parrot ↗

Goldman Sachs says most of the AI boom may already be priced in

While high valuations can hold up when the economy is strong, investors usually end up paying the price when growth slows or the cycle turns.

🔗 Business Insider ↗

15 stocks to watch 💸

Ranked using weekly data trends, company fundamentals, and market intelligence.

Weekly Stock Power Watchlist

⚪ 15. Marvell Technology ($MRVL) :

Marvell Technology trades at $77.45 with a $66.78B market cap, strong analyst buy ratings, and 12-month price targets 20% above current levels, making it a popular AI chip play despite recent share price volatility and elevated P/E.

⬆️ 14. Rocket Lab ($RKLB) :

Rocket Lab, trading near $40, has over 100% YTD gains on commercial launch growth with high volatility; long-term outlook is bullish for space exposure, but price swings remain a significant risk.

⬆️ 13. Mastercard Inc ($MA) :

Mastercard Inc., currently at $540, continues to grow via global payments expansion, fintech partnerships, and reliable dividends, underpinning long-term stability for defensively minded investors.

🔻🔻 12. ASML Holding ($ASML) :

ASML Holding dominates advanced chipmaking with a record order backlog and EUV technology, supporting strong performance through sector cycles as demand for cutting-edge semiconductors grows.

⬆️⬆️ 11. Applied Materials ($AMAT) :

Applied Materials benefits from robust AI/memory chip demand and stable industry positioning for ongoing growth, even as cyclical risks remain.

⬆️ 10. Lam Research ($LRCX) :

Lam Research rides strong wafer equipment and AI demand through 2025, making it a core holding for semiconductor infrastructure exposure.

⬆️⬆️ 9. Micron Technology ($MU) :

Micron Technology leads in AI memory, supported by rising revenues and forecasts for sector tailwinds, but historical earnings volatility warrants prudent sizing.

⬆️ 8. Apple Inc ($AAPL) :

Apple Inc. remains resilient in demand and innovation, trading near $271, and is favoured for portfolio core strength as its global brand power endures.

🔻🔻🔻 7. Taiwan Semiconductor ($TSMC) :

Taiwan Semiconductor delivers sector-leading chip foundry scale for AI hardware, underpinning profit growth and global tech supply chains.

⚪ 6. Amazon.com Inc ($AMZN) :

Amazon.com Inc. remains a leader in e-commerce and cloud, delivering strong margins and positive analyst momentum for long-term appreciation.

⚪ 5. Meta Platforms ($META) :

Meta Platforms continues expanding its AI-driven advertising base, with revenue momentum and active user growth sustaining multi-year price performance.

⬆️ 4. Alphabet Inc ($GOOGL) :

Alphabet Inc.’s innovative cloud and ad businesses fuel recurring earnings and long-term value for diversified investors.

🔻 3. NVIDIA Corp ($NVDA) :

NVIDIA Corp sets the pace in AI chips, with robust analyst forecasts and continued innovation, leading sector growth into 2026.

⚪ 2. Broadcom Inc ($AVGO) :

Broadcom Inc. delivers diversified earnings upside, balancing AI chip growth and software supply reliability in the technology infrastructure market.

🔻 1. Microsoft Corp ($MSFT) :

Microsoft Corp anchors blue-chip portfolios with recurring high-margin cloud/AI revenue and solid analyst forecasts for multi-year outperformance.

Key

⚪ = No changes vs last week

⬆️ = +1 vs last week

🔻 = -1 vs last week

⬆️⬆️ = +2 vs last week

🔻🔻= -2 vs last week

⬆️⬆️⬆️ = +3 vs last week

🔻🔻🔻= -3 vs last week

Quantitative Insight Qualitative Screening (QIQS) data has been used to pick these stocks.

How was today’s newsletter?

NOT FINANCIAL ADVICE.

🔴 Risk Notice: This content summarizes publicly reported data. It is not advice. Consult a qualified advisor before investing.

This content is for informational purposes only and does not constitute financial advice. All investments carry risks. Past performance is not indicative of future results.