Good morning investors,

This is one of those in-between weeks. Liquidity is thin, headlines are quiet, and markets are closing 2025 near record highs with the S&P 500 hovering just below 7,000.

The real story is not the Santa Claus Rally. It is what leadership looks like as we step into 2026. Beneath the surface, the market has begun to rotate away from the most crowded AI trades toward platforms, cash-flow durability, and select cyclicals.

This week is best spent observing, not chasing. The signals you see now often shape the first real trends of January.

Here’s what I’m watching into year-end and why it matters…

Read more → 3 mins read

The Fear and Greed Index

My Portfolio Performance 🔍

All-time Portfolio Performance (ISA+SIPP)

All-time | Year-to-date | |

|---|---|---|

Total Profit | 42.93% | 25.98% |

vs S&P 500 | 9.95% | 17.09% |

vs NASDAQ 100 | 3.32% | 13.56% |

Must Reads 📌

Top US Stocks to Watch as 2025 Ends and 2026 Begins

Holiday liquidity, Fed minutes, and early rotation signals shape the final trading week of 2025 as investors position for broader leadership in 2026.

🔗 Portfolio Parrot ↗

AI Stocks in 2026: From Hype Cycle to Market Reality

As AI enters 2026, markets shift from hype to execution. A clear breakdown of where AI stocks sit in the cycle and what normalisation really means.

🔗 Portfolio Parrot ↗

ASML: The EUV Chokepoint Powering AI’s Chip Complexity

ASML’s EUV and High-NA roadmap sits at the centre of sub-2nm chipmaking, with 2030 targets of €44–€60B sales and 56–60% gross margin.

🔗 Portfolio Parrot ↗

Amphenol (APH): The Hidden Backbone of AI Hardware

Amphenol sells the connectors, cables, sensors and fibre that power AI, EVs and networks. Big growth, bigger M&A, and a premium valuation.

🔗 Portfolio Parrot ↗

Celestica Stock Thesis: The AI Hardware Boom Meets Reality

Celestica has moved from contract manufacturing into AI data-centre infrastructure. Growth is real. So are valuation, concentration, and cycle risk.

🔗 Portfolio Parrot ↗

The investing winners and losers that made or crushed portfolios in 2025

Despite turmoil from the trade war, most global markets approached the end of the year in the black

🔗 Financial Post ↗

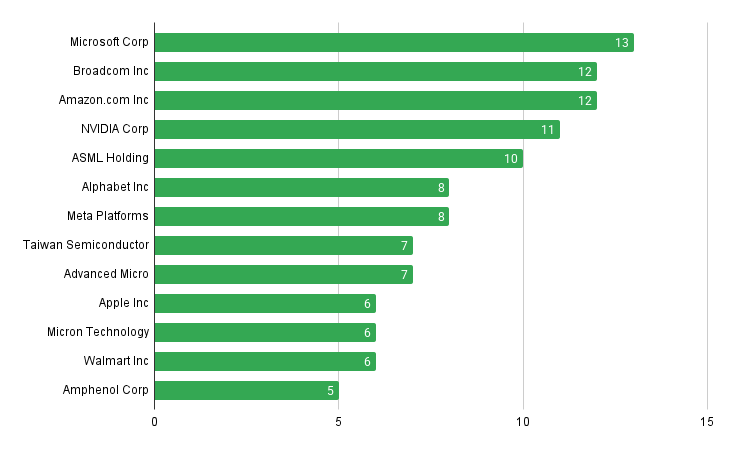

13 stocks to watch 💸

These stocks are ranked based on weekly data trends, company fundamentals, and market insights.

Weekly Stock Power Watchlist

The chart shows what changed. The breakdown explains why.

How was today’s newsletter?

NOT FINANCIAL ADVICE.

🔴 Risk Notice: This content summarizes publicly reported data. It is not advice. Consult a qualified advisor before investing.

This content is for informational purposes only and does not constitute financial advice. All investments carry risks. Past performance is not indicative of future results.